January was an eventful month, as stocks around the world had one of their worst starts in history. Many market commentators believe that the bad economic news from China is currently the strongest influence on markets.

Worries about China are for the moment drowning out the good news in the U.S., as preliminary estimates show the U.S. economy grew 2.4% last year, and unemployment has reached a multi-year low of 4.9%.

As is usually the case, markets are much more volatile than the real economy. Although the Chinese government is using all of its available tools to keep their economy growing, the capital flight from China is enormous and it seems their currency concerns will get worse before they get better. So the bad economic news from China continues…

Stocks & Bonds

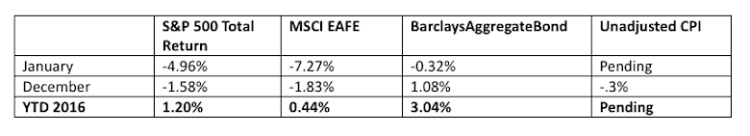

The S&P 500 dropped in January, as did most global stock indexes. Even bonds, normally a safe haven, weren’t immune, although highly-rated U.S. treasuries performed well. By the numbers:

Commodities & Currencies

NYMEX crude oil continued its slide in January, dropping almost 12% to start the year. The US Dollar moved in line with its traditional safe-haven status, gaining almost 1% against a trade-weighted basket of foreign currencies.

After some rough months and years, gold finally gains just over 5%, as global financial worries led to gold’s re-emergence, at least for now, as a safe-haven instrument.

Economy

ISM Manufacturing PMI in January came in at 48.2, marking the 4th consecutive month of contraction. The non-manufacturing, or services index, is still in expansionary territory at 53.5. American business with other Americans, which represents the majority of the services index, is quite strong as our domestic economy seems resilient. American manufacturing depends much more on exports, and so is more impacted by recent dollar strength and global economic weakness, hence its relatively weaker reading. The Commerce Department released its first estimate of GDP for 2015, indicating that our economy grew 2.4% last year. This would match exactly the pace of growth in 2014. The number of sales of existing homes in 2015 was 7.7% higher than in 2014. Also, the median price in December 2015 was $224,100, a 7.6% increase from December 2014. Distressed sales (foreclosures and short-sales) continue to shrink as a percentage of the overall market, down to 8% of the total. A year ago that number was 11%.

Summary

More than one person has asked me whether oil is an attractive buying opportunity. After all, we experienced a price collapse of oil in 2008, and subsequently saw the price almost triple in just a few years. For the record, I was buying oil majors on behalf of many clients in 2008, as I also believed that the price collapse represented a compelling opportunity. I believe there is one fundamental difference between then and now. In 2008, there was a financial crisis – a credit crisis which led to a collapse in stock markets, debt markets, oil markets etc. Basically panic ruled the day. The underlying demand for oil remained quite strong, and government stimulus was yet to be applied to ignite global growth. So the panic sell off of crude oil was more about financial markets than it was about underlying supply and demand in the oil markets.

Last year’s crude oil selloff was not predicated on a financial crisis, at least not an obvious one. The revolution in U.S. oil production really is a revolution. The U.S. has surpassed Saudi Arabia as the world’s largest producer of oil. This massive and unexpected supply glut is finally pushing prices lower. Many market observers believed that these low oil prices would be unsustainable for very long, and that less efficient oil producers would declare bankruptcy, bringing balance back to the force. And by ‘the force,’ I mean ‘the oil market.’

That has not happened. U.S. production has barely budged. Saudi production has actually increased as they defend their market share. On the demand side, a large part of global oil demand growth has come from… you guessed it… China. And the bad economic news from China doesn’t bode well for the oil market.

As China continues to devalue the yuan, it is likely that their crude oil purchases will ultimately fall as well. A large amount of their oil purchases are not for consumption; rather China has been building one of the largest strategic petroleum reserves in the world, taking advantage of falling oil prices to buy extra oil.

So even though crude oil prices are low, they are actually artificially inflated as a result of Chinese buying oil and pumping it into the ground, after the Saudis have pumped it out of the ground and shipped it across the globe. This sequence of events makes sense from a political and military perspective, but certainly not from an efficiency, environmental, or economic perspective. I expect this pattern to dwindle, perhaps significantly, in the coming months and years, essentially in lockstep with any further yuan weakness.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.