Once again, the European Central Bank (ECB) made their presence felt. Yesterday, the markets were greeted by a another ECB decision that played within the confines of Mario Draghi’s “Whatever It Takes”.

Once again, it was big news. And once again, the markets are trying to digest the meaning of another in a growing line of unprecedented central bank actions.

The ECB came out swinging yesterday with a wide array of measures aimed at taking on the many problems it faces, from deflation to weakness in the credit market and from weak commodity prices to lackluster growth in the EU area.

Although the ECB decision and announced measures went far beyond what analysts expected, the tone during the conference call was rather cautious and left many wondering whether it undermined the scope of the measures themselves.

Here is a list of monetary policy measures taken by the Governing Council of the European Central Bank as stated on its website (and announced yesterday with the ECB decision):

(1) The interest rate on the main refinancing operations of the Eurosystem will be decreased by 5 basis points to 0.00%, starting from the operation to be settled on 16 March 2016.

(2) The interest rate on the marginal lending facility will be decreased by 5 basis points to 0.25%, with effect from 16 March 2016.

(3) The interest rate on the deposit facility will be decreased by 10 basis points to -0.40%, with effect from 16 March 2016.

(4) The monthly purchases under the asset purchase program will be expanded to €80 billion starting in April.

(5) Investment grade euro-denominated bonds issued by non-bank corporations established in the euro area will be included in the list of assets that are eligible for regular purchases.

(6) A new series of four targeted longer-term refinancing operations (TLTRO II), each with a maturity of four years, will be launched, starting in June 2016. Borrowing conditions in these operations can be as low as the interest rate on the deposit facility.

Aside from the moves regarding the bank credit channels, deflation is clearly still a major point of interest for the European Central Bank. Mario Draghi admitted that the bank had cut Eurozone inflation projections to reflect the recent decline in oil prices. The bank now expects inflation to be just 0.1% this year – considerably lower than the previous estimate of 1%, explaining the need for the ECB to take more substantial measures than expected.

The ECB said inflation is expected to rise to 1.3% in 2017 and 1.6% the following year. Considering how many times these estimates have been lowered in the past 12 months, there is good reason to question whether these projections will materialize as estimated. Mario Draghi insists that the EU is not in deflation. He also warned that risks to economic growth across the 19 countries that use the Euro remained “tilted to the downside”.

The ECB cut its growth forecasts to an increase of 1.4% this year – down from 1.7%; 1.7% for 2017 – down from 1.9%; and 1.8% for 2018. Key interest rates are expected to remain at present or lower levels for an extended period of time, and well past the horizon of net asset purchases, which should continue at least until the end of March 2017.

Along with government debt, the ECB will now be able to use its newly printed money to buy bonds issued by companies as well. The market for the European investment-grade corporate bond market is worth about €800bn, according to UBS.

The question now is whether the ECB’s actions have any effect on economic growth. If they don’t, the central bank has a major problem on its hands. As do the major European economies, held in a deflationary spiral by slowing growth, feeble global demand and crumbling commodity prices.

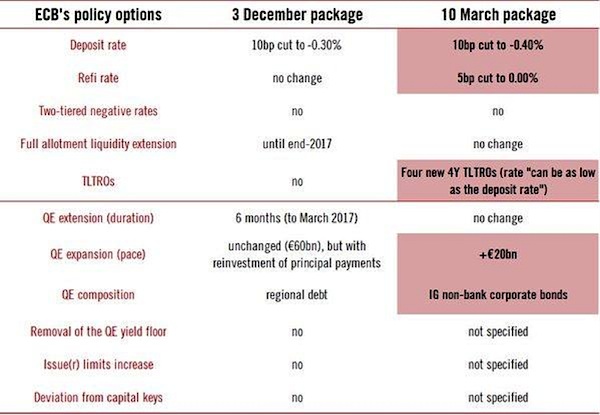

Below is a chart of the new moves taken by the ECB compared to their Dec. 3rd meeting (source: Intermarket & More):

“It’s hard to see even lower rates and more QE in Europe as a positive development. The fact that the ECB is still pursuing such extreme monetary policy paints a depressing picture of the European economy, and markets are beginning to question what central banks have left in the locker if the global economy slips back towards recession,” said Laith Khalaf, senior analyst at Hargreaves Lansdown in an article with BBC News.

The ECB also expanded its negative interest rate policy (NIRP) from -0.30% to -0.40%. The effects of NIRP are still uncertain in the long run and have been the subject of lively, ongoing debates among financial and economic analysts.

The inclusion of regional and local government bonds decided at the ECB’s December meeting predominantly widened the amount of purchasable bonds in Germany and today’s decision will further expand that window. In the graph below shared today by Frederik Ducrozet (@fwred) we see that almost 80% of German Bunds are now eligible for QE.

How did today’s news affect markets and what will be its effects in the near future? Many are asking this question as major events like today’s ECB quant move can often cause pain on both sides of the trade and today was no exception.

Global stock markets initially reacted with a morning rally until Draghi’s conference in which he claimed that further rate cuts may not be necessary in the future. This brought equity markets back down into negative territory and also caused the Euro to spike against the US Dollar after a strong morning decline. US markets mostly made up the losses to close flat for the day while European markets closed off their lows but still in negative territory.

If one of the intentions of the ECB’s move today was to weaken the Euro currency, it clearly failed after Mario Draghi’s words on the likelihood of not needing further rate cuts. After an initial drop to the $1.0822 level from an open at 1.0998, the Euro spiked up to 1.12 and closed the day at 1.1180 with a large bullish engulfing candle. In fairness, it does seem that the ECB decision and announced moves was more focused on the credit side of the spectrum than the currency.

Many are questioning whether the end of Draghi’s “whatever it takes” stance unwound the super quant move taken by the ECB this morning. It certainly seems so for the time being.

The wild market volatility that ensued confirmed a state of uncertainty with regards to where markets are headed in the short term. The ECB’s actions clearly did not have the lifting effect that QE used to provide for markets. There will be many questions answered in the months to come as to the effectiveness of the measures taken today but for now we remain mired in a sea on uncertainty.

As for US equities in the short term, it’ll be interesting to see who wins the battle between bears and bulls here. As you can see from the chart above, the S&P Large Cap Index (SPY) has been struggling to hold on to an 11% run from the Feb. 11th lows and the back and forth after Mario Draghi’s speech seems to indicate the uncertainty of more unprecedented central bank moves.

The bears, however, failed to take control and bulls were able to rally stocks back to flat by the end of the day, printing a long legged doji that will need confirmation in the days to come. It’s hard at the moment to say how we proceed from here and I’m not in the business of making directional calls.

Two things to keep in mind, however:

(1) We are still in the midst of earnings season

(2) We still have a two day Federal Reserve meeting to look forward to next week (March 15-16) where Janet Yellen should shed some light as to where we are going with interest rate policy.

All of these things can sway market action in the upcoming days and weeks.

In the meantime, for those actively trading this tape, the one thing you can use to navigate times like these is simply… price. Price will never lie to you in times when macro factors rock indices and you can rest assured that it is, and always will be, the single most reliable and unbiased measure of market action. While this is true at all times, it is never more true than when news and headline noise succeeds in keeping people from staying focused on where stocks are and where they may be headed from a purely technical perspective. As always, stay disciplined.

Thanks for reading!

Further reading from Marco: “Are Sovereign Wealth Funds Roiling Global Financial Markets?“

Twitter: @DDCapitalFund

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.