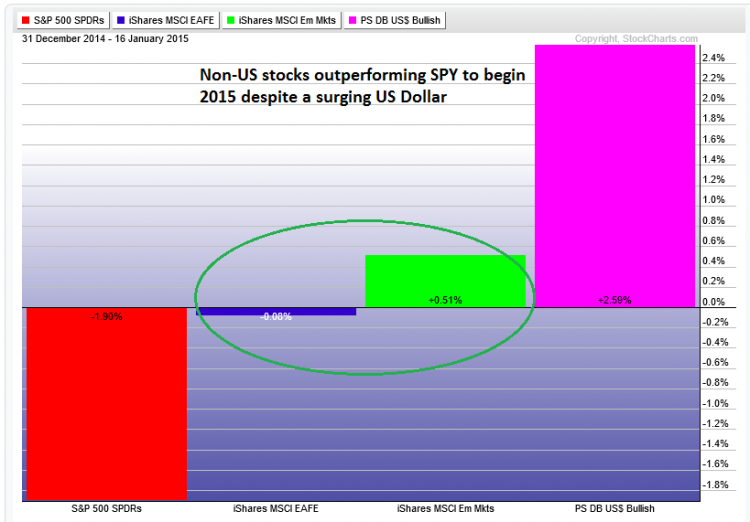

2014 was a terrible year for international stocks, as measured by the iShares MSCI EAFE ETF (EFA). EFA underperformed the S&P 500 ETF (SPY) by about 20% for the year. Much of this move can be attributed to the US Dollar Index surging to 10 year highs. 2015 has started in an interesting fashion with EFA outperforming SPY despite a continued strong US Dollar Index. The US Dollar as measured by PowerShares US Dollar Bullish ETF (UUP) is +2.4% to begin 2015.

And Emerging Markets have performed even stronger than EFA despite resource-based emerging economies experiencing pressure from a continued plummeting WTI Crude Oil price; the United States Oil ETF (USO) is down 10% YTD).

Check out the performance chart below.

International Stocks vs U.S Equities

The key chart for me that shows a potential shift away from US stocks to international stocks is the EFA:SPY ratio chart (see below). The chart was in a sharp down trend since May 2014 when the US Dollar began to surge. The ratio never climbed above its 20-day exponential moving average until just this past week. I prefer to use an exponential moving average in a fast moving trend like EFA:SPY, with the more recent days weighted more heavily.

An interesting development is the performance of emerging markets to start 2015. The iShares Emerging Markets ETF (EEM) is positive year-to-date while the S&P 500 ETF (SPY) is down 1.9% as of this writing. EEM still trades in a multi-year range, so its out-performance may see pressure once the ETF gets closer to the 45 level. (click charts to enlarge)

Emerging Markets ETF (EEM) Chart

I am watching the 2004 and 2005 highs in the mid-92 area on the US Dollar Index as potential resistance. Momentum continues to be strong for the US Dollar. A decline of the US Dollar Index would be beneficial to international stocks in general, benefitting ETFs like EFA and EEM.

US Dollar Chart

Thanks for reading and have a great week!

Follow Mike on Twitter: @MikeZaccardi

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.