Amid the volleys of bad economic news coming out of Europe during the summer, we posted charts at See It Market in July that suggested traders could watch for a modest countertrend bounce in the iShares MSCI Italy ETF (NYSEARCA:EWI). During the time since that post, price support has held in the area we identified and a tradable rally has formed.

Though modest, it appears that Italian stocks are reacting positively to our elliott wave analysis. But how much further can this bounce extend?

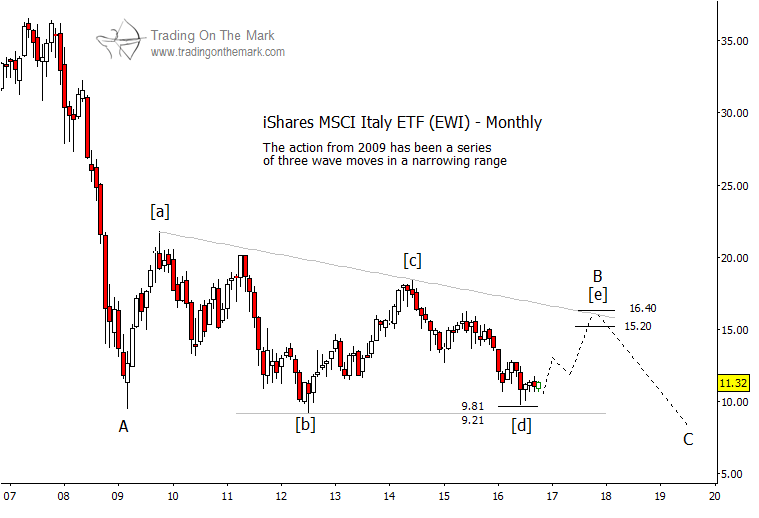

In terms of Elliott wave structure, the Italy ETF (EWI) appears to have spent the past seven years tracing a corrective triangle. The pattern has the characteristic converging range, and each leg has consisted of three smaller sub-waves.

Italy ETF (EWI) Monthly Bar Chart

Although the triangle scenario is not certain, it makes sense to treat it as the most likely pattern for now. In that case, the main target area to watch for wave [e] is near 15.20 to 16.40. Since triangles are time-wasting formations, it could take a year or longer for price to reach that area. A patient trader might see nearly a 45% increase in share value.

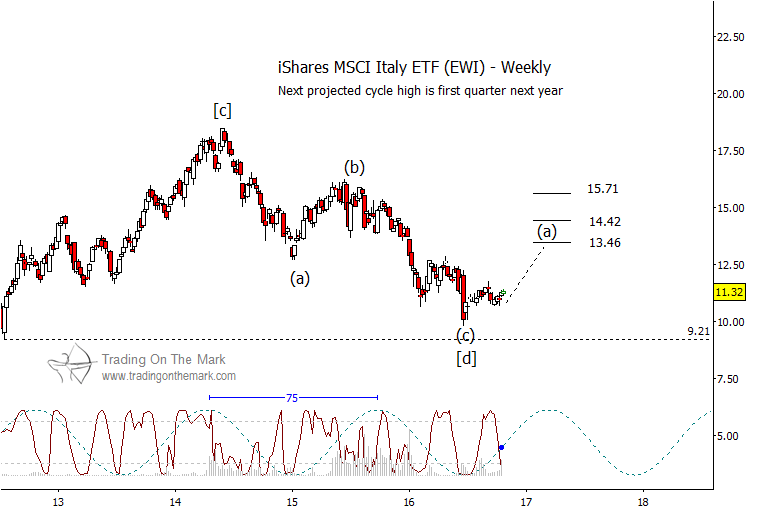

Italy ETF (EWI) Weekly Bar Chart

We have drawn nearer-term targets on the weekly chart below. Since wave [e] of a triangle should consist of three sub-waves, it will be helpful to note areas of resistance that could cap the first of those sub-waves – wave (a) of [e]. One of our preferred Fibonacci-based techniques shows that a rally should meet resistance near 13.46, 14.42, and/or 15.71. A rise into one of those areas should coincide with the next peak of the 75-week cycle shown on the chart.

Our next email bulletin will focus currency futures and ETFs. Request your copy via this link. Thanks for reading.

Also read: British Pound Nearing A Bounce

Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.