Since it can provide valuable information about investors’ tolerance for risk, monitoring market leadership is a worthwhile habit. When conservative consumer staples lead, it sends up some yellow flags. When mid caps and small caps lead, it is indicative of a bullish acceptance of risk.

Since it can provide valuable information about investors’ tolerance for risk, monitoring market leadership is a worthwhile habit. When conservative consumer staples lead, it sends up some yellow flags. When mid caps and small caps lead, it is indicative of a bullish acceptance of risk.

Screening With Relative Charts to Gauge Market Leadership

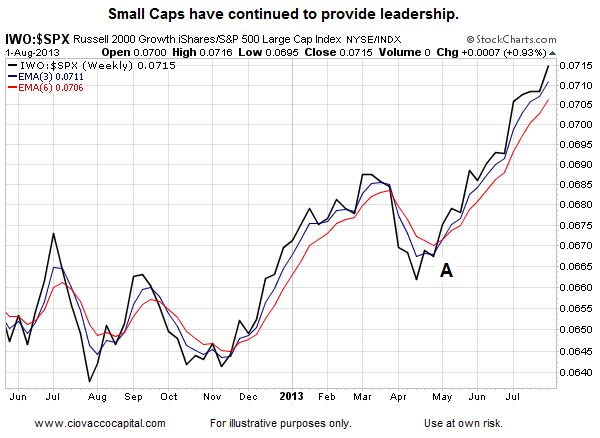

If you are looking for market leaders, an excellent first step is to make a list of ETFs that are trending vs. the S&P 500 on a weekly chart. The best time to consider making an investment is when a new trend has been established (see point A below).

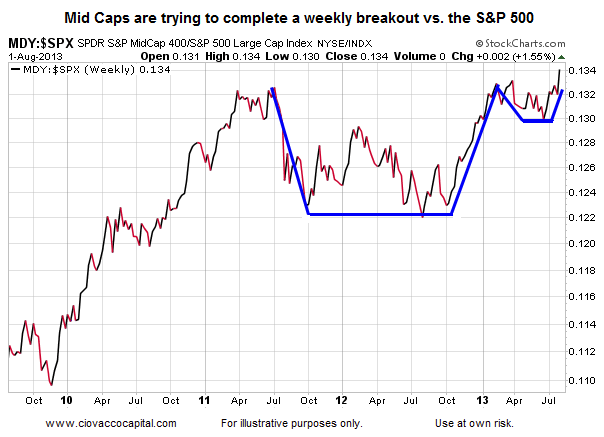

Bullish Cup With Handle Set-Up

Disciples of William O’Neil’s book, How To Make Money In Stocks, are intimately familiar with a bullish cup-and-handle set-up. As of Thursday’s close, the S&P MidCap 400 (MDY) is trying to complete a bullish weekly breakout relative to the S&P 500. The breakout will become much more meaningful if it can hold into Friday’s close.

Using Isolation Charts To Monitor Trend Health

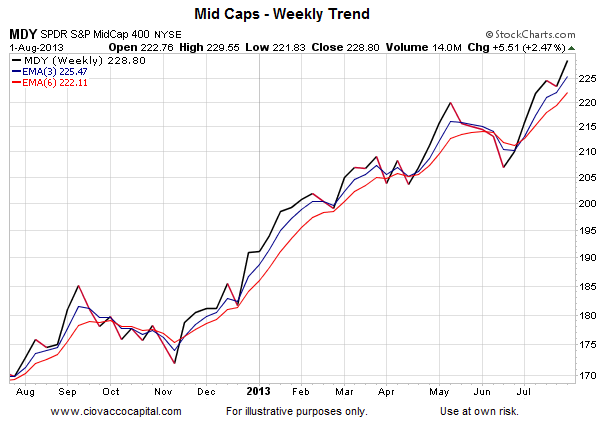

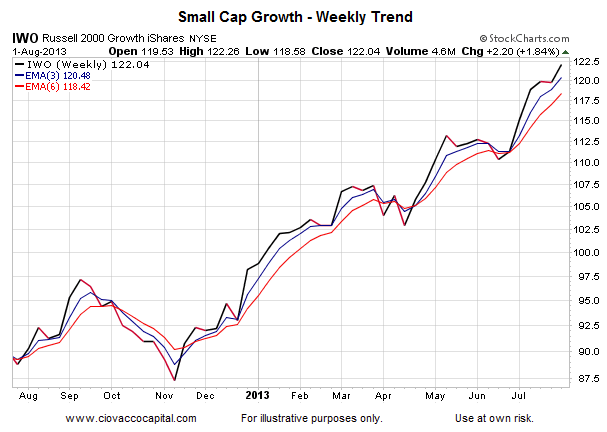

Once we have identified and purchased an ETF, we prefer to manage the position using a standard weekly chart rather than a chart showing performance relative to the S&P 500. Why? We want to let winners ride and a winner does not have to outperform the S&P 500 continuously during a holding period.

In the chart below, the weekly trend for MDY remains healthy. Price is above both the 3-week exponential moving average (EMA) and 6-week EMA. The 3-week is above the 6-week and the slopes of the moving averages are positive.

In a similar vein, the Russell 2000 Growth iShares (IWO) in isolation looks healthy from a trend perspective. It also is trying to nail down a higher high this week and continue to provide market leadership.

The Trend Is Your Friend

Mr. Livermore’s tweet outlines a valuable tenet of trend following:

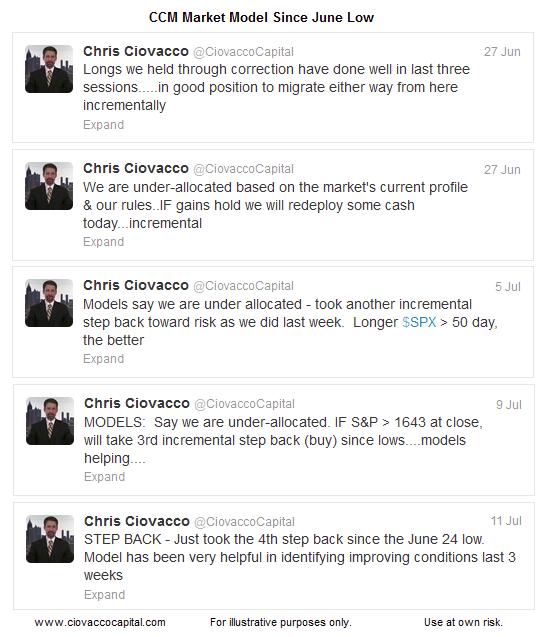

Concepts Helped Capture Gains After June Low

Our market model incorporates both principles outlined above: (1) using relative charts for screening, and (2) standard weekly charts for monitoring the health of a position. One of the great things about Twitter is it can act as a de facto trading journal since tweets are dated. The methods above helped us successfully manage risk while repositioning to profit during the recent move off the June low.

Twitter: @CiovaccoCapital @seeitmarket

Position in MDY and IWM at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.