Market volatility returned with a flourish last week. After spending 44 days within 1% of its all-time high, the S&P 500 Index (INDEXSP:.INX) moved sharply lower on Friday (down 2.5%) as the index had its worst week in seven months. It’s been a shaky start this week as well.

And the VIX Volatility Index (INDEXCBOE:VIX) is letting investors know about it.

While longer-term breadth trends remain relatively robust, the rally (in the broad stock market indices) has lost some steam in recent weeks. Lagging upside momentum has been replaced with emerging downside momentum (the NYSE on Friday saw downside volume outpacing upside volume by near 32-to-1, while the NASDAQ experienced a 12-to-1 down day). That could leave stocks vulnerable to some further near-term weakness. As long as stock market breadth remains strong, any further market correction in stocks would be expected to be limited in degree and duration.

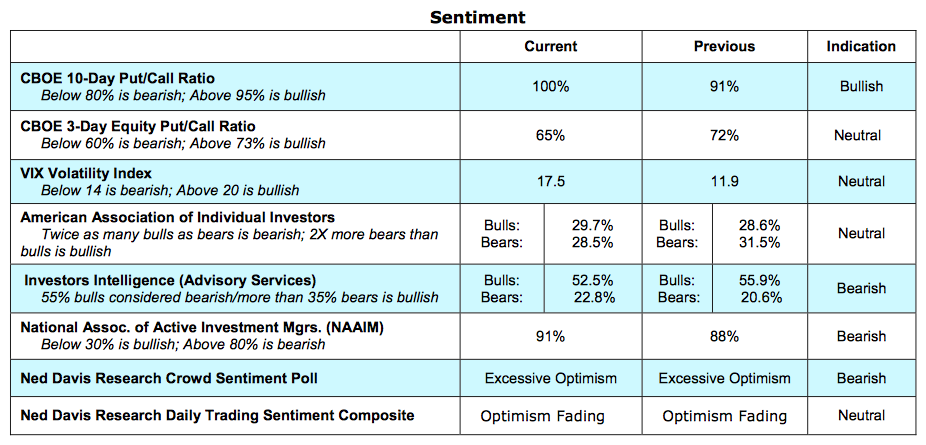

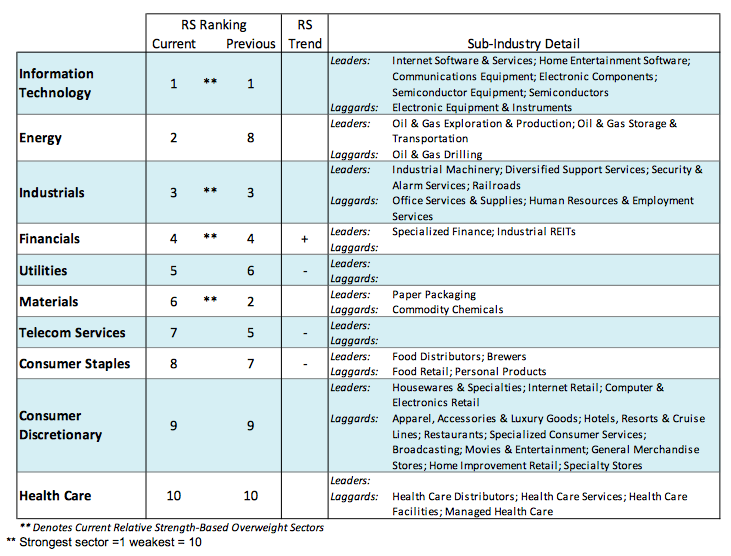

Our industry group trend indicator has fallen back from a recent peak of 84% to a current reading of 73%. A drop below 50% would represent a significant weakening in the broad stock market. Last week did see a continued move away from excessive optimism in most of the sentiment indicators.

The NDR trading sentiment composite moved to its lowest level in more than two months. And the VIX began to spike with Friday’s sell-off as market volatility finally reared its head. The notable exception on the sentiment front was the NAAIM exposure index, which ticked higher last week (back above 90%) and continues to show that active investment managers are fully invested in stocks. In the wake of excessive optimism, sentiment indicators tend not to offer significant relief for stocks until excessive pessimism starts to become evident. For now, support on the S&P 500 is likely to emerge in the 2110-2080 range, while resistance is near 2160.

Accompanying the weakness in stocks has been a rise in bond yields both at home and abroad. This followed a decision by the European Central Bank (ECB) to hold off on further stimulus and came amid increased chatter that the Fed may decide to surprise the market with a rate hike later this month. The yield on the benchmark 10-year T-Note yield rose to 1.68% last week, moving above down-trend resistance and its highest level since June. Yields rose in Europe as well, with the yield on the German 10-year Bund crossing back into positive territory last week. The rise in bond yields could add to headwinds facing the defensive, higher-yielding sectors of the stock market (which have already begun to lose relative strength and remain near all-times highs in terms of valuations). The key event this week may be a final opportunity (on Monday) for the Fed to massage its message to the markets before entering a quiet period ahead of the September FOMC meeting.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.