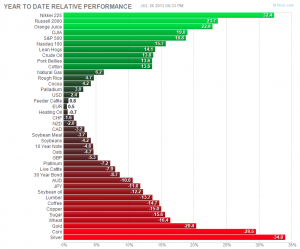

Market-leading small-cap benchmark Russell 2000 (RUT) just closed out the last full trading week of July +23.7% YTD, currently outpacing…just about every major asset class that exists. Ordinarily, this would be cause for celebration.

Market-leading small-cap benchmark Russell 2000 (RUT) just closed out the last full trading week of July +23.7% YTD, currently outpacing…just about every major asset class that exists. Ordinarily, this would be cause for celebration.

But in this case, we’re all doomed.

It turns out too far too fast may be too much of a good thing (and never mind the Nikkei way up there: Japanese fiscal and monetary policy are currently operating out of a different universe). Due to a unique technical feature that has come to light, the index’s outstanding performance is now threatening to rip a hole in the universe, miss the Enchantment Under the Sea dance, “nuke the site from

orbit”, “cross the streams” and otherwise fulfill the worst of all possible futures warned about by a whole host of other, lesser-known apocalyptic popular 80’s sci-fi movie memes.

Despite a seemingly endless host of contrary political and economic headwinds arrayed against it, US equities have doggedly persisted in pursuit of the higher calling of their 4.5 year bull market, just recently peaking over the highest summit set by its forebears to attain the much-coveted status of “Strongest Bull Market of the Last 65 Years“.

All the poisonous permabear hate in the world has been incapable of dismantling the careening momentum spurring stocks forward. Even the devastating combo of John Boehner (so impudent in his pigheaded insistence on fiscal prudence) and the dessicated husk of a formerly credible ratings agency known as Standard & Poors couldn’t keep the market down in 2011. More than 4 years on from the S&P 500‘s (SPX) biblical contrarian signal at 666, the market is convinced, given sufficient time, the economy will return to normal (i.e. unsupported, organic growth).

But now the dark arcana of physics is threatening to do what these myriad antagonistic forces could not.

Peering back across the last 15 years of activity, in contrast to the “Triple Top” exhibited by the S&P 500 (SPX) the Dow Industrials (DJIA), the Russell 2000 has installed markedly higher highs in 2000, 2007 and now 2013. The resulting pattern is a truly massive Right Angle Broadening Ascending Formation (RABAF) that ultimately incorporates 16 years and +233% of market history. There’s a reason it looks familiar: the pattern (below) closely resembles Darth Vader’s Super Star Destroyer from Return of the Jedi.

The problem, specifically, is that the Russell is poised to go back in time. No less than theoretical physicist Stephen Hawking held a party no one attended a few years ago to plausibly demonstrate this isn’t possible; and yet the Russell is about to do so, all the same (even Hawking has nothing on Laszlo Birinyi). Regrettably, the theory would take several chalkboards to demonstrate long-hand, so we’ll settle here for a few lines describing how:

Since the index’s last RABAF pattern touch at 300-350 support in March 2009 (the prior tags came in quick succession in late 2002 and early 2003), through the present the Russell 2000 has advanced at angle of 70 degrees. From the Russell’s October 2011 low to the present it has advanced at 79 degrees. Finally, from the post-QE3 announcement November 2012 low, the Russell has run up at a truly parabolic 85 degrees.

8.5 month, +38% parabolic 85 degree advances. Like I said: up to this point, everything is perfectly normal. But these unremarkable statistics belie the secret of a disturbing trend.

According to this multi-year trajectory the next advance of this liquidity-fueled, euphoria-reflexivist virtuous wealth feedback loop that is the Russell 2000 will be at 91-94 degrees. Not only does that resolutely snap the RABAF pattern to the upside, the Russell’s up-trend on its next leg (or the present one, in a true blow-off) will violate our rational conception of spatio-temporal reality and go backward in time.

Yes, the stock market is about to cross the streams.

That long litany of adverse developments that have threatened (in vain) to undermine this bull market? Thought it’s difficult to comprehend: they were effectively and futilely pulling a John Connor on our nascent 21st century prosperity.

So much for the human race. Suddenly all those unrealized paper 401k gains (and pallets of gold bars, canned goods and 100,000 .223 rounds surreptitiously bought off the back of a Walmart-bound tractor-trailer at a rest stop outside Meridian, Mississippi) appear worthless.

Why haven’t the songs these canaries sang carried far enough and loudly enough to forestall this imminent calamity? It would be

convenient (but no less appropriate because of it) to lay blame at the feet of the Federal Reserve’s accommodative policy, the deceptively benign Ben Bernanke his equally innocuous right-hand woman and probable successor, Janet Yellen. All things considered, though (see left), maybe the venerable Larry Summers isn’t such a bad idea: maybe the guy who lost Harvard a paltry $1.8 billion is the man for just such a time as this where all other would-be, market-correcting, value-discovering catastrophes have been dispatched by the irrepressible Bernanke Put-backed optimism. If anyone can harness the full market-collapsing, financial Ragnarok-summoning power a Fed Chairman is capable of, it’s him.

Inadvertently (it’s never anyone’s fault) and ironically, that creative destruction would effect our market salvation.

Until President Obama sorts that out and staves off cataclysm (just as he did when he refused to let Detroit go bankrupt), continue to watch the RABAF with intense interest as it approaches 90 degress; and hope for the worst.

Twitter: @andrewunknown and @seeitmarket

Author holds short position in Russell 2000 mini Futures (TF) at the time of publication.

“Don’t Cross the Streams” image copyright Andy Kluthe

“Enchantment Under the Sea” image from Back to the Future, copyright Universal Pictures

Super Star Destroyer from Return of the Jedi, copyright Lucasfilm Ltd.

Terminator image from Terminator 2: Judgement Day, copyright Tristar Pictures

Emperor Palpatine image from Return of the Jedi, copyright Lucasfilm Ltd.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.