Markets have been getting crushed lately and volatility is on the rise. The Russell 2000 Index (RUT) has fallen 25% from its high last year and the Russell 2000 Volatility Index (RVX) is up to 31 which is a level we have not seen too often over the last 4 years.

While it seems we are well in to a bear market, some investors like to be contrarian and some traders such as Northman Trader are making the case that we could be getting close to a tradable bounce in stocks.

Playing for a bounce is risky business. In this environment stocks could easily fall 3-4% in a day or 10% over the course of a week.

Bull Put Spreads Variation

That type of volatility and uncertainty makes bull put spreads a risky play.

Bull put spreads are a staple trade of professional option traders. However, losses on these trades can accelerate very quickly if the market moves against you.

If traders still feel bull put spreads are the way to go, there are some things you can do to provide yourself with a little bit of protection. One variation I trade occasionally involves adding a bear put spread in front of the bull put spread.

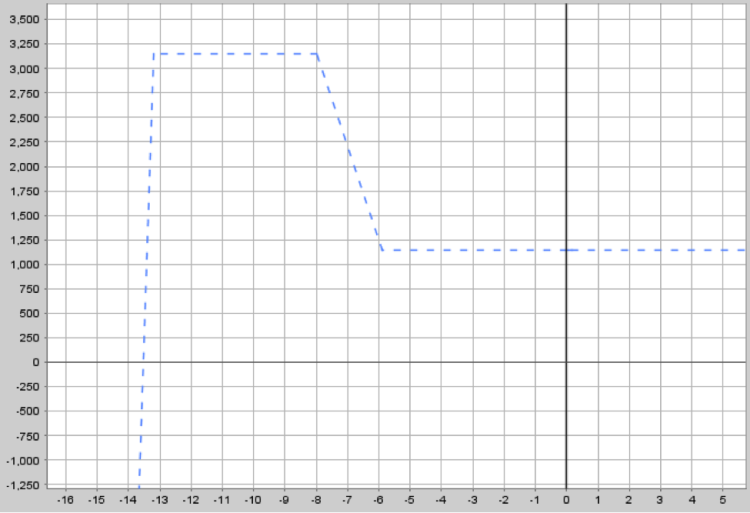

This is what it could look like:

As you can see, this hypothetical trade creates a profit zone below the current market. The options trade sets up as follows:

Trade Date: Feb 8, 2016

Trade Details:

Buy 1 RUT 900 March Put

Sell 1 RUT 880 March Put

Sell 10 RUT 830 March Puts

Buy 10 RUT 810 March Puts

Capital at Risk: $17,000

The trade has an income potential of $1,000 or 5.88% which will be less than a standard credit spread, but the profit zone creates a higher profit potential if RUT falls down into the zone at expiry.

Keep in mind, this trade is still positive delta, so ideally you want the index to rise. Sharp falls early on in this trade will still hurt, the debit spread can only provide so much protection.

Happy trading.

Further reading from Gavin: “Apple (AAPL) Head and Shoulder Pattern Signals Caution”

Twitter: @OptiontradinIQ

The author does not hold a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.