By Andrew Nyquist

By Andrew Nyquist

After taking a few days to consolidate gains following the Bernanke-Draghi two week two step, the market “liquidified” again… as in, rained dollars down on investors. On Thursday, “Helicopter” Ben and the Federal Reserve continued their promise to boost asset prices, including housing, but added a new wrinkle… a goal of lowering unemployment. Enter QE3. And more political and economic debate just in time for Presidential election season.

Apparently more bond buying (of the mortgage backed variety) is going to assist in getting cash heavy companies to accelerate hiring again. In many ways, it’s unfortunate that America is left to rely so heavily on the Fed, but due to political gridlock (and our distaste for natural cycles) there really aren’t a lot of options. So fiscal cliff or not, Big Ben stands ready to stretch the balance sheet.

Now back to what matters most to active investors, price action. And that has been going higher. In summary, last week saw continuations for Small Caps (IWM), Emerging Markets (EEM), the Financial Sector (XLF), Commodities (CRB), Homebuilders (XLB), Technology (QQQ), and, well yeah, you get the picture; the market went up. But a brief excerpt from last week reminds us to stay focused and disciplined, especially if involved in high beta stocks:

“Well although higher seems likely over the coming weeks, the stock market doesn’t tend to move in a straight line. And further, the market never takes it easy on us. So if it starts to feel “easy,” check yourself by drawing on past experience; in short, active investors need to stay focused on technical indicators and important support and resistance levels. The second we get complacent, we open the door for a costly mistake.”

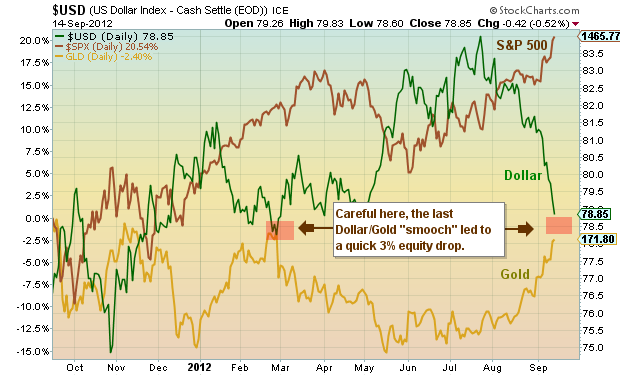

So what are the charts telling us now and what lies ahead? Well, the S&P 500 almost reached that pesky 1478 open gap magnet I mentioned last week, and still has the 1497 gap on its radar. I’d think that anything above last week’s high will trigger some profit taking, considering overbought conditions and the way the market reversed off 1474. Support resides below near the breakout band at 1435-1440, then 1400. Note that Monday will mark bar 8 of 9 of a daily sell setup on many indices, including the S&P 500, which could limit upside. Also, the Dollar recorded a daily buy setup last Thursday, so it is expected to firm up a bit this week. As well, the second chart down (a continuation of last week’s Gold and S&P 500 versus the US Dollar analysis). A Dollar-Gold “kiss” could bring some near term selling.

Looking a bit further out, the AAII percentage of Bulls stands at just 36.5 as of last week (39 is long term average) and although it should rise considerably next week, it is still within the bounds of reason. As well, the percentage of S&P 500 stocks above the 150 day average is below 80 and under Spring highs. This will likely keep short index funds on a tight trading leash (Note I took a starter in the Short S&P 500 index fund (SH) on Friday).

Thanks for reading. As always, trade safe and trade disciplined.

S&P 500 Daily Chart:

Gold and S&P 500 versus US Dollar – 1 Year:

———————————————————

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

Author has a starter position in SH (short S&P 500 index fund).

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.