Recently I posted a piece for trend followers using Point and Figure charts to highlight the strength of the S&P 500 (SPX) over the past two years. And wouldn’t you know it, less than two weeks later we got a double bottom sell signal when the SPX printed 1889.51

So does this mean that investors should go short? For starters, adhering to point and figure guidelines, it is not advisable to initiate a short position in upward trending market even if a sell signal occurs.

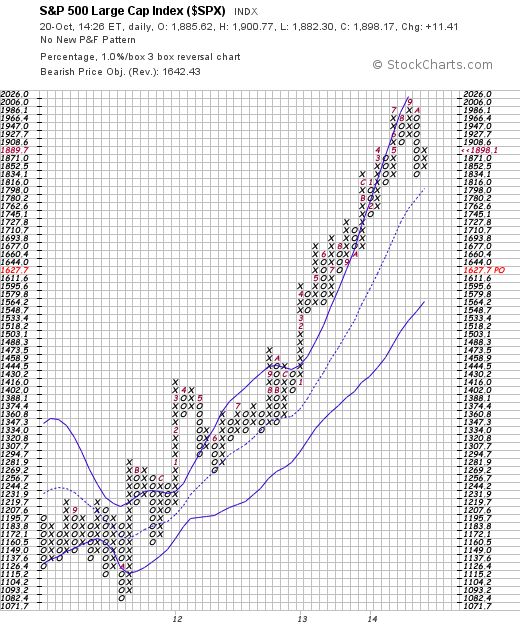

By all accounts the trend of the market is still very much intact when looking at the chart below. Also note that the slope of middle Bollinger Band is trending higher and the price action is still above that trend.

So what’s next?

As investors, we should respect the sell signal and start looking for clues to see if the dynamics of the chart begin to change or if this was just some overbought pressure being released from the market. As you can see in the chart above, price has already started to recover with a new column of X’s developing. It is important to note that when using a three-box reversal (which I am), price has to reverse by at least three percent to change direction. The reason for this is because I am using one percent as a scaling method along with a reversal of three. This helps reduce the short term moves and noise.

If the market reverses here and it would create another sell signal at 1816 (as of the time of this writing using the chart above). Now if you look left that would be at support where a column of O’s was established in April of this past year. This price level also rests just above the center Bollinger Band, which may act as further support.

At this point the trend is still intact with a little cautionary undertone. Thanks for reading.

Follow Karl on Twitter: @Snyder_Karl

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.