With the S&P 500 Index (INDEXSP:.INX) marching to new all-time highs, I’m battling a bout of deja vu? It wasn’t too long ago that a similar setup was occurring in the German stock market. Could S&P 500 new highs

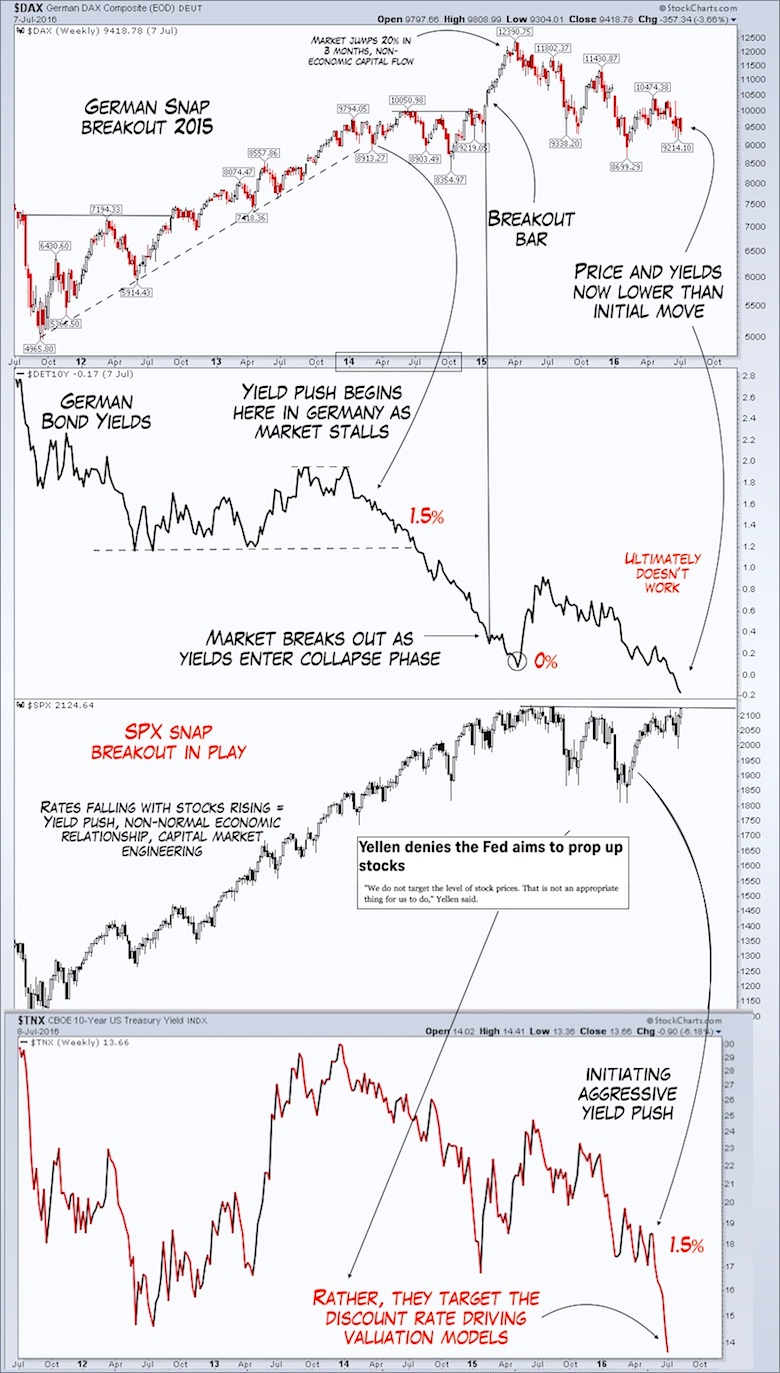

Rewind to 2015. The German DAX (INDEXDB:DAX) began to rip higher as yields collapsed.

Now it may be happening here in the U.S. marketplace. But it’s a dangerous game to play. Here’s a recap of the 2015 German markets and how this has played out.

- In early 2015, the German 10-yr Bund yield collapsed to zero as institutions front ran QE purchases.

- Concurrently, the German DAX stock market index broke out, popping 20% to all time highs in anticipation of ECB QE.

- Ultimately, the central bank’s actions distorting 10-yr yields had no lasting positive effect on the DAX.

Is a similar yield chasing/discount rate crushing breakout occurring in the S&P 500 now? Will it last?

Thanks for reading.

Twitter: @JBL73

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.