Last week saw a spike in stock market volatility. The S&P 500 finally had a move +/- 1%, ending the run of 62 days of below average volatility. What looked like the beginning of a correction on Thursday quickly reversed itself on Friday when it closed less than one half of a percent below its all-time-high of 1,985. Still, the trending indicator that I use to determine the intermediate trend of the market went from up to down on Thursday. That trending indicator has been in use for over 20 years and has accurately done an excellent job helping investors know when it is time to venture into the markets and when it is time to flee. Still, just because it has turned down doesn’t mean it is the start of a huge plunge or a Bear market. It only means that it is time to exhibit some caution.

I have been warning that there is the potential for a severe correction and/or a crash for months. And I’m not alone in sounding the alarm. Jim Rickards uses the analogy of an avalanche. He says that conditions are ripe for an avalanche in the financial markets and that when conditions are right, it only takes a single snowflake to trigger it. We don’t know which snowflake will trigger it or when, but we do know that there is a high probability of one occurring. If that is true, what do we do to protect ourselves—especially if you are retired or nearing retirement?

I have been warning that there is the potential for a severe correction and/or a crash for months. And I’m not alone in sounding the alarm. Jim Rickards uses the analogy of an avalanche. He says that conditions are ripe for an avalanche in the financial markets and that when conditions are right, it only takes a single snowflake to trigger it. We don’t know which snowflake will trigger it or when, but we do know that there is a high probability of one occurring. If that is true, what do we do to protect ourselves—especially if you are retired or nearing retirement?

The financial services industry provides mass-market solutions. By default, they lump together everyone’s money into large pools and manage it that way—en mass. Those invested that way are a part of the herd and when a correction or crash happens, they all get slaughtered.

The real issue is that the financial services industry believes that there isn’t any way to ‘time the market’. That’s why they say you have to just Buy and Hold. In my opinion, that is intellectually dishonest (to put it kindly). They want you to believe that even though we can now forecast the weather with amazing detail that we can’t yet find ways to identify trends in the stock market?

The goal isn’t to earn as much as we can. The goal is it earn what you need and with the least amount of risk.

Just as the S&P 500 finally broke its streak without a 1% move in a day; the market indexes’ long streak without a 10-20% correction will also be broken. And there is a real and present danger that a ‘crash’ (decline > 20%) could occur. The main question investors should be asking themselves is whether they have a plan to weather that kind of storm.

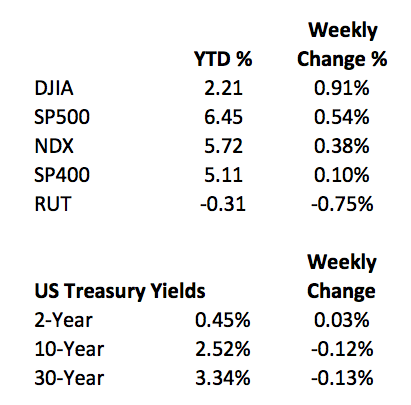

Data Bank:

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.