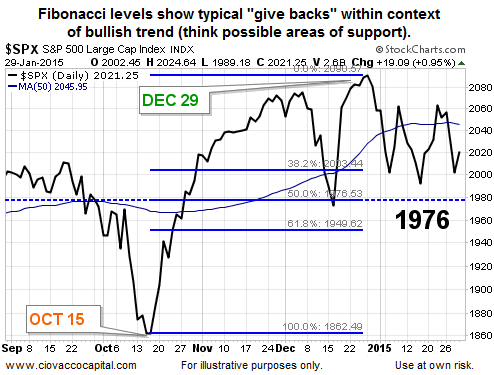

Math plays a big role in nature and the financial markets. For instance, several trading algorithms use Fibonacci retracement levels to identify levels where buyers may interest in stocks (support). The math provided below may be helpful to us in the coming days. At a minimum, it is prudent for investors to be aware of the possibility that the S&P 500 could bounce near 1976 should the market test that level:

The S&P 500 closed at 1862.49 on October 15; the index then rallied to a closing high of 2090.57 on December 29, for a gain of 228.08 points. A 50 percent retracement of that gain is 114.04 points, which means the 50 percent Fibonacci retracement level is 1976.53. The S&P 500 closed Thursday at 2021.25. Therefore, the S&P 500 would need to drop 44.72 points before reaching 1976.53.

S&P 500 Daily Chart – Fibonacci Retracement Levels

US 4th Quarter GDP Report – Not Too Hot, Not Too Cold

As we hypothesized yesterday, it is possible for GDP to calm the markets a bit if it comes in “within the consensus range”. While Friday’s GDP reading of 2.6% growth reduces the odds of an imminent bear market in stocks, it does not take the potential for a correction off the table. Therefore, it is important for us to remain flexible and open-minded, especially as the S&P 500 nears 1976.

How Will We Use The 1976 Fibonacci Level?

1976 is simply a probability reference point – nothing more, nothing less. As long as the S&P 500 can remain above 1976 on a closing basis, investors can continue to “try to be patient”. That said, a close above 1976 may not allow for a “do nothing” session since the readings on our market model (i.e. hard evidence) align with a less favorable risk/reward profile for equities.

Regardless, 1976 is a relevant guidepost for the next week or so. Thanks for reading.

Read more from Ciovacco Capital here.

Follow CCM on Twitter: @CiovaccoCapital.

Author holds positions in securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.