In my last article I outlined why I believe a huge move is brewing for the S&P 500. While I’m patiently waiting for the index to provide greater directional certainty, I’m also looking for setups that may provide clues as to whether it will be the Bulls or Bears who ultimately gain control. What’s recently caught my eye is the price action in both the US Dollar and Silver.

Analyzing the US Dollar Index leads me to be negative on the greenback over the long-term. The US Dollar’s rally the last few years failed right around its 61.8% Fibonacci Retracement, and it’s recent downside reversal follows a beautiful “bearish divergence” on its Relative Strength Index (RSI).

While many chart watchers have observed a sort of Flag pattern on the US Dollar’s daily and weekly chart, it’s interesting that the Dollar could close the month of April below its 20 month simple moving average, and record its lowest monthly close since 2014.

This could leave the monthly chart sporting a sort of “megaphone” topping formation, which is certainly an ominous sign. While there remains the possibility of recent Dollar weakness being constructive, or simply a pause within an ongoing uptrend, I don’t believe it’s the most likely outcome at the moment. With recent correlations seemingly suggesting that a weak US Dollar equals a higher S&P 500, this could be a tailwind for stocks going forward.

From a fundamental perspective, explaining the US Dollar’s weakness could be market participants way of saying that not only will there be no further rate hikes anytime soon, but QE4 is on the way. After all, just take a look at the price action in both the stock market and bond Market. Plunging yields and a permanent bid in both Stocks and Bonds, the defining characteristics of the QE environments. Add in the recent improvement in inflation expectations as the cherry on top.

Now let’s turn to Silver. Or, more importantly, let’s peak at the Gold:Silver ratio.

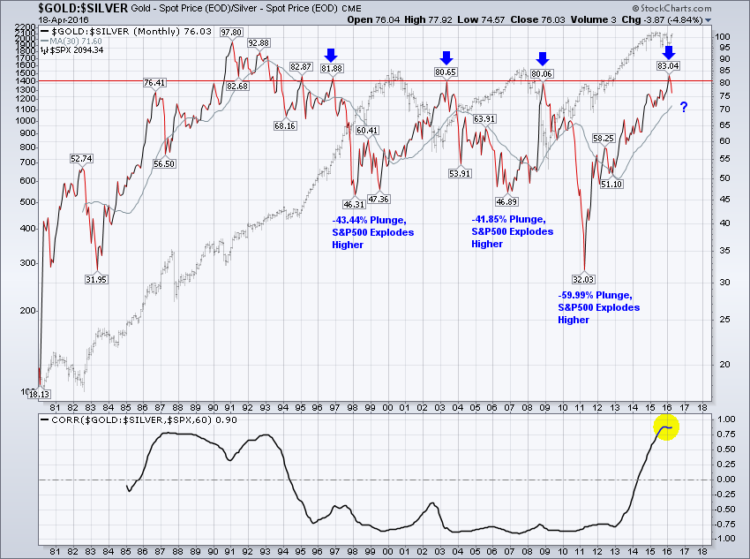

The action here also leads me to give the advantage to stock market Bulls. The Gold:Silver ratio has recently rolled over from the most obvious price level imaginable. Over the last 20 plus years, every single time the price of Gold has reached 80 times that of Silver, Silver demonstrated tremendous relative strength on a forward looking basis.

The importance here is, Silver demonstrating relative strength when compared to Gold is a hallmark of bull markets for stocks and the S&P 500. Every time the Gold:Silver ratio’s plunged the last 3 decades, the S&P 500’s responded by moving to the upside in a major way. Note the strong negative rolling 60 month correlation from 1995-2013.

I’d be remiss in not mentioning that over the past five years the correlation has completely converged, but there’s speculative evidence that suggests this correlation is topping and perhaps ready to move back toward an inverse relationship. After all, just look at the performance of Silver relative to Gold in April, which is occurring right alongside the S&P 500’s seemingly permanent bid thus far in April. Lastly, remember how Silver priced around QE2? Perhaps Silver’s recent relative strength is another sign that QE4 is more likely than we all realize.

In summary, the S&P 500 remains range bound, confined between critical levels of both support and resistance. However, recent developments are encouraging, and akin to the Bulls having the ball in the redzone. From a seasonality and fundamental perspective, it would seem the Bulls are facing a defense like the Broncos with Von Miller off the edge given the historical successes of “Sell In May and Go Away”, along with the current weakened state of earnings. However, the price action in the Dollar and the Gold:Silver Ratio seem to be supportive of the Bulls inching closer to the goal line. If they can break a few tackles here and there, or perhaps get some help from the zebras, otherwise known as the Federal Reserve throwing their QE4 flag, they might just take it to the house.

Thanks for reading.

Twitter: @SJD10304

The author may hold positions in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.