Every week Morgan Stanley issues a report consisting of charts about everything related to the credit markets. Unless one is a fixed income portfolio manager, the week-to-week changes don’t really mean a whole lot, but looking at the charts once a quarter or so does help in getting a “big picture” idea for where things stand with corporate credit. The data are also a good cross-checking tool to make sense of and filter out the mass/social media noise of “bubbles”, “crashes”, “bankruptcies”, etc.

So here are some of those charts, with commentary from yours truly, relevant to the most common refrains as to why corporate bonds and the credit markets are on the verge of the abyss.

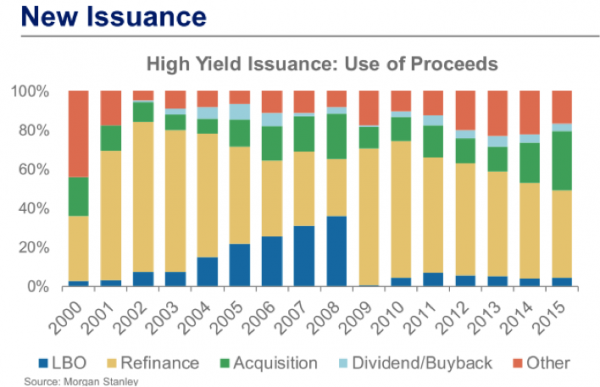

“Junk bonds are in a bubble because everyone is issuing debt to buy back stock; the whole thing is out of control!!”

No doubt that bond issuance for stock repurchases is alive and well. I’ve been writing for years now – and the data in the Fed Release Z.1 Table F.213 bears that out – that the only net buyers of stock have been the companies themselves, while the aggregate net equity exposure of all other market participants has been basically flat.

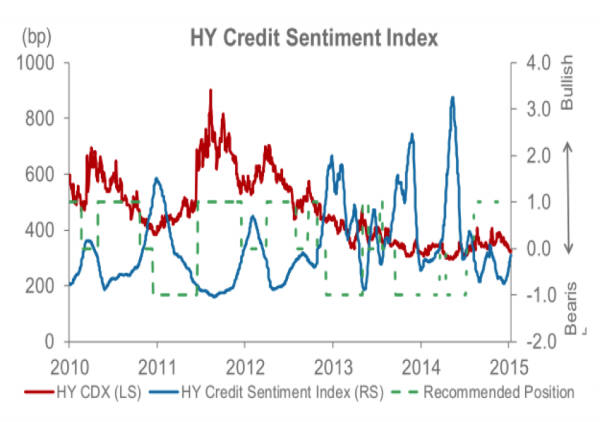

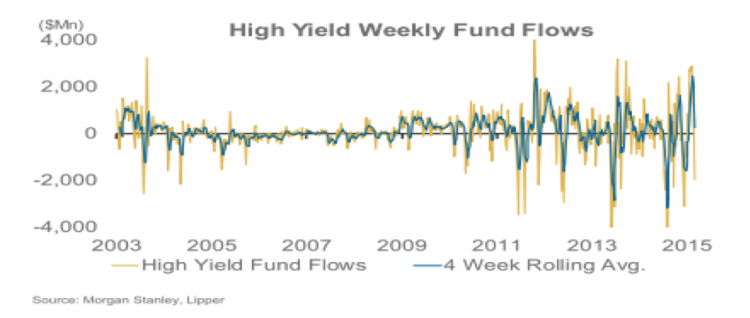

That said, based on the chart below, this dynamic hardly seems to be spinning out of control. The percentage of proceeds from new issuance being earmarked for stock repurchases is consistent with what has happened over the last 6 years. Furthermore, if a key ingredient of a bubble in the credit markets is “euphoric sentiment”, the following chart suggests that it too seems to be conspicuously absent.

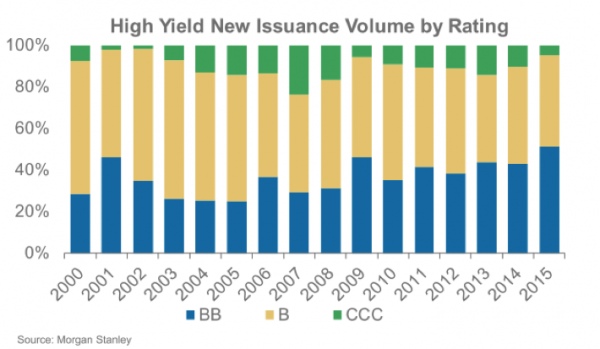

“Only the weakest of companies are left to issue new bonds!!”

As you can see below, that is again not true. Quite the opposite in fact as the volume of BB issues has eaten into the volume of new CCC rated bonds.

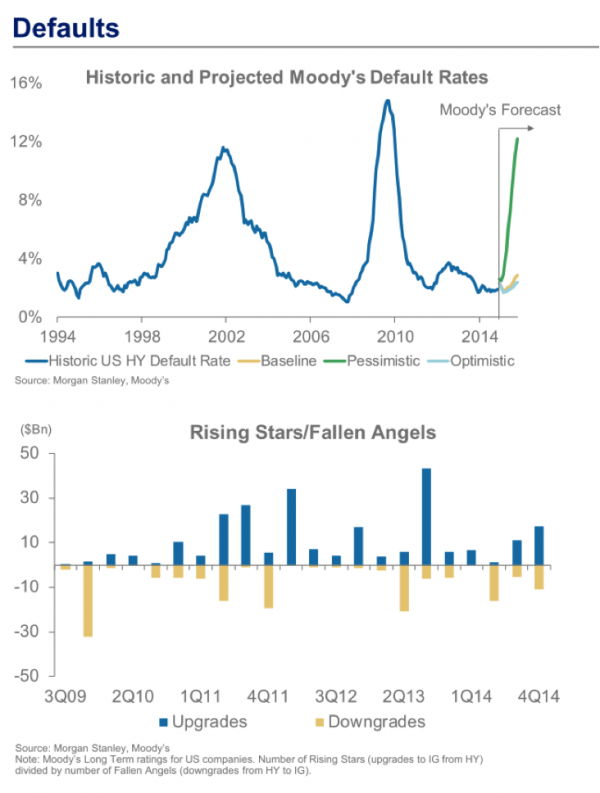

In addition, based on Moody’s assessment (and I’ll grant you that I’m not sure how much ratings upgrades/downgrades can or should be relied on), the overall credit health of bond issuers continues to trend toward the good, and projected default rates remain at historic lows. It can change in a hurry of course – and at some point it will – but it is not happening now.

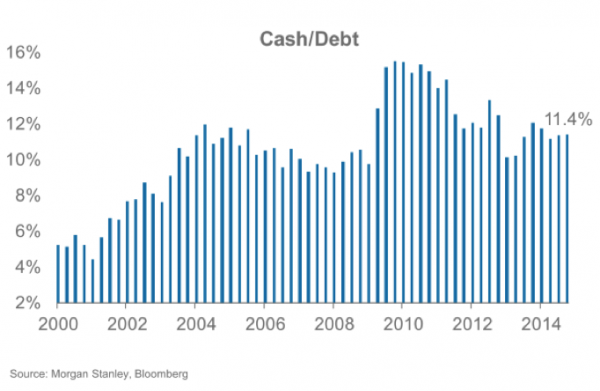

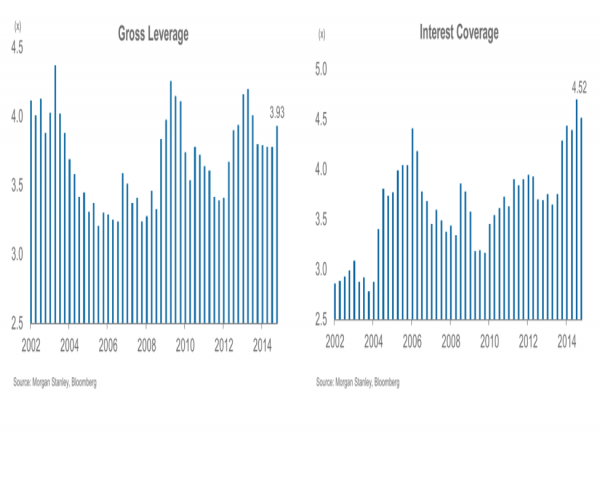

Lastly, the overall gross leverage of companies is on the high side of historical levels, but it’s been higher as late as 2012 and 2013; the Cash-to-Debt ratio is at the mid-point of the range, and the interest coverage ratio has only been healthier once. Further indications of on-going strength in the current credit markets cycle.

“There’s no liquidity in the bond market and when the selling starts it will be a disaster!!

Lack of liquidity in the corporate bond market is a truism, and when credit debacles a-la 2001 and 2008 unfold what little liquidity there is, it disappears. I will also agree that in the current environment there’s a significant lack of supply of new issues relative to the amount of demand. That is why whenever a large bond sale shows up – say the recent offering by Valeant Pharma (VRX) – buyers with large cash balances start fighting over it. But that’s the kind of lack of liquidity the bond market should always hope for!!

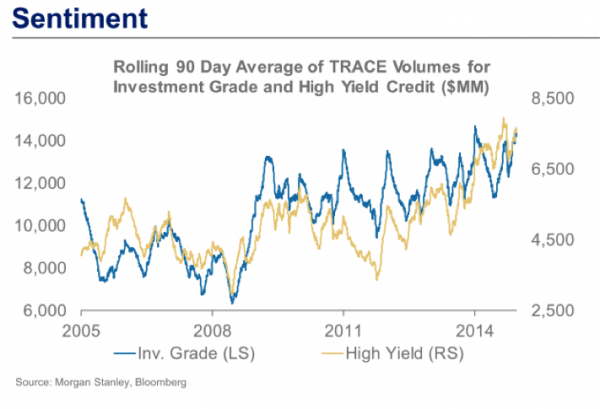

Meanwhile, in the here and now, with respect to secondary market liquidity, you can see that the dollar volume of bonds traded is as healthy as it has been in a decade.

“Look at the HYG and the JNK, the high yield market is crashing!!”

I saved this for last because extrapolating the movement of a couple of retail ETFs to the health of corporate bonds is a “special kind of nonsense”. As you can tell from the increased volatility in and out of these funds since 2011, they have become the darling of day traders who have come to convince themselves that they are actually trading “high yield credit’.

However, the fact is that the combined market capitalization of the SPDR Barclays HY Fund (JNK) and the iShares iBoxx HY Fund (HYG) is $26.5B. If their market cap dropped 40% overnight it would equal about as much as the Valeant junk bond issue that was sold in ONE day to an oversubscribed crowd. So at risk of repeating myself: enjoy trading these ETFs seven ways to Sunday – they are liquid, they are not subject to M&A risk if one wants to short them, and longs can scalp them for pennies all day long. BUT please do not think or suggest that they are relevant to what is actually going on in the credit markets. That would be the same as when – during the internet bubble – people would hype ticker “BABY” because ticker “MAMA” was ripping higher. (Go back and check if you think I’m making this up).

In sum, while it is fine entertainment to rant and rave on how the Federal Reserve has re-inflated the bubble in credit and investors are some lack of “patience” away from the inevitable collapse, the fact is that the corporate credit markets show nothing remotely close to being in a bubble, let alone a bursting one. If anything there continues to be way more cash to be invested than there are bonds, and even more money getting allocated to credit by pensions and foundations every month.

As Rosenblatt’s Brian Reynolds – who taught me whatever little I know about credit – is fond of saying, the market is in a credit cycle, which, like all credit cycles will eventually end. But arguing that it is ending now just because its persistence irritates those who intellectually “disagree” with it, is simply not going to do the trick.

Thanks for reading.

Follow Fil on Twitter: @FZucchi

No positions in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.