There are some amazing streaks happening right now that have many concerned the bull market has gone on for too long. Well, over at Yahoo Finance I asked the question how old is the bull market?

There are some amazing streaks happening right now that have many concerned the bull market has gone on for too long. Well, over at Yahoo Finance I asked the question how old is the bull market?

You might be surprised, but my findings suggested this bull market might be mature, but I wouldn’t call it old when looking at past bull cycles.

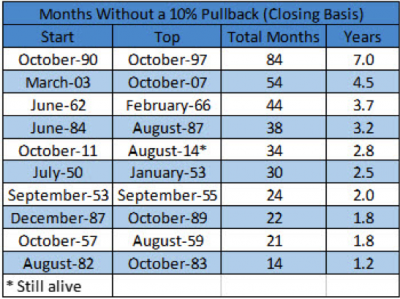

We’ve gone 34 months with a 10% correction, but since 1950 there have been four longer streaks.

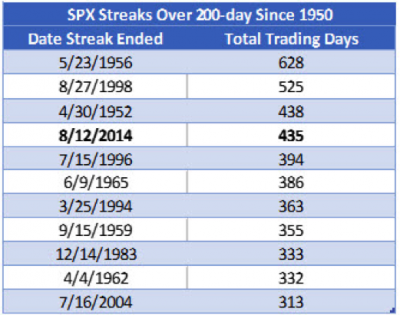

The S&P 500 (SPX) has closed above its 200-day moving average for 435 days. Just three other times has it closed above 400 days and two of those went over 500 days with one making it clear over 600 days.

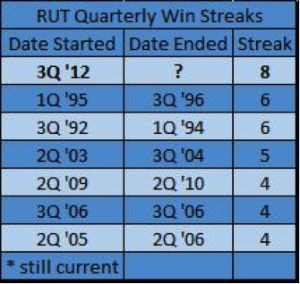

The Russell 2000 (RUT) is up an incredible eight quarters in a row, the most ever.

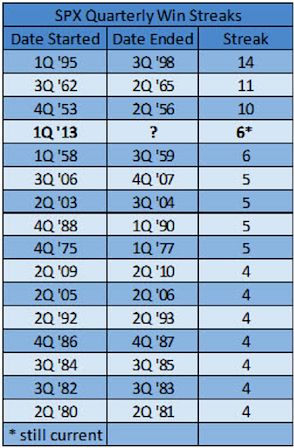

Meanwhile, the SPX is up six quarters in a row. Sounds like a lot, but three other times we saw at least four more quarters of gains.

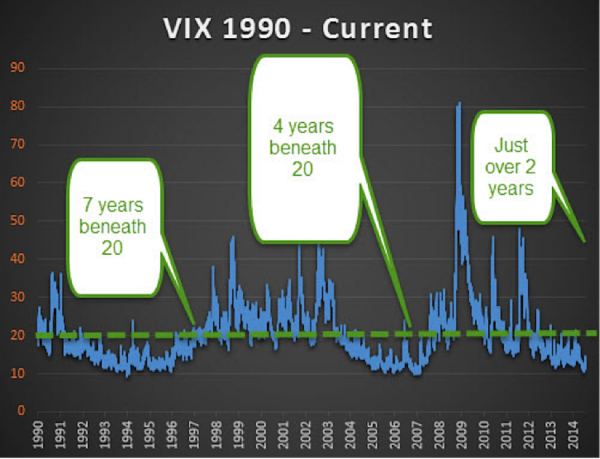

I gave my thoughts on why the CBOE Volatility Index (VIX) could stay low for years here. The bottom line is every decade the VIX tends to trade beneath 20 for years. This string is just two years old, which could mean it has a few more years left to trend beneath the 20 area.

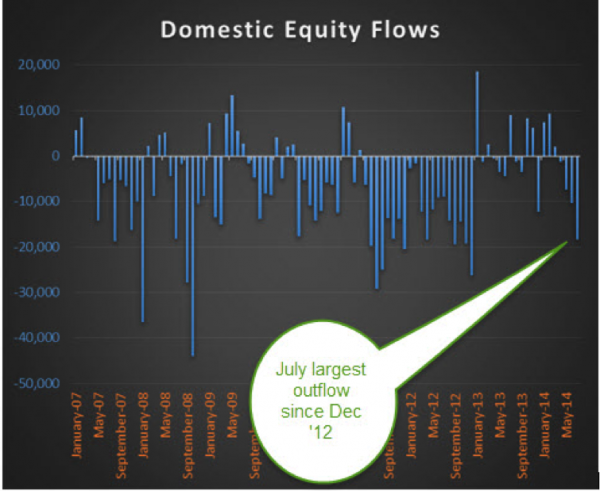

Let’s take a look at sentiment for a second. Here’s something that just happened that is very interesting. According to the ICI, domestic mutual funds in July had their largest monthly outflow since December 2012. In fact, we’ve now seen outflows for four straight months. Now I get it, most of these flows usually go to ETFs. Still, I find this as a worthy contrarian indicator which suggests the overall bullish trend is still alive.

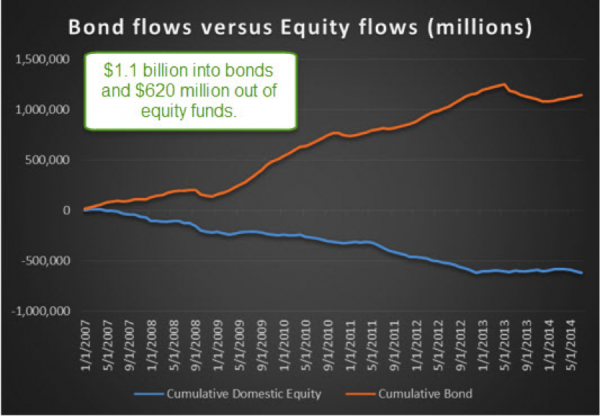

Check out the flow of bonds and stocks since 2007. One looks crowded, the other doesn’t.

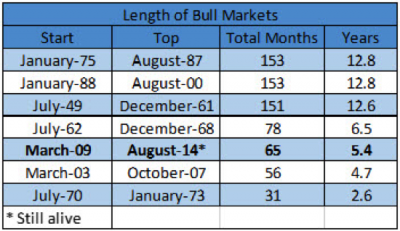

Lastly, just how old is this bull market? The current bull streak of 65 months is getting up there, yet we’ve seen three other bull markets that last more than seven years longer.

So there you go. Near-term seasonality is still a worry, but bigger picture I think this bull market is alive and well. Could it last for another seven years? I have no clue, but my point is don’t think it isn’t possible – as it has happened before.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.