Investor skepticism is something that we hear about often in the stock market. More importantly, we feel it deep in our core.

It is usually entwined with disbelief that a current trend can continue given a specific set of concerning factors. Investor skepticism is also the reason that investing can be so frustrating to those who try to fit logical arguments into a psychologically driven system.

Let me know if you have heard or internalized any of these arguments lately:

- I’m skeptical of the major stock market indices making new highs in the face of mixed economic data.

- I’m skeptical of the bank stocks not participating here.

- I’m skeptical that the rally isn’t being driven by former leaders like biotech and consumer discretionary stocks.

- I’m skeptical how this can keep going with so much margin debt, consumer debt, government debt, and global central bank intervention.

- I’m skeptical of how many rate hikes we are going to get this year.

- I’m skeptical of the companies that beat earnings estimates this quarter.

- I’m skeptical of stock buybacks. I don’t know why, but I am.

- I’m skeptical how weak Apple Inc (AAPL) is, being that it’s the largest stock in the market.

- I’m skeptical that the transports haven’t made a new high yet. The transports!

- I’m skeptical of bonds and stocks rising together. One asset class has to be wrong.

- I’m skeptical of this rally in gold and the 50%+ gains in mining stocks.

- I’m skeptical that oil prices can keep driving gains in stocks.

- I’m skeptical that rising commodity prices will actually fuel meaningful inflation.

The simple fact of the matter is that there is always something to be worried about no matter how the market is performing. And since we have skin in the game (our money), it’s natural to have some level of investor skepticism.

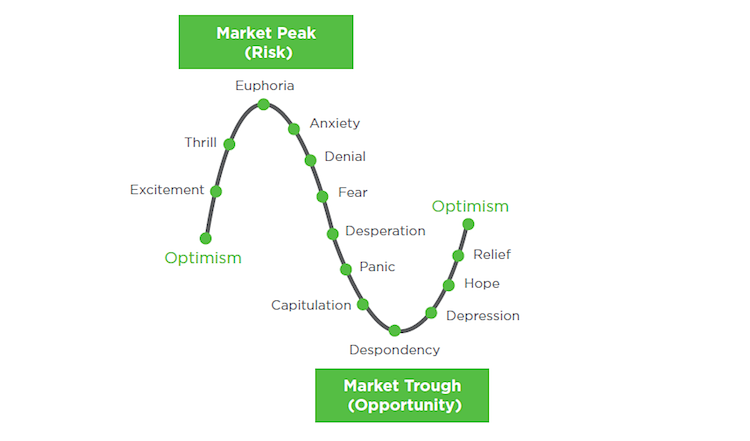

When stocks are falling, it seems like the narratives always seem to make sense because it’s usually accompanied by negative headlines and worries over bear markets or recessions. Conversely, when the market is on the upswing, it’s usually viewed as a much slower transformation to convert the masses to a sense of enthusiasm. That’s because when everyone is finally excited about the fundamentals and technical price action lining up to their bullish thesis, the end is near.

Put it this way – if you are still skeptical about this market rally, then it’s probably a good thing. There are more than likely other investors on the same wavelength who are also reticent about putting money to work and want to “wait and see” how this unfolds.

Earlier this year I wrote about how It’s Never A Perfect Time To Invest In Stocks. That was roughly a week before the February low. That timing was purely coincidental, but illustrates that when things seem the worst, it’s usually a sign that we are nearing an inflection point.

I find myself getting just as caught up in the psychology of investing as everyone else. Fear of losses on the way down. Fear of missing out on the way up. That is why I temper my urge to buy or sell every little move in the market by making sure the core of our portfolios stay consistent with our goals. Furthermore, I make incremental changes over time so as not to disrupt the balance, risk, and correlation that we are striving for.

A healthy dose of investor skepticism is a good thing when you are evaluating a new investment, advisor, or strategy. However, it can turn into paralysis by analysis when you find yourself overly critical of every uptick or striving to find the “why” in market fundamentals.

Thanks for reading.

Twitter: @fabiancapital

Gather more insights from David’s investment blog.

The author of his clients may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.