The Canaries Are Quiet

In the late summer months of 2015 the Federal Reserve were actively discussing the possibility of raising the Federal Funds rate signaling a reversal of their prolonged, zero-interest rate, crisis management attitude towards monetary policy. The prospects of rising U.S. interest rates occurring while many central bankers were actively lowering interest rates and/or printing upset the global financial markets.

In mid-2014 when this policy divergence was first suspected by market participants, the U.S Dollar started rising against most currencies. The trade weighted broad dollar index rose approximately 15% from mid-2014 to mid-2015.

Taking Notice

As 2015 progressed, markets around the world were slowly taking notice of the dollar’s ascent and pricing in the economic side effects. As a side bar to help better understand why the strength or weakness of the U.S. Dollar (USD) is so important to the global economy we share a paragraph from an earlier piece we wrote:

“The volume of USD borrowed, for foreign purposes, is heavily dependent on the value of the USD relative to other currencies. In the scenario where the foreign currency strengthens relative to the USD, the foreign denominated funds required to re-pay the USD loan decrease, effectively lowering the cost of borrowing. Conversely, during periods of USD appreciation borrowing in USD is not as popular as the cost-benefit to foreign borrowers and U.S. based investors is reduced. Consequently, USD strength or weakness heavily influences borrowing in currencies of all types, and thus international monetary supply. In a global economy, largely dependent on debt, monetary supply is the fuel governing the pace of the global economic engine.”

To summarize, U.S. Dollar appreciation is the equivalent to global monetary tightening.

The markets showing the most concern for dollar appreciation and the prospects for a reversal in Federal Reserve policy were emerging market currencies, commodities and domestic high yield bonds. These markets steadily dropped throughout 2015. During the summer months, the U.S equity markets started paying closer attention to the Fed’s posture as well as the aforementioned markets. In August, the U.S. equity markets reacted violently with the S&P 500 falling from 2,100 to a low of 1,867 (12%) within a very short period. It then partially recovered only to retest the lows again in later September.

This volatility appeared to make the Federal Reserve nervous that their policy stance was roiling markets around the world. At their September 17th meeting they inserted the following sentence into their policy statement: “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term”. The market interpreted this new language as an excuse for the Federal Reserve to delay any interest rate hike for the time being. Since that meeting most U.S equity markets have recovered the majority, if not all, of their losses.

The Fed removed the warning at their late October meeting and on the heels of a better than expected employment report, the interest rate markets significantly raised the odds for an interest rate hike in December. The U.S. Dollar has risen approximately 5% over the last month as market expectations for an interest rate hike in December are now higher than at any other point this year. While the U.S. equity markets, until the last few days, seemed unconcerned about the prospects of the interest rate hike, the so called canaries in the coal mine are once again sending troubling signals.

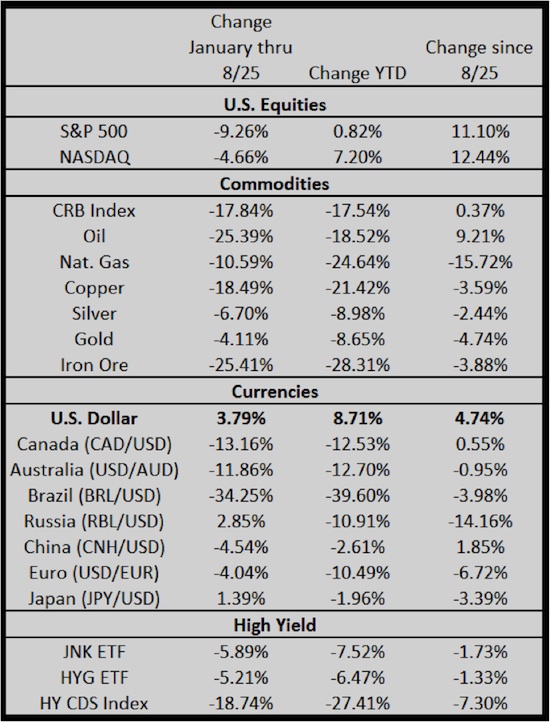

The following table lists various commodities, currencies and high yield securities/indices, most of which are now trading back to or below their August lows. The S&P 500 and NASDAQ, as proxies for U.S. equity markets, have thus far failed to take notice.

Data Courtesy: Bloomberg, 720 Global

This missive is not a dire warning that stocks are once again going to follow the “canaries” lower like in August. That said, the consequences of a reversal of Fed policy after 7 years of crisis management are significant, and the stresses are amplified as policy change looks likely to occur while most other central banks are taking the opposite monetary policy tact.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.