There have been some interesting developments in the semiconductor sector that I think are worth mentioning. Moreover, I think recent moves in this space could be signaling something more ominous on the horizon. To highlight this, let’s take a look at the Market Vectors Semiconductor ETF (SMH) and a few charts.

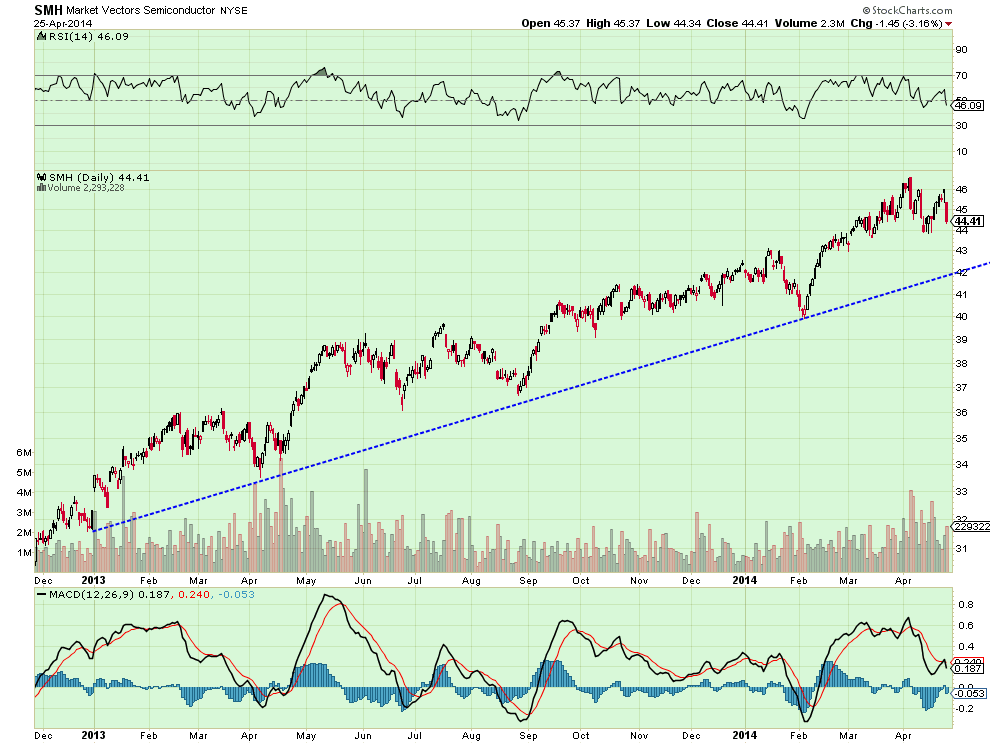

The first chart is a daily chart that shows why the SMH came up on my radar and why I continue to monitor it. Note the bearish engulfing candle and the recent failure to make higher highs. This is important to note because it’s indicating a short-term change of trend.

The next chart is important as well, as it puts things into a bit of a longer term perspective. The Semiconductor sector is still in a solid uptrend that goes back to 2013. So, for longer term investors the trend is still on their side.

The third chart shows the notable pullbacks of the SMH in 2013. Some traders would consider this a little unusual, as many were accustomed to seeing much larger and longer lasting corrections. The final chart illustrates this by showing the kinds of pullbacks we saw in the Semiconductor sector from 2010-2012.

So, are we on the verge of a deeper correction for the Semiconductor sector? Or will we continue the 2013 playbook with mini 7-8% hiccups on the SMH? Time will eventually tell. One thing to keep an eye on is whether these lower highs and lower lows continue. Another thing to watch is whether the SMH breaks or holds that 2013 trend line. Thank you for reading.

Author has a position in SMH and components MU and AMD via in the money puts at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.