By Ross Heart “Inflation will eventually rear its ugly head because of the Federal Reserve”

By Ross Heart “Inflation will eventually rear its ugly head because of the Federal Reserve”

“Runaway inflation is inevitable and the US Dollar is going to get crushed”

“Interest Rates will rise dramatically once inflation starts to take hold”

How many times have you heard these or similar arguments regarding inevitable inflation as investors debate the Federal Reserve, the Great Rotation and when interest rates will eventually rise. See my previous article for some questions to think about if/when rates rise. The arguments seem especially prevalent within the “gold bug” crowd. And frankly, all this doom chatter about inflation on the horizon has grown a bit tiresome.

As a value investor, I’ve struggled recently as the existence of under-valued opportunities seems to be rapidly shrinking. Digging into asset class after asset class, I’ve found myself repeatedly arriving at the same conclusion – everything seems more expensive. How could this be? Inflation is still manageable and only a longer-term risk to the markets because of the Fed’s money printing……right?

On Dec 16 2008, the Fed implemented their Zero Interest Rate Policy (also known as ZIRP) and drove the Federal Funds rate to 0% where it has remained since. Due to their move, traditional valuation methods seem compromised as money flows and moving averages have temporarily replaced cash flows, earnings and “wide moats” in investor importance when evaluating investments.

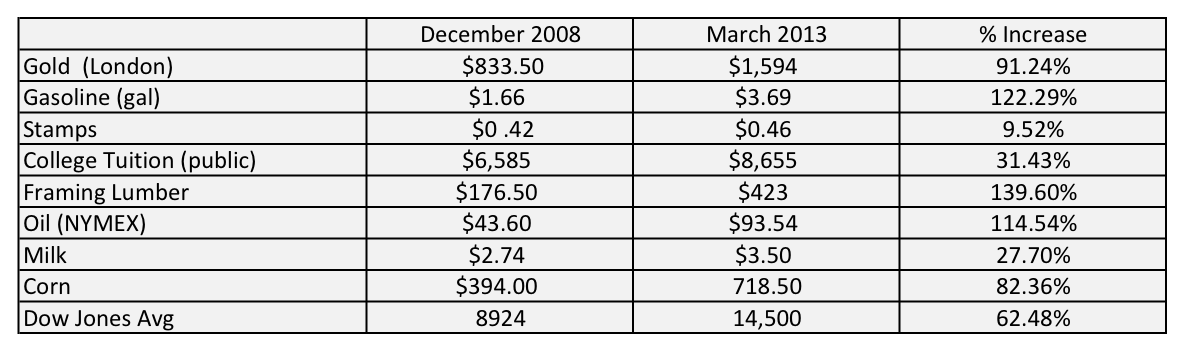

Let’s go back to ZIRP’s birth and see what the Fed has created (prices are as close to 12/16/2008 and the publication date of this post). Click to enlarge.

Oh, those are just cherry-picked items that have seen massive spikes due to other factors, you say? Healthcare, property taxes, or other numerous examples of core expenses that can’t easily be abandoned could’ve easily been added as well.

Well, one thing we do know for certain is that many of these expenses are higher because monetary expansion weakened the dollar. Actually the US Dollar is one of the few things that has not moved dramatically. The US Dollar Index (DXY) traded at the same exact levels on December 16, 2008 as it did during mid-March 2013.

At least ZIRP saved us from the brink of financial calamity and rewarded us with a crucial economic expansion. Perhaps it alleviated a greater banking crisis, but economic expansion is debatable. Current dollar GDP in 2008’s 4th quarter was $14.2 trillion, which then expanded to $15.851 trillion during 2012’s 4th quarter. This equates to a 2.788% average annual increase in GDP not factoring in inflation.

This brings me back to fears of future inflation and the struggle value investors face in locating new investment opportunities that haven’t experienced the Fed’s reflation. If you want to buy gold, the S&P 500, lumber, corn, farmland, gasoline, butter, the Nasdaq, et al they are now substantially higher in price than they were when the Federal Reserve embarked on ZIRP. Prices are higher! That is inflation! There is no “inflation could rear its ugly head.” It has!

Unless purchases are made by investors cannibalizing savings and investments, these increases in prices have to obviously be paid for with wages. And we are questioning why average Americans don’t feel richer with the Dow Jones setting a new record? Perhaps their pocketbooks are starting to comprehend that a 20% increase in a 401k isn’t really a “wealth effect” when purchasing essentials that have reflated in similar fashion.

I fully understand that you have to play the hand (i.e. market) you’re dealt, but given current inflation, stagnant wages, and other consumer pressures, perhaps it’s time to start questioning how long the Fed’s reflation scheme can continue.

Heart Capital does not offer investment advice via this medium. Under no circumstance whatsoever do these postings, opinions, charts, or any other information represent a recommendation or personalized investment, tax, or financial planning advice.

Twitter: @heartcapital and @seeitmarket

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.