As the temperature trends lower and the leaves change colors, now might not feel like the right time for traders to consider a position in Pool Corporation stock (NASDAQ:POOL). But, the company continues to perform, regardless of season.

The $4B swimming pool supplier reported a 7%+ rise in sales for Q3 on October 20th as earnings of $1.03 per share topped analyst expectations (5th consecutive quarterly beat). A boost to their EPS guidance and strong positioning for the upcoming swimming season make POOL a great stock to consider, even at this time of year.

If fact, the winter months have actually been a seasonally strong period for POOL’s stock price (5 year averages listed below).

- December: higher 3 of the last 5 years; median return of +1.7%

- January: higher 3 of the last 5 years; median return of +3.4%

- February: higher 3 of the last 5 years; median return of +4.2%

- March: higher 5 of the last 5 years; median return of +4.9%

And coupled with the additional reasons below, I am putting Pool Corporation (POOL) on my trading radar.

Shares of Pool trade at a P/E ratio of 25.07x (2017 estimates), 1.60x sales, and 14.84x book value. Solid pricing power combined with a modest increase in consumer spending are likely to keep annual earnings growth in the 10-15% range for the foreseeable future. If so, this keeps the PEG ratio, the multiple investors pay for growth, at or below 2.

Given its market cap, the Pool Corporation stock (POOL) tends to be under the radar for most Wall Street firms. Currently there are 4 hold ratings and 2 buy ratings on the stock. On October 21st, Wedbush reiterated their outperform rating with a $109 price target.

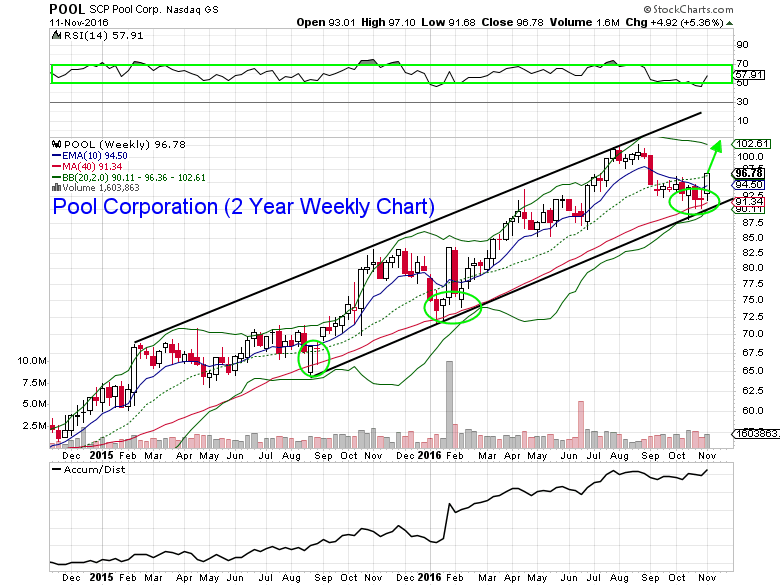

Reviewing the 2 year weekly chart above, Pool shares are starting to attract buyers after the recent 10%+ correction. For the third time since August of 2015, the 40-week simple moving average acted as the floor (bottom of the uptrending channel as well) and sets up for a move to the mid to high $100’s next year. In order to manage risk effectively an initial stop loss can be placed under the October lows.

Pool Corporation (POOL) Weekly Stock Chart

Thanks for reading.

Twitter: @MitchellKWarren

The author does not hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.