In Federal Reserve Chairwoman Janet Yellen’s testimony before Congress last week we heard more of the same. Last week she basically confirmed that the economy is continuing to slow down and that poses ‘risks’ to her forecast for growth. Thus rate hikes over the summer are likely off the table.

Here’s a brief recap: Our esteemed Federal Reserve Chairwoman seems to be confused. Changes in the direction of interest rates traditionally occur slowly over time so that the markets can build those projections into their investing logic. The more visibility in the economy, the easier it is for investors and money managers to structure their portfolio for the long-term. And understanding monetary policy (and the direction of interest rates) is a big driver here.

If the economy is ‘heating up’ investors will expect the Federal Reserve to likely embark on a policy of raising interest rates to tap the brakes on the economy. Traditionally, the Federal Reserve will move gradually over months or years in that direction with measured interest rate hikes. With that guidance, investors can adjust their portfolio accordingly without disrupting the market. Likewise, when the economy starts to slow the Federal Reserve will typically lower interest rates to press on the gas. Lower interest rates are seen as being conducive to investing in stocks so investors and money managers adjust their portfolios accordingly. Since the Federal Reserve actions typically play out over months and year’s market disruptions are minimized.

Lately, though, the Federal Reserve appears confused. Instead of trying to macro-manage the economy with changes in the direction of interest rates over months and years now she is micro-managing the economy month by month.

- March 2015: Tightens using forward guidance that the Fed intends to raise rates

- September 2015: Eases by delaying the forward guidance actions announced in March.

- December 2015: Going To Raise Rates (hawkish)

- March/April 2016 = Reversed course and walked back the increase (dovish)

- May 2016 = Reversed course again and signaled will raise rates (hawkish)

- June 2016 = Reversed course again and signaled will walk back any increases (dovish)

How are investors and portfolio managers supposed to react in such an environment of uncertainty? Most mutual fund and hedge fund managers have to change the way they are invested every time Janet changes her mind. The result is much greater market volatility as witnessed by a roughly 15% decline in August of 2015, a recovery, then another decline of almost 15% in January and February that was the worst start of a year ever in the history of the US stock market. Then the market recovered over the next couple of months and may be starting to decline again.

If the Fed doesn’t understand what is going on in the economy then how can investors?

Or, perhaps, do the actions of the Federal Reserve signal that they are very concerned about our economy and realize that the tools they are using aren’t arresting the economic slowdown that has been underway the last year or so?

What happens if investors lose confidence in the Federal Reserve’s ability to ‘control’ the economy? In Japan, the belief system (in the Central bank’s ability to control/guide the economy) seems to be breaking down. Japan’s Nikkei stock index is down 22% in the last year. If investors in other countries lose faith in ‘system’ we could see significant corrections in stock markets around the world.

So how do we invest amidst all the confusion?

During times of uncertainty I believe it is prudent to reduce market risk. Generally, there is greater market risk in stocks than in bonds. Reducing the amount invested in growth-oriented stocks to raise cash seems prudent. In my opinion, with the markets still at or near all-time highs, there is still time to reduce stock risk. And just about everyone is aware of my affinity to own US Treasury bonds during an economic slowdown.

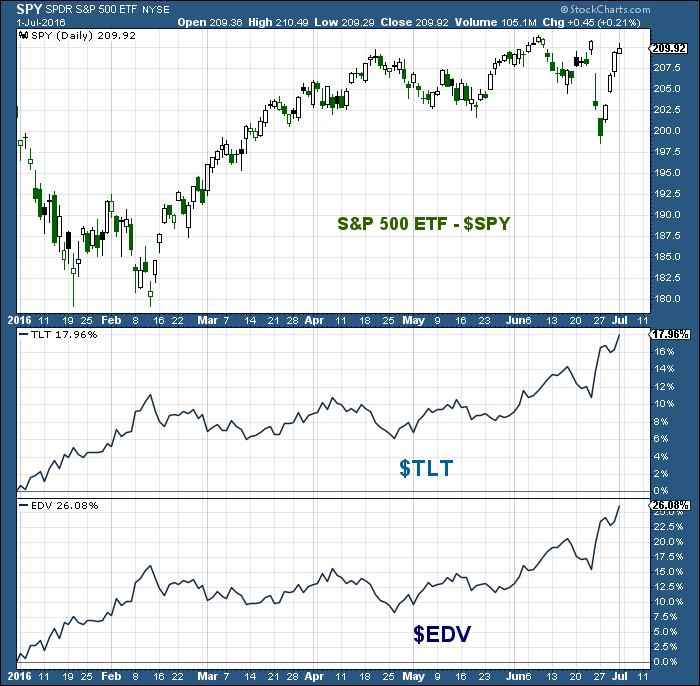

US Treasuries have continued to out-perform with less volatility and I don’t expect that to change any time soon. The 30+ year US Treasury ETF (symbol EDV) is up around 20 percent in the last 12 months compared to the S&P 500 Index clocking in around even..

The S&P 500 Index is currently up around 3 percent year-to-date while EDV is up well into the double digits.

So US Treasury bonds have continued to perform well amidst all the economic uncertainty. That doesn’t mean that investors should rush out and put all of their money into UST’s right now. However, I do believe that it is possible for UST’s yields to continue to decline over time (which creates profits).

The economic slowdown hasn’t ended yet and the central banks still haven’t found a way to create growth. Until they do, I will remain cautious and defensive.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.