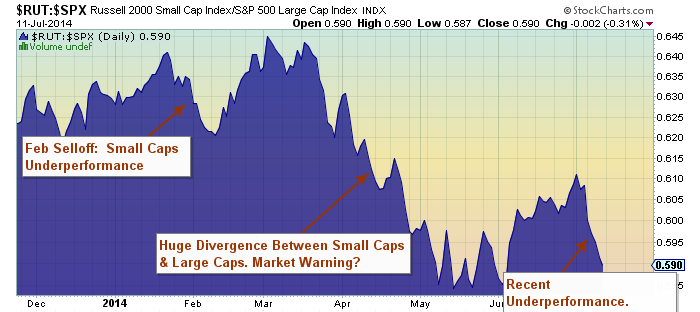

Despite a quick wave of uncertainty and renewed European bank fears, U.S. equities continue to show resiliency in the face of selling. Especially large cap stocks: Although no indicator should be used in isolation, I think that it’s interesting to note that large caps are showing little deterioration thus far. On the flip side, high beta little brother, the Small Caps (as measured by the Russell 2000), are getting hit hard during bouts of uncertainty.

Despite a quick wave of uncertainty and renewed European bank fears, U.S. equities continue to show resiliency in the face of selling. Especially large cap stocks: Although no indicator should be used in isolation, I think that it’s interesting to note that large caps are showing little deterioration thus far. On the flip side, high beta little brother, the Small Caps (as measured by the Russell 2000), are getting hit hard during bouts of uncertainty.

Enter the % Stocks Above The 50 Day Moving Average indicator. In the chart below, it’s clear that however stretched to the upside U.S. equities are, Large Cap stocks have yet to taste any of the short-term pain. 86 percent of the S&P 100 (OEX) stocks are trading above their 50 day moving average. How about large cap tech stocks? 85 percent of the Nasdaq 100 (NDX). And a broader look at large caps through the S&P 500 (SPX) shows 76 percent trading above their 50 day moving average.

I think this theme is particularly interesting, as the markets clearly haven’t abandoned “risk-on” just yet but seem to have a very big red “Sell Small Caps” button that is being used in a very reactionary way – the latest example being the Banco Espirito Santo trading halt. This isn’t entirely uncommon, as small caps have a higher beta, and this works both ways (up and down). But because the outsized divergence that formed earlier this year when small cap stocks had a full blown correction while larger cap stocks held up pretty well, investors seem to have a hair trigger with small caps.

Typically, small cap underperformance would be a precursor to a broader market pullback. But thus far, large cap stocks have remained a safety net of sorts and haven’t felt much pain. This likely has something to do with growing dividends and buybacks (for another article). But perhaps the global focus of U.S. large cap stocks has further separated them from the more locally focused small cap stocks (see 1st quarter GDP). Either way, change is (and has been) afoot in 2014. And successful investors will need to continue to monitor this theme and be ready to adjust accordingly.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.