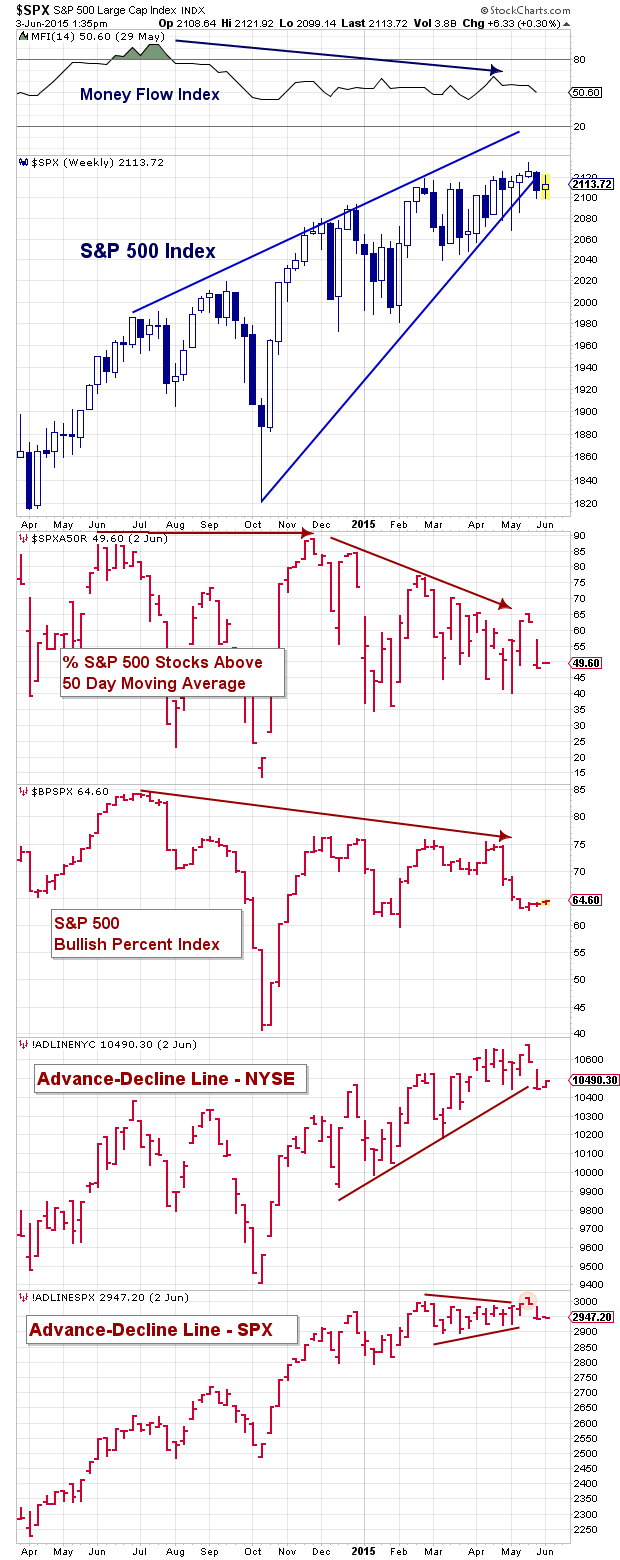

Over the past several weeks, market breadth indicators have largely been neutral to weak. The one saving grace had been that the NYSE Composite Advance-Decline Line had remained bullish. But even that has fallen into the neutral camp. So what are we to do? Everyone seems to be aware that market momentum has slowed.

Over the past several weeks, market breadth indicators have largely been neutral to weak. The one saving grace had been that the NYSE Composite Advance-Decline Line had remained bullish. But even that has fallen into the neutral camp. So what are we to do? Everyone seems to be aware that market momentum has slowed.

The problem with breadth indicators has more to due with timing than accuracy. Markets don’t put in major tops on the first sign of lagging breadth. Similar to how major divergences develop, breadth indicators can remain a warning sign for months… and investors can go broke trying to bet against the market too early, or by leaning on breadth indictors alone. In my opinion, it’s important to wait for other technical confirmations (like trend line and lateral support breaks). The S&P 500 is definitely in the caution zone with market breadth indicators waning for weeks, and in some cases months. Another trip below 2100 could lead to a deeper pullback.

And all this together is enough for investors to keep their antennae up. It’s probably best to simply stay patient, keep risk on a leash, and wait for price confirmation. Stocks can definitely go higher, but weak market breadth may limit the advance.

Note that the “Money Flow Index” is updated weekly through last Friday and all other indicators are through yesterday’s close with the exception of the S&P 500 Index (which is intraday today).

Other market studies by Ryan Detrick (on June Seasonality), Sheldon McIntyre (on waning momentum), and Trading On The Mark (on market index divergences) are all indicating that investors need to stay on top of their plans and tighten up risk discipline. Thanks for reading and good luck out there.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.