With the US Dollar down nearly 7 percent from its highs, one would think Gold and Silver would be off to the races. Well, they are moving higher, but not exactly racing. Silver has seen a bit more pop than Gold, but that’s to be expected due to its higher beta. Note that I highlighted the trading setup in Silver last week (and I just sold my trading position there). More importantly, though, the rallies are just getting going.

Better late than never, but it’s likely to be choppy (see fellow contributors Kurt Hulse and Tom Pizzuti recent post on why Silver is likely to chop higher.)

Today I want to focus on Gold and share a few charts. Although I believe lower prices are coming later this year, I think Gold has the potential to chop higher as well. Below is a long-term chart showing the down sloping channel that Gold prices have been in for nearly 2 years. Note that there is still room to move higher (perhaps up to $1325).

Should that channel break to the downside, Gold could see sub-$1000. But for now, it’s trying to move higher.

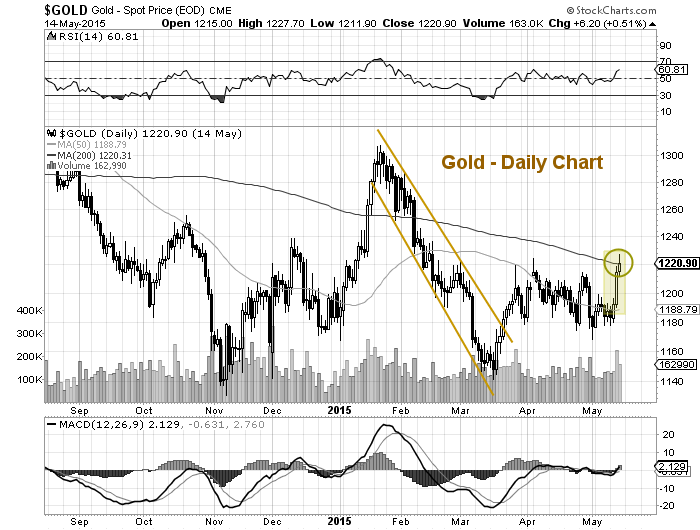

When we zoom in on the daily chart for the last year, we can see that Gold prices have just started to wake up. As I mentioned earlier, this is bit of a delayed reaction, considering the US Dollar has been in correction mode since March.

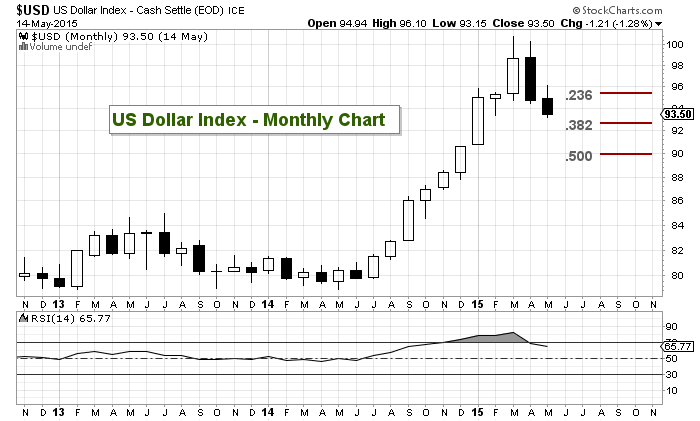

I’m including a monthly chart of the US Dollar with some downside targets. The Dollar is oversold (on the daily chart) and any multi-day rallies could cause choppiness in Gold’s advance. As well, Gold is testing its 200 day moving average (resistance). Expect more volatility ahead.

Gold Prices – Daily Chart

US Dollar Monthly Chart – Fibonacci Pullback Targets

Should Gold break out above 1225/1230, it could run as high as 1300-1350. But that may depend on how long the US Dollar wants to cooperate. Another potential tailwind would be a pullback in equities (with some fear). Food for thought, but my take is that Gold prices will continue to be choppy but likely higher into summer.

Trade safe.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.