Just when everyone had written off the commodity sector as being a serial underperformer for the last two years, it has resurged in 2014 with force, particularly soft commodities.

Just when everyone had written off the commodity sector as being a serial underperformer for the last two years, it has resurged in 2014 with force, particularly soft commodities.

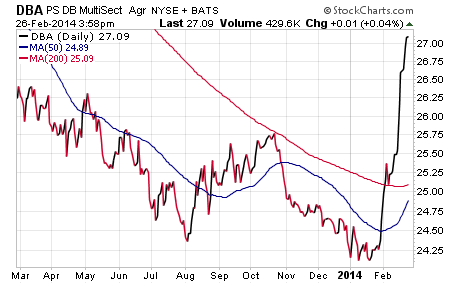

The PowerShares DB Agriculture Fund (DBA) lost over 12% in 2013 and has a 3-year annualized return of -8.41% through December 31, 2013. However, this broad-based index of soft commodities such as corn, coffee, soybeans, and sugar (among others) has leapt out of the gate with a gain of more than 11% to start 2014. Commodity prices have been steadily rising as weather patterns and other factors have spurred fears over crop availability and supply issues. These fears have been supportive of the liquid and widely traded futures contracts that DBA invests in.

Coffee in particular has shot to the moon as retailers have been steadily increasing demand and farmers have been slow to keep up. The iPath DJ AIG Coffee Total Return Index (JO), which tracks the price of coffee futures contracts, has risen more than 60% so far this year. Coffee as an individual holding currently represents about 16.55% of DBA.

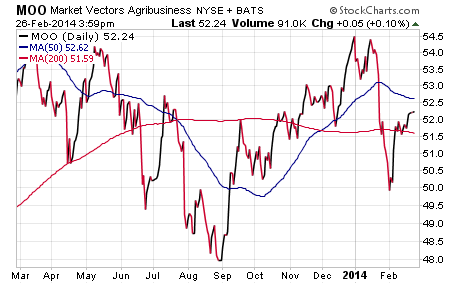

One of the more interesting things I have noted is that companies engaged in the agriculture business have not been participating in this rally. The MarketVectors Agribusiness ETF (MOO) currently controls $3.8 billion in some 52 companies that focus in this sector. The top three holdings include: Monsanto (MON), Syngenta Ag (SYT), and Deere & Co (DE).

So far this year, MOO has declined 4% in value while the majority of broad-based stock indexes are flat and commodities are surging. This may be due to the fact that the quick move in commodities has not yet trickled down to support the earnings and momentum of stocks engaged in this sector. It might also signal that investors are wary that the move in soft commodities is just a short term blip on the radar.

One area that rising commodity prices will likely affect the hardest is food and beverage retailers as these higher prices will increase their costs and squeeze their profits. The PowerShares Dynamic Food & Beverage Portfolio (PBJ) invests in a portfolio of 30 holdings that include companies such as Starbucks (SBUX), Green Mountain Coffee Roasters (GMCR), and General Mills (GIS). All of these companies are likely going to be looking at making changes to their pricing as a result of higher costs if this trend continues spiking.

It should be interesting to see how this sector continues to shake out for the rest of the year. Many investors are likely going to be concerned about the effects of rising commodity prices on inflationary statistics and purchasing power as well. I would not be surprised to see a consolidation or pullback from these highs given how far and fast prices have progressed in a short period of time. However, there is certainly room on the charts for soft commodities prices to continue much higher. Only time will tell.

For those that are interested in getting my latest take on a number of sectors and ETFs, check out this recent video presentation.

No positions in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.