Oil prices near-term are looking very extended and I think prices are getting ready to peak out very soon.

Looking at the chart below, it’s easy to see that oil prices are at the top of regression channel, sitting roughly 2x away from the mean (at current prices).

Oil prices could continue to squeeze a bit above $48, but there is a lot of overhead resistance around $50.

In my opinion, I think if we get a few months of +$50 a barrel oil, rig counts will start to explode back to the upside… once again putting a cap on oil prices.

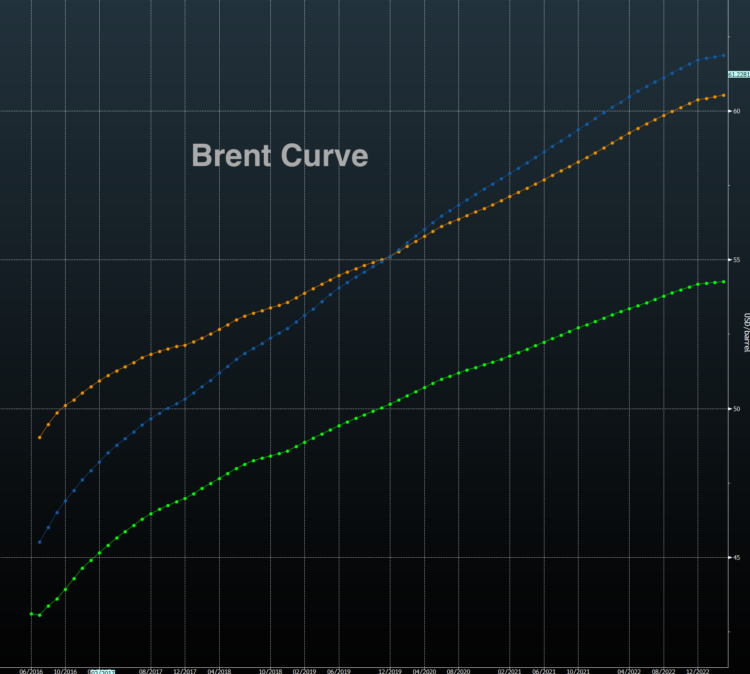

Looking at the Brent curve, it seems that future prices will remain anchored in the near term. Oil producers are placing some big bets as short positions climb to 4.5 year highs for protection against another large decline.

$50-60 per barrel oil prices seems to be a good level for prices to level off over the next few months. The only major catalyst for over $60 a barrel, would be a pickup in global growth. Any sign of further global growth weakness and oil prices may find themselves back down around $30-35.

Thanks for reading.

The material provided is for informational and educational purposes only and should not be construed as investment advice. All opinions expressed by the author on this site are subject to change without notice and do not constitute legal, tax or investment advice.

More from Korey: Echoing 1937: Stock Market, Economy Set For More Volatility

Twitter: @stockpickexpert

The author or his clients may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.