The financial markets got off to a good start on Monday, seeing the major US stock market indices rise in unison over 1 percent. But even with all the positivity, investors couldn’t escape the reality of “Fed week”. With the Federal Reserve on tap, the noise level has increased to a nearly unbearable level as speculation runs rampant about the Fed’s choice of words (and tweaks) in their upcoming Fed statement.

As well, investors are awaiting clues on the market’s next move, as the past two weeks have seen momentum slow and an element of uncertainty rise. With this in mind, it’s becoming clear that the coming days will prove important for active investors. And perhaps the Fed’s FOMC statement will be the catalyst.

But concerns are mounting as investors wait on the Fed. Notably, the US Dollar eclipsed the 100 mark for the first time in 12 years. At what point will the US Dollar become an economic concern? Will the Fed address this (directly or indirectly)?

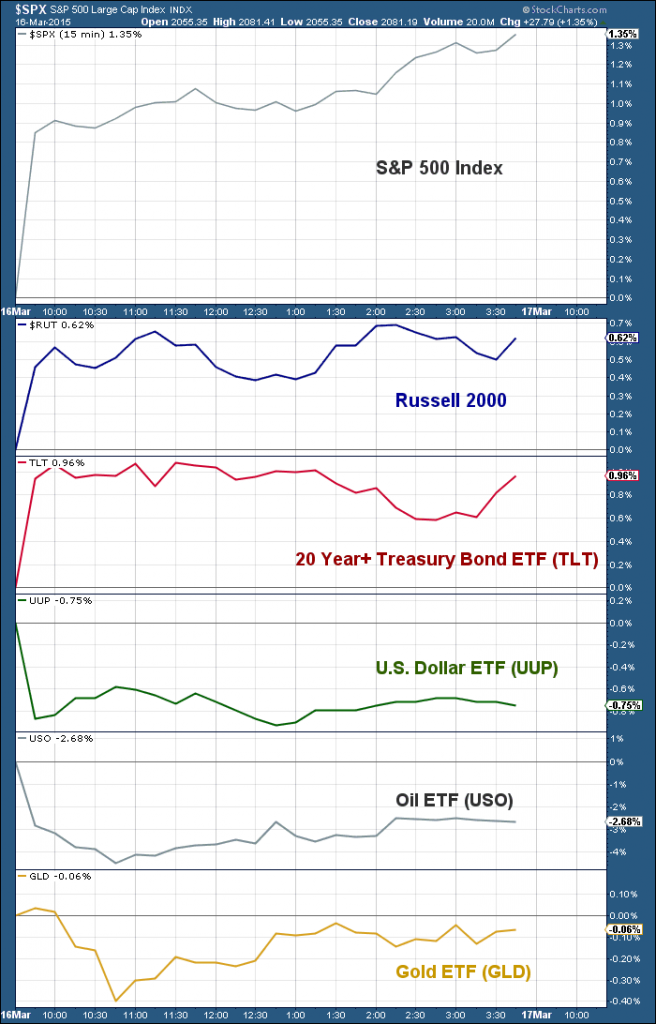

Concerns aside, the S&P 500 was up 1.35%, the Dow Jones Industrial Average was up 1.29%, and Nasdaq Composite was up 1.19%. The lone laggard was the Russell 2000 (up 0.62%). Although one could argue that investors were focusing on blue chips today, it should be noted that the Russell 2000 has been strong of late, and it’s battling resistance at all-time highs.

A strong US Dollar means a weak Euro. And this, coupled with European QE, has been a huge tailwind for select European stock markets, especially the German DAX. Although the Euro firmed up a bit today, the German DAX was up 2.24%.

Treasury bonds rose slightly as yields fell. The long bond was favored over the short bond as The 20+ Year Treasury Bond ETF (TLT) was up 0.96%, while the 7-10 Year Treasury Bond ETF (IEF) was up 0.35%. The US Dollar let off the gas peddle, pulling back from a high of 100.78 overnight to close near 100. This helped select commodities like as Crude Oil, Gold, and Silver recover some of the early morning losses. That said, all 3 commodities are trading near 52 week lows… another byproduct of a strong US Dollar.

Below is a recap of the markets intraday performance, using popular ETFs for bonds, oil, gold, and the dollar.

For more weekly insights, be sure to sign up for our free “Market Navigator” newsletter.

Follow Andy on Twitter: @andrewnyquist

Author has net long exposure to US equity indices via ETFs at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.