Small cap stocks were one of the strongest areas of the market in the first half of the year and have recently seen much of their gain for the year erased. Growth investors are typically emboldened by periods of strength in smaller companies because they have traditionally been leaders during bull markets. Nevertheless, the recent weakness is a concern and should be noted as significant divergences are popping up throughout the broader market.

Let’s examine where we stand today and some potential scenarios that could develop….

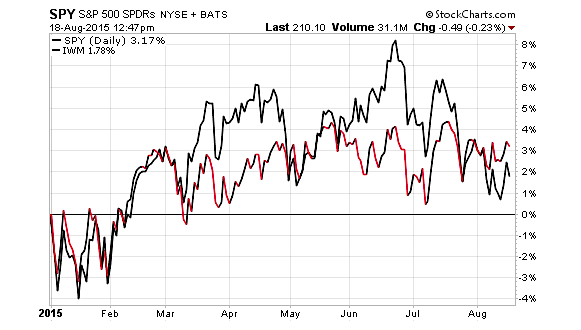

The initial leadership in the benchmark iShares Russell 2000 ETF (IWM) was driven by strength in technology, health care, and consumer discretionary stocks. IWM led the large-cap oriented SPDR S&P 500 ETF (SPY) by 3.5% through the first six months of 2015, yet has surrendered those gains after a sizeable drop in July and August.

SPY vs IWM Performance Chart 2015

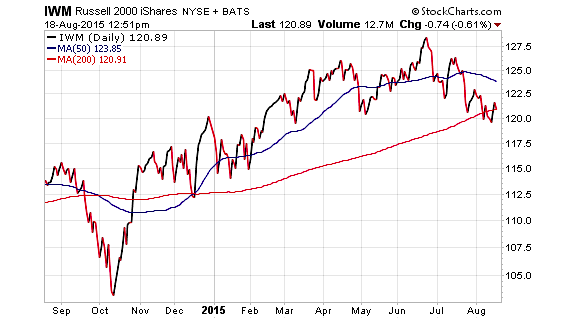

IWM has recently breached its 200-day moving average on the downside and managed to claw back a portion of that drop. It is now seated firmly near this long-term trend line and appears to be setting up for another big move.

As you can see on the chart below, the succession of lower lows and lower highs has created a stair step pattern in IWM. Technical analysts would consider this to be a bearish sign that favors lower prices. Nevertheless, if the small cap stocks ETF can move back to the green for August and recapture its 50-day moving average on the upside, much of this damage in small cap stocks can be repaired. But that is a big if.

IWM Small Caps ETF Chart

The catalysts for this type of move will likely depend heavily on the breadth and sentiment throughout the broader stock market. The summer is historically a very volatile period of time for stocks that can lead to repositioning and a pullback in overall risk taking. That coincides with the type of drop that we have already experienced in the small cap segment versus the relative lack of movement in large-cap stocks.

If the bulls can pull it together and mount another rally attempt, the momentum may ultimately shift back to small cap stocks and small cap indexes that have farther to run to recapture their highs.

Selecting Your Small Cap Exposure

While IWM may be the largest and most well-known small cap stocks index, I actually favor the iShares Core S&P Small Cap ETF (IJR) or Vanguard Small Cap ETF (VB) as core holdings.

IJR and VB are formed based on narrower indexes with under 1,000 small cap stocks, compared to the widely diversified nature of IWM. This varying methodology has helped produce a noticeable level of outperformance over a 5-year period.

IWM vs IJR vs VB 5 Year Performance Chart

These ETFs have miniscule expense ratios of 0.12% and 0.09% respectively compared with 0.20% for IWM. In addition, they are listed on commission-free trading lists at brokers such as Fidelity, TD Ameritrade, and Vanguard. This makes them a cost-effective solution for accessing instant exposure to the small cap space.

For clients in my Opportunistic Growth Portfolio, I currently have a 10% allocation to VB as a core holding. This asset allocation sits right in the middle of an equity market cap sleeve that could range anywhere from 5-15% depending on market conditions. If conditions deteriorate further, I may look to reduce that exposure as a function of risk management and capital preservation. Conversely, if small cap stocks are able to regain their momentum, we may be presented with an opportunity to add to this segment.

The Bottom Line

A modest degree of small cap exposure within the context of a diversified portfolio can boost your exposure to stocks with the potential for above-average growth. However, those same characteristics also make this group susceptible to higher volatility as well.

My advice is to avoid being overly predictive or one-sided in calling the direction of small cap stocks. If you are worried about the potential for further declines, simply set a sell discipline or employ a risk management plan in place to avoid a significant sell-off. This will protect your capital and still allow you to participate in the upside if conditions react favorably. Thanks for reading.

Gather more insights from David’s investment blog.

Twitter: @fabiancapital

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.