After a strong summer relief rally, the precious metals sector is back in the doghouse again. With the Fed on tap and budget talks seemingly ready to gridlock, precious metals are bracing for a bumpy fall. In the short-term, however, much is riding on the FOMC two day meeting that concludes today. Precious metals investors and traders will be listening to specific language used in the Fed’s statement to glean insights into their purchasing plans. Many eyes will also be on the US Dollar.

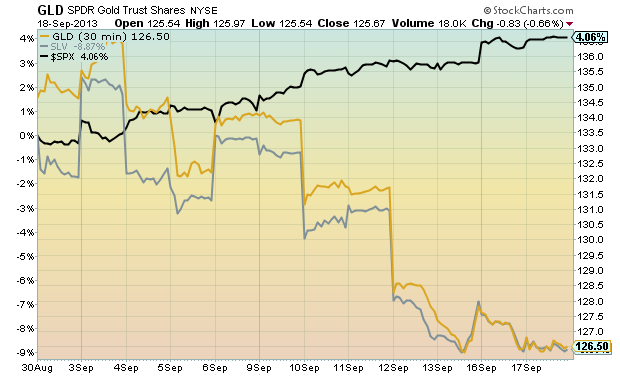

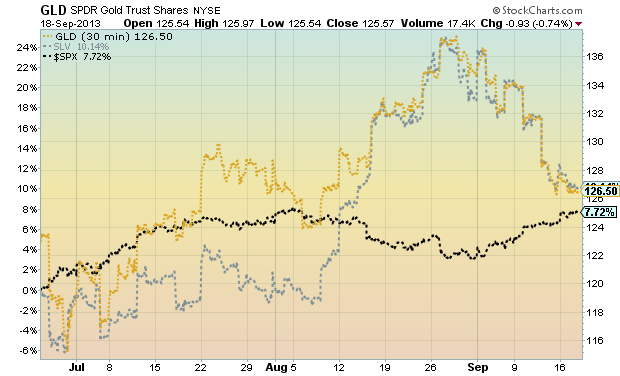

Aside from domestic issues with the Fed and budget talks, investors will be tuned to global events such as the civil war in Syria and European elections this weekend. There will be no shortage of news events this fall. Below is a chart of gold and silver vs equities (S&P 500) for September. Clearly precious metals are reeling of late. For a broader, yet still short-term picture, a 3 month chart is also pictured below. If gold and silver have some energy, investors will want to some life soon.

Gold and Silver vs S&P 500 – September

Gold and Silver vs S&P 500 – 3 Month Chart

Twitter: @andrewnyquist @seeitmarket

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.