Recently, I have been collaborating on a research project with Arun Chopra, an experienced investor and good friend who holds a CFA and CMT. Together, we have been blending longer-term fundamental indicators with technical indicators to do historical studies. If you like what you see here, note that we will be launching a subscription service soon.

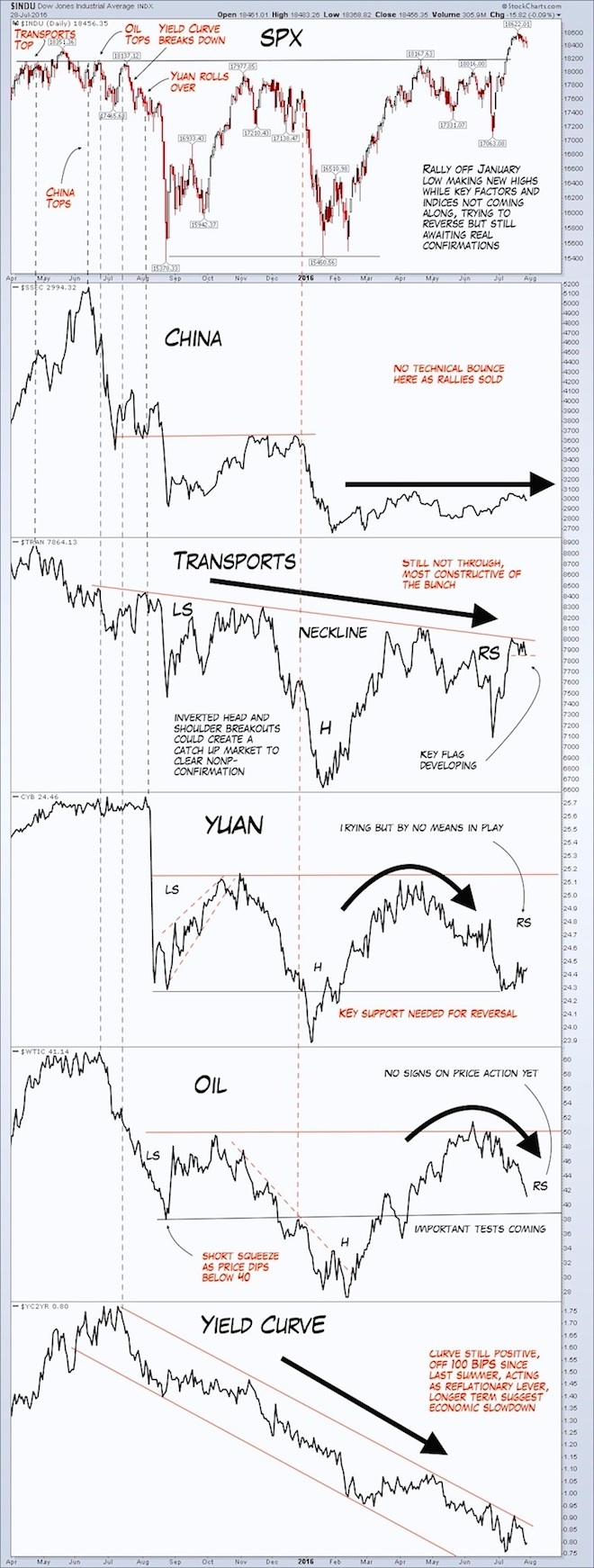

Today, we take a closer look at the S&P 500 Index (INDEXSP:.INX). More specifically, can the S&P 500 July breakout continue into late summer/fall without the assistance of China, the transports, and crude oil?

Here area few nuggets of interest to keep an eye on:

- Spring/Summer 2015, Transports and China topped, Oil bounce topped, Yield Curve and Yuan broke down.

- These traditional “growth” indicators have continued sideways to down.

- While S&P 500 has v-shaped repeatedly off these and other scares (Iran, terror, Brexit, EU).

- The rebounds ostensibly lie on the backs of further easing from global central banks (Helicopters).

We often ask rhetorically: “It doesn’t matter until it does”? (in terms of divergences)

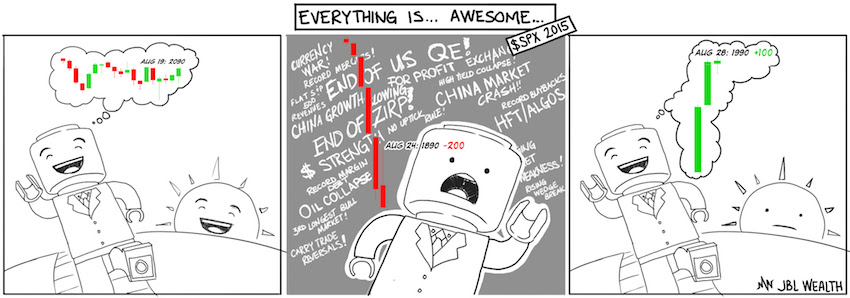

With the S&P 500 reaching new highs this Summer (Brexit bounce/jobs data), is Everything Awesome? Will the S&P 500 July breakout stick?

Does it matter in a world of central bank “whatever it takes”? Extra Credit:

“Everything is Awesome” bounces

Thanks for reading and best of luck out there.

Further Reading: Nikkei Tests Key Resistance Into BOJ Meeting

Twitter: @JBL73

The authors may have positions in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.