S&P 500 Futures Trading Outlook for July 27, 2016 – The broader stock market indices led by the S&P 500 Index (INDEXSP:.INX) are looking forward to the Federal Open Market Committee (FOMC) meeting release today at 2pm. More specifically, active investors are awaiting news from the FOMC on interest rates.

It seemed a forgone conclusion that the market did not expect a rate hike, but the wait on this release, and the likely news that there is no rate hike, will provide a catalyst for greater expansion to the north as charts stay strong. We sit above congestion near 2166 this morning, with mildly bullish momentum. Resistance is between 2172.5 and 2177.25, but we could breach into 2183.25, and even 2189.75 if there are lots of stops sitting above us. Breaches should fade back to higher breakout levels with momentum being a bit damp. Support to watch below is 2158, but we hold a much higher overnight low of 2163.75. Below that, we see 2155.75 and 2151.5 nearby. Buyers continue to have trouble getting past overhead supply, and moving averages are flattening, but the catalyst of the FOMC release should do the trick to loosen up the tight price action here.

See today’s economic calendar with a rundown of releases.

RANGE OF TODAY’S MOTION

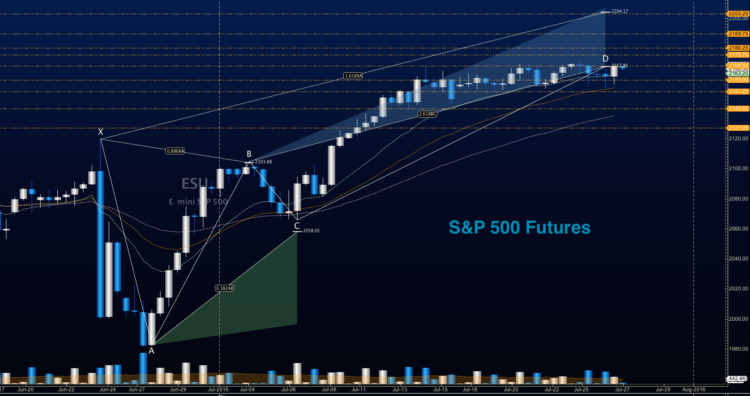

S&P 500 Futures Trading July 27 – ES_F Chart

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2168.5, or a positive retest of the bounce off 2158.5 with positive momentum. Remember that the feel of the chart is congestion, so breakouts will be difficult to maintain. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2158.5 are 2161.5, 2164.5, 2168.5, 2172.25, 2175.75, 2177.25, 2179.25, 2180.25, and if we expand, we may stretch above into 2183.75 and 2189.75. Well above these ranges sits 2196.25 as an interim target in the pattern shown on the image that stretches to 2203.25 to 2204.75

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2160.25 or at the first failed retest of 2165.75 with negative divergence. As this is still a relatively countertrend trade keep your eyes on the lookout for higher lows developing intraday. Retracement into lower levels from 2165.75 gives us the targets 2163.5, 2060.5, 2158.25, 2156, 2153.5, 2149.75, 2145.75, 2143, 2141.75, 2138.75, and 2136.75 to 2128.25, if sellers take over.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Nasdaq Futures (NQ_F)

Nasdaq futures broke out last night on AAPL releases running right up to 4699.25. Dips are likely to be shallow, and bought as moving averages and formations as a group look bullish, as recent overhead resistance clears. Support remains near 4645-4648, with a lower break into 4627, if sellers gain traction. Resistance levels are now between 4704-4723, with the high of this year to breach at 4719, and 4739.5 late last year. Breaches should retest before any real expansion holds, and that that old resistance (now likely new support) looks like the 4678-4681 region.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4694.75, or a positive retest of 4678.5 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Watch for the lower high to develop with this range break, if sellers exercise more power intraday. Targets from 4678.5 are 4681.5, 4689.75, 4691.25, 4694.25, 4696.5, 4698.75, 4704.25, 4711.25, 4721, 4723.75, and 4727.75 to 4736.5, if buyers continue the rally north.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4691, or at the failed retest of 4696.5 with negative divergence. Watch those moving averages and trend lines when taking the shorts. Retracement into lower levels from 4696.5 gives us the targets 4693.75, 4691.25, 4687.75, 4682.75, 4678.5, 4664.75, 4660.25, 4658.5, 4655.25, 4651.75, 4645.5, 4642.5, 4637.75, and 4632.5 to 4628.75, if sellers resume control.

Crude Oil

The API report yesterday showed a draw of .8MMB, but after only a small drift up, the charts have stabilized near 42.6 – just above important support previously noted at 42.45. Momentum is negative with new near term lows, as charts are quiet into the EIA report due out today. The support area near 42.45 will be key to watch again today, with a failure to breach bringing lower levels to oil.

Trading ranges for crude oil should hover between 41.65 and 44.36, with most trading signals suggesting that bounces will likely bring higher lows as the chart attempts to recover off this level.

Upside trades on crude oil can be staged on the positive retest of 43.09, or at a bounce off 42.65 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 42.65 are 42.84, 42.97, 43.18, 43.3, 43.47, 43.68, 43.83, 44.02, 44.22, 44.49, and perhaps, 44.71, if buyers really take control.

Downside trades on crude oil can be staged on the failed retest of 42.5, or at the failed retest of 42.9 with negative divergence. Targets from 42.9 are 42.75, 42.4, 42.27, 42.12, 41.94, 41.8, 41.65, 41.44, 41.19, and perhaps 40.74.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.