A lot of the information I am about to cover could feel like a surprise, and in many ways it is. Tesla’s market size is likely more than twice as large as previouly forecasted.

Here are some details on why I feel this way. Hint: The Tesla Model 3 is coming (more on that later).

Tesla Is Dominating

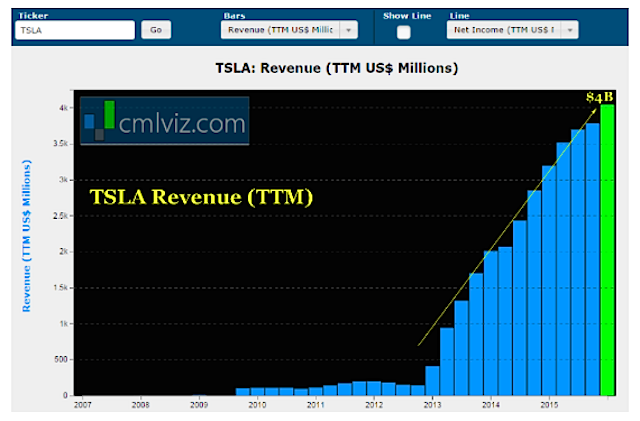

U.S. sales figures for 2015 reveal that Tesla’s Model S rose to become the number one top seller within the U.S. market for large luxury vehicles, overtaking the Mercedes-Benz S-Class for the first time. Here’s the incredible data (highlighting added):

Source: electrek

All of these vehicles start around the same $70,000 as the Model S.

Just so we’re perfectly clear on this data: Every other luxury sedan saw falling sales while Tesla saw a 51% increase. Tesla’s Model S is now the single best selling large luxury vehicle and now owns more than 25% of the market. (Source: electrek).

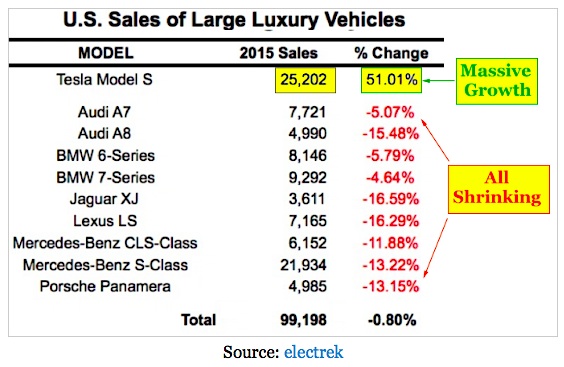

Here is an all-time revenue chart for Tesla Motors ($TSLA):

Tesla’s Secret?

Those numbers presented above are basically a mathematical impossibility if not for one stunning secret: Not everyone buying the Model S was an owner of a $70,000 car before.

In 2015, Jefferies conducted a survey of Tesla Model S owners and discovered that nearly 40% had previously owned a car that cost less than $40,000 (Business Insider). That’s borderline ludicrous. Tesla is not only moving people up — it’s moving people up by staggering amounts.

Here’s why that reality changes everything.

Tesla Model 3

Both the Model S and Model X have selling prices in the $70,000 – $140,000 range. Tesla aims to reach its 500,000 unit sale through a mass market vehicle — aptly named the Model 3. It will have an initial sales price around $35,000 (CNN Money).

It’s this vehicle that will likely make or break Tesla’s dreams of uber growth and mass market enterprise.

Skeptics vigorously point out that even if Tesla is able to create a car with a $35,000 base price, the average actual cost, after options are added, will be above $40,000 and that is not a mass market vehicle.

Here’s where that data on the Model S breaks eveything.

Mass Market

We actually now know that the $70,000+ Model S is already poaching from non-luxury brands like Toyota even though the prices are wildly different. Keep in mind that Prius sales were down 11% last year and we have data from vehicle registartions that indicate Tesla’s $70,000+ vehicles may be a culprit.

Enter the Model 3 — even if it becomes a $40,000 vehicle as cynics insist, based on the brand appeal, we get this:

All of a sudden, we’re now talking about Model 3 potentially competing with the Camry and Honda Accord and other non-luxury sedans. Camry and Accord alone sold a combined 784,742 vehicles in the U.S. in 2015. – Source: Business Insider

So, Tesla’s Model 3 will be going after two markets. First, the agreed upon “Midsize Luxury Vehicle” segment with its 508,000 unit sales in 2015. These are cars like The Audi A4, BMW 3-series, Mercedes C-Class, Acura TLX, Infiniti Q50, etc.

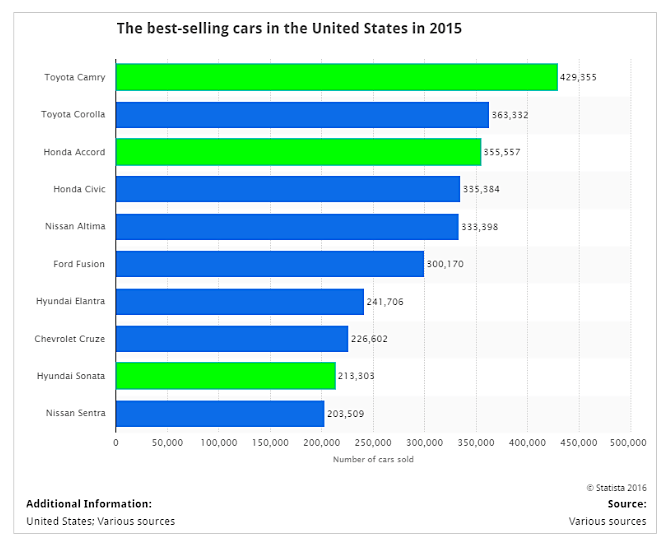

But, if that market isn’t big enough, consider our new reality where Tesla brings buyers of less expensive cars up. The Tesla Model 3 is absolutely in play for at least some of the non-luxury sedan market. Here are the best selling cars in the United States for 2015 via Statista:

Those three highlighted in green are in play, and here’s why:

The MSRP for the Honda Accord is listed in the range of $22,205 – $34,680 by KBB.com. The Toyota Camry’s MSRP comes in at $23,070 – $31,370. The Hundai Sonata is $21,750 – $34,075. Just those three vehicles alone totaled nearly one million vehicles.

Friends, the market Tesla is aiming at for its Model 3 isn’t the 508,000 luxury sedan market, it’s all of it — totaling well over 1.5 million vehicles.

Tesla will start taking pre-orders on March 31st for the Tesla Model 3. A $1,000 down payment will be required. Soon after that, Tesla will tell the world how many pre-orders it received. This will be one of “the moments” for Tesla as an enterprise.

The Real Risk: Apple and Google

The risk for Tesla is not any of the existing vehicles. We can see quite clearly that it is a total and utter disruptor, destroying demand for even the hallowed Mercedes Brand.

The risk is Apple (AAPL) and Alphabet / Google (GOOG, GOOGL). You can find out more about these potential battles on CMLViz and via our subscription service, CML Pro.

Google’s plans are a bit less disruptive, but equally dangerous. If we’re looking for the possible derailment of Tesla — we can stop looking at existing automanufactures and start looking at the best technology companies in the world.

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

Author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.