One positive mentioned plenty in the market this week is small cap outperformance. One might suggest that we are at a sign of a bottom because of it. Well, that may be a farce. Let’s take a look, starting with the Russell 2000.

One positive mentioned plenty in the market this week is small cap outperformance. One might suggest that we are at a sign of a bottom because of it. Well, that may be a farce. Let’s take a look, starting with the Russell 2000.

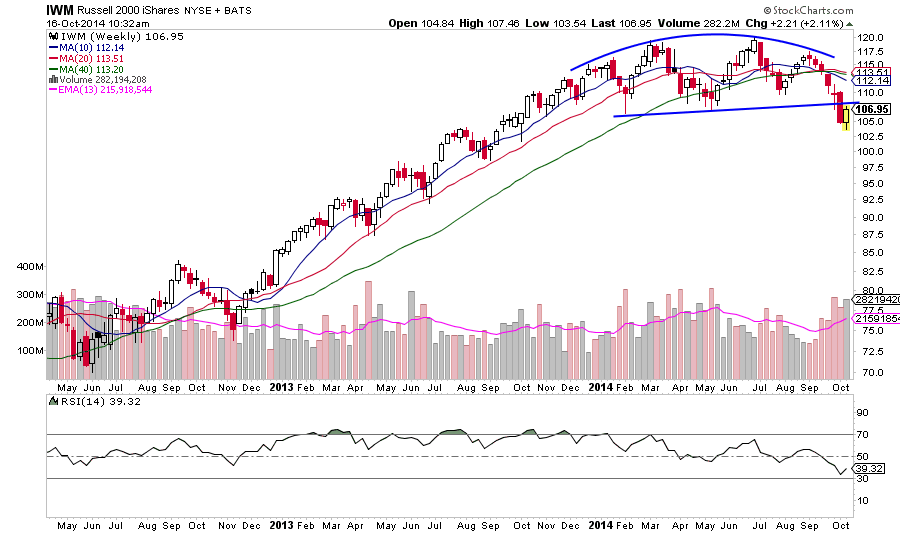

The Russell 2000 iShares ETF (IWM) has broken a major 1 year topping pattern, pushing below 2014’s year-to-date support in February and May near 107. It’s unorthodox, but there is still an open measured move lower to 95.50:

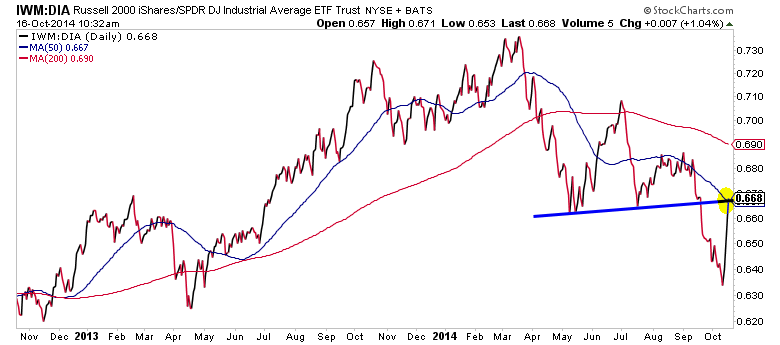

Also: the IWM to Dow Jones Industrial Average ETF (DIA) is just now testing the falling 50-day simple moving average, which is also a prior support zone. This appears to be a breakdown back-test. Also note the slope of the falling 50 and 200-day simple moving averages. They have turned lower, suggesting a new downtrend. Even if it continues a few more days, the trend is still lower.

Also: the IWM to Dow Jones Industrial Average ETF (DIA) is just now testing the falling 50-day simple moving average, which is also a prior support zone. This appears to be a breakdown back-test. Also note the slope of the falling 50 and 200-day simple moving averages. They have turned lower, suggesting a new downtrend. Even if it continues a few more days, the trend is still lower.

The market may just bottom here, but it’s worth separating the immediate term from the larger broad market picture.

Trade ‘em well! Thank you for reading!

Follow Aaron on Twitter: @ATMcharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.