Prove It To Me Market

As we outlined in last week’s video, the “return to the year of the whipsaw” action in the S&P 500 over the last few weeks means we prefer to make the market “prove it” by clearing some overhead guideposts. For reference, here’s the link to last week’s video.

Below you will find some important S&P 500 guideposts for active investors to watch. These levels will likely determine if the stock market rally will continue… and if this bull market has more upside.

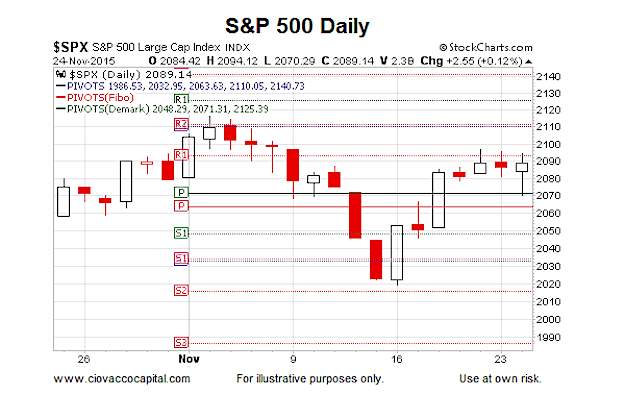

S&P 500 Guideposts – Daily Chart

If the S&P 500 is to rally for several months and go on to make significant higher highs, it has to clear and hold above 2093, which is the R1 line shown in the chart below. The S&P 500 closed at 2089 on Wednesday, November 25.

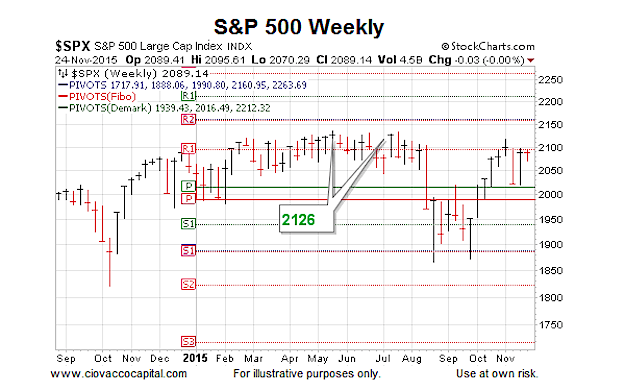

S&P 500 Guideposts – Weekly Chart

When areas of possible resistance or signals occur on multiple timeframes they tend to be more useful. The R1 level on the weekly chart of the S&P 500 sits at 2095. The S&P 500 closed at 2089 on Wednesday, November 25.

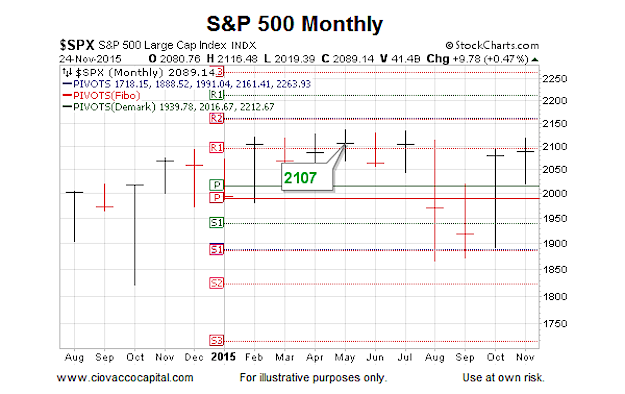

S&P 500 Guideposts – Monthly Chart

The possible resistance trifecta is in play with R1 on the monthly S&P 500 chart coming into the picture at 2095. The S&P 500 closed at 2089 on Tuesday, November 24.

How Can Investors Use This Information?

If the S&P 500 closes over 2095, does it mean we have entered bullish utopia? No. A single close or even a handful of closes over 2095 does not necessarily mean resistance has been cleared for good; there is no magic number of days. If 2095 is cleared and held, the longer the market stays above 2095 and the further it moves above 2095 into new highs, the more relevant it becomes.

Twitter: @CiovaccoCapital

Read more from Chris on the CCM blog.

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.