Tableau Software $DATA: This fallen angel’s stock price has gotten too cheap in a healthy M&A environment.

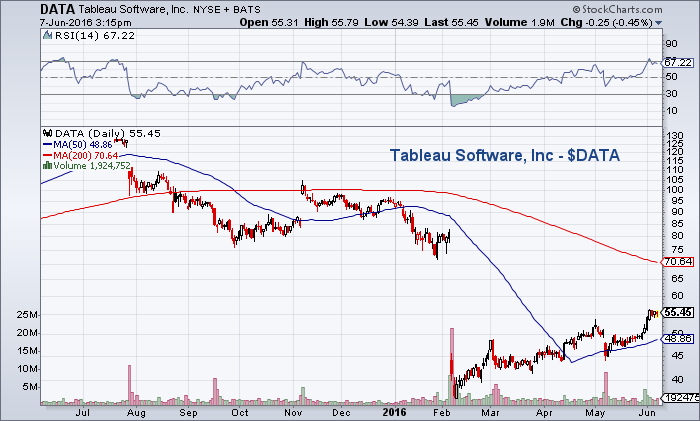

Tableau Software (DATA) was one of the hottest stocks around from May 2014 to July 2015 as shares rallied from $55 to above $120 as the “Big Data” theme took hold across the technology sector.

However, shares have now sold off since Summer 2015 more than 50% and closed today at $55.70 following a couple quarters of “disappointing” growth. Disappointing is a loose term, as it is still growing faster than most stocks in the market. But as the case with any company growing scale, the Y/Y growth comparisons start to hit a wall before coming down to a sustainable level.

Tableau Software Stock Chart – $DATA

Pac-Crest was out with a great M&A report on Sunday that highlighted the Software sector and anticipation for a new software M&A cycle through 2017, seeing a similar pattern to 2011 after multiple Tech stocks corrected and strategic buyers stepped in seeing the future opportunity. The report highlights a number of potential acquisition targets across SaaS, Security, Cloud, Analytics, and Healthcare Tech. A few of those names have seen some unusually bullish options positioning as well such as Shopify (SHOP), Fire-Eye (FEYE), and Imperva (IMPV). The report also shows that 7 of the largest Software companies have a cumulative buying power of more than $200B.

Tableau Software stock (DATA) is the name I want to focus on in part because it has seen a few sizable call purchases since its last earnings report. The most notable was on 5/31 when 3,050 of the January 2018 $100 calls were bought to open $2.55 to $2.70 with shares trading near $50.50. On 6/2 nearly 3,000 July $60 OTM calls bought to open $1.40 to $1.70 and the July $55 calls have seen some accumulation with 2,600 now in open interest. Lastly, a trade from 5/6 bought 2,950 of the October $50 calls to open $4.30 to $4.70 that are in open interest. Looking at IV Skew, DATA has a parabolic profile for June, and a fairly flat July and October skew, showing a bullish bias. One caveat is that short interest at 12.55% of the float has steadily risen from 4.15% in August 2015.

The $4.14B business analytics Company trades 67X FY17 Earnings, 5.9X Sales and 47.1X FCF. Now, at first many may say how can you possibly call a stock at those levels cheap, but those are not appropriate metrics to value a Tech company with such high levels of growth. For a better view of growth DATA was growing revenues 2012-2015 Y/Y at 104.8%, 82%, 77.5%, and 58.4% respectively. DATA revenue growth has steadily come down and FY16 is projecting just under 30% revenue growth and closer to 25% in FY17 and FY18, but FY18 revenues at $1.32B is right around double its FY15 revenues, so still an impressive growth company. DATA is projected to hit $1.24/share EPS in FY18, more than double the $0.56/share in FY16.

The more appropriate valuation metric for a growth software company is EV/Sales and utilizing relative valuation with comparative revenue growth numbers. At 3.1X FY17 EV/Sales, DATA is in fact very cheap on a peer comparison with a mean on 6.5X, table shown below via Sentieo Comparison. DATA is also a clear leader in its industry and at this depressed valuation it could attract names like Microsoft (MSFT), Cisco (CSCO), SAP (SAP) or others. In a deal I would expect DATA to demand a 4X EV/Sales multiple at minimum, or around 30% higher from current levels. That would put Tableau Software stock right around $70, but would not satisfy those Jan. 2018 $100 calls. Considering the environment and scarcity value, there could be a bidding war with willing over payers flush with cash, or even without a deal DATA may look to grow itself into a Software leader over the next few years, either way the upside opportunity is there as shares get revalued back to a mean multiple as investors get more comfortable with 25% revenue growth.

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a current position in DATA. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.