Later this morning, the Bureau of Labor Statistics publishes it’s monthly Non-Farm Payrolls report (what it refers to as “The Employment Situation”).

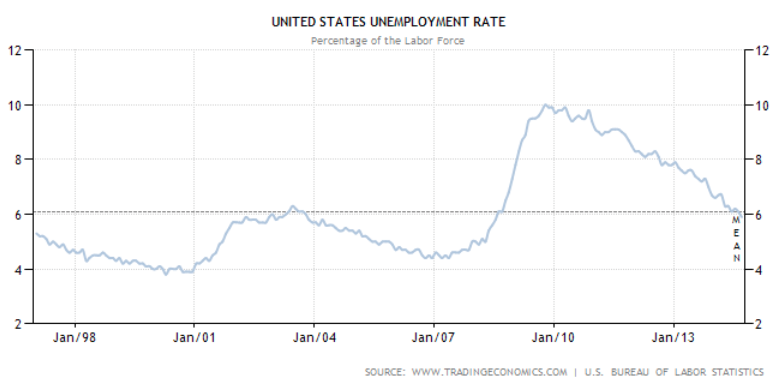

The benchmark U-3 Unemployment Rate is projected to hold steady at 5.9%, which maintains a level just below the mean developed over the last several cycles:

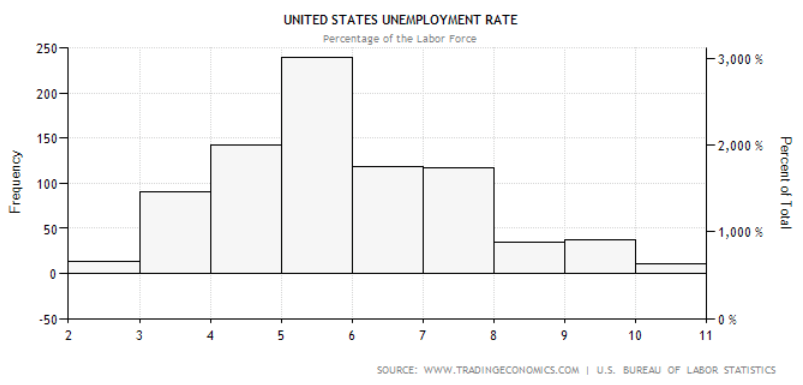

In case that seems skewed by 2008-2009’s elevated levels, here’s the distribution of U-3 data from 1939-Present. As you can see, a 5-handle is the most common:

Mission Accomplished, Fed?

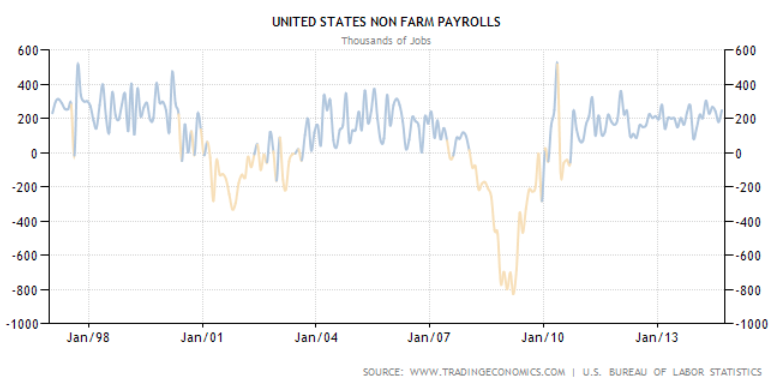

Analyst consensus sees few surprises in today’s release, with NFP forecast at 235k versus 248k previously.

7 of the last 8 NFPs and 9 of the last 12 NFPs. have been over 200k, a trend that is evident in the decidedly calm NFP data for this cycle. In fact, this is now the longest cycle on record (just beating 1986-1990) of consecutive months of NPF above 0. Here you can see Non-Farm Payrolls in comparison to the two previous cycles:

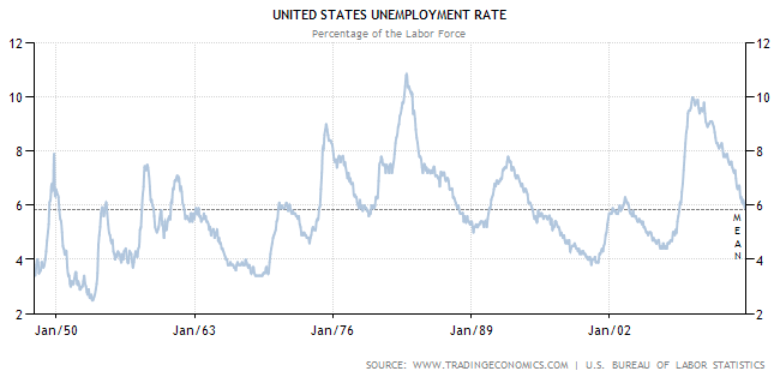

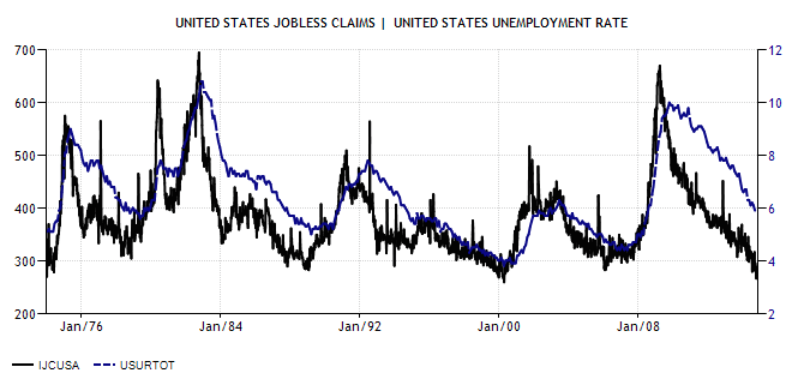

So is this cycle nearing it’s expiration date? U-3 tends to lag but track Weekly Initial Jobless Claims very closely. Judging by how these measures have correlated over the last 5 major cycles (40 years), the answer is “yes”:

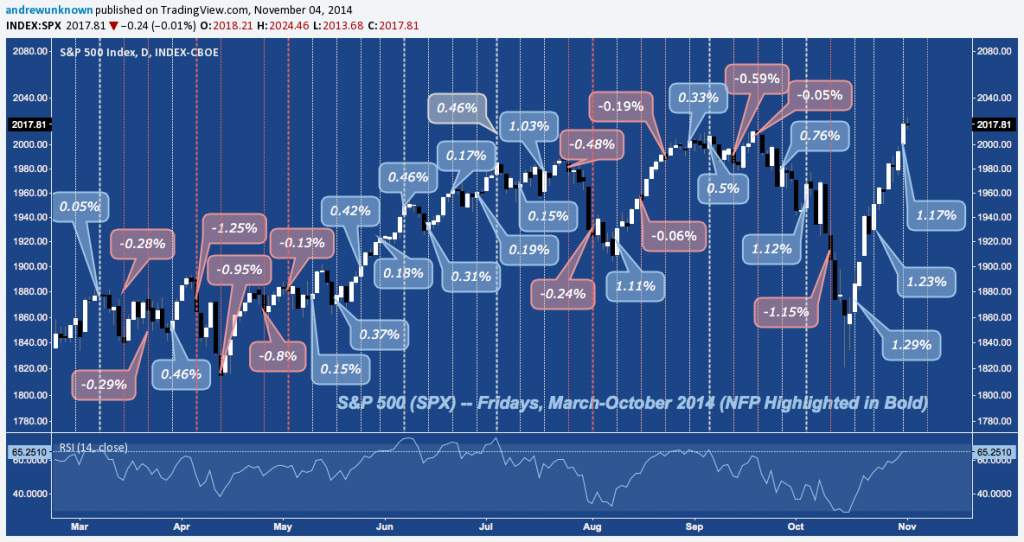

Zooming in to the present, how have stocks performed on Fridays in general, lately; and on NFP day specifically? Here are a few stats on S&P 500 (SPX):

Fridays:

- Fridays YTD (n=42): -0.09% average.

- Several major runs in 2014: 4/5 negative in January; 6/7 negative in March-May; 10/10 positive in May-July; 4/5 negative in July-August. 7/10 positive in August-October.

- 7 of the last 10 Fridays have been positive: +0.46% average.

- 4 of the last 5 have been positive: +0.73% average.

- 5 of the last 5 finished higher or lower by greater than +/- 1%.

And on NFP Fridays:

- 12 of the last 15 (80%) NFPs have been positive: +0.43% average.

- Positive NFPs average (N=12): +0.62%.

- Negative NFPs average (N=3): -0.54%

Here’s a composite view of these performance statistics broken down over the last 6 months:

Twitter: @andrewunknown

Author holds no exposure to asset classes mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.