Today I would like to discuss time. Time is a huge factor in making up the price of an option. Options are a decaying asset by their very nature but that doesn’t mean that all options decay at the same rate. As expiration approaches time decay tends to accelerate and this gives great opportunities for trading time. One of the most versatile options trades is the time, or calendar, spread. Let’s look first at the horizontal calendar spread. So called because it involves the same strike price but spread across different expiration months.

Today I would like to discuss time. Time is a huge factor in making up the price of an option. Options are a decaying asset by their very nature but that doesn’t mean that all options decay at the same rate. As expiration approaches time decay tends to accelerate and this gives great opportunities for trading time. One of the most versatile options trades is the time, or calendar, spread. Let’s look first at the horizontal calendar spread. So called because it involves the same strike price but spread across different expiration months.

A horizontal calendar spread is a great way to play a move that you think is coming down the line but not just yet. Let’s say you think the market will drift or move slightly higher for the rest of the summer and then have a classic October puke. Using yesterday’s prices you could sell the SPY August 164 put (SPY closed yesterday at 165.13) at 3.50 and buy the October 164 put at 5.25. If the August put expires worthless you own the October put at an effective price of 1.75, or a third of the price it’s trading at now.

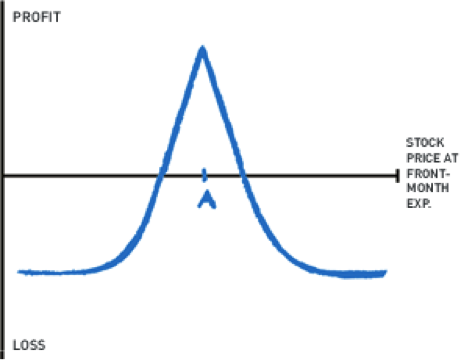

Another low risk directional way to use time spreads is this truth: A calendar spread is widest at the strike.

Look at calendar spreads logically. Take a hypothetical stock trading at 100. The first and second month 25 call calendar has both options so deep in the money that there will be virtually no difference between them. And, the 175 call time spread has both options so far out of the money that there will be scant difference between them. Therefore, logic shows that the time spread is widest at the strike. This means that if the stock is 80 and I think it will drift to 100 then I want to buy the calendar (buy further month, sell nearer month) because it will widen as the stock approaches the strike. The same holds true if the stock is 120 and I think it will drift lower to 100, then I am a buyer of the calendar spread.

However, if the stock is exactly at 100 and I think it will move higher or lower but not stay at 100 then I want to sell the calendar spread (buy front month, sell further out month) because the spread will narrow in price as the stock moves away from the strike. Time spreads are low risk, moderate reward strategies.

So, there you have it…Time is Spreadable! And that’s just horizontally. In a future column I will discuss the diagonal time spread. Thanks for tuning in, and be sure to catch me every day at The Liss Report.

Twitter: @RandallLiss

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.