By Joshua Schroeder Once again Europe’s leaders spoiled a chance to take coordinated action to effectively address the bailout in Cyprus. This failure has further eroded credibility in the already weak solidarity of the European Union. Luckily, the effects of this bungled bailout are expected to be limited to Cyprus, an economy of $24.7 billion with an overall debt level slightly under $20 billion.1 That said, where Europe’s leaders have really dropped the ball is not in Cyprus, but rather in their unwillingness to address the inordinately high European youth unemployment rates.

By Joshua Schroeder Once again Europe’s leaders spoiled a chance to take coordinated action to effectively address the bailout in Cyprus. This failure has further eroded credibility in the already weak solidarity of the European Union. Luckily, the effects of this bungled bailout are expected to be limited to Cyprus, an economy of $24.7 billion with an overall debt level slightly under $20 billion.1 That said, where Europe’s leaders have really dropped the ball is not in Cyprus, but rather in their unwillingness to address the inordinately high European youth unemployment rates.

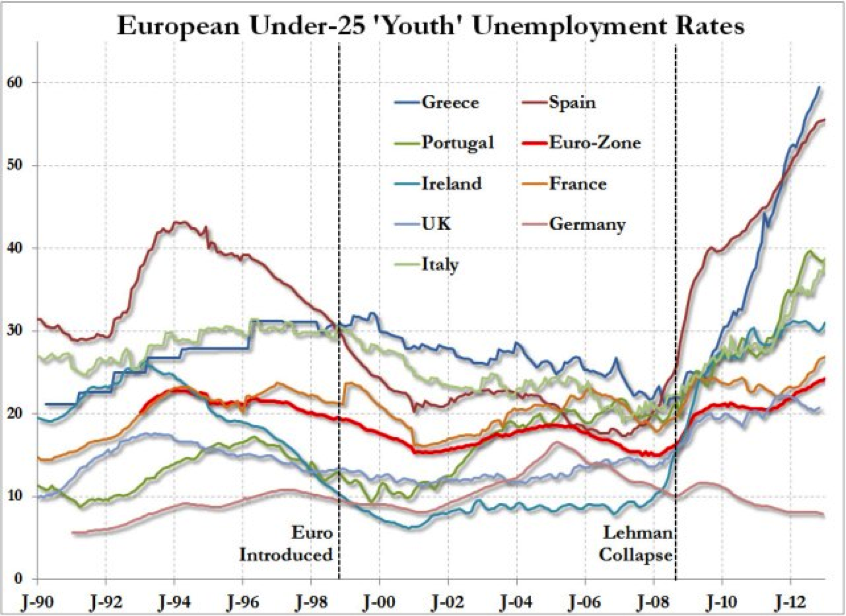

Many pundits fail to realize that the Eurozone crisis is about more than just the next “sovereign debt” headline. The crisis is far reaching, with dire social implications. European youth unemployment should be at the forefront of policy initiatives. Of the 27 countries in the Eurozone, 13 have youth unemployment rates over 25%.

According to Quartz: “While fewer than 10% of Germans under age 25 are unemployed, a full 62% of young Greeks are out of work, 55% of young Spaniards don’t have jobs, and 38.7% of young Italians aren’t employed. Italy (38.7%) surpassed Portugal (38.6%) in this measure for the first time in January 2013.” 2

European Youth Unemployment Rates – Click to enlarge image.

Source: Quartz – qz.com

An intense focus on austerity measures and financial regulations has pushed pressing issues like European youth unemployment to the back-burner. But I believe Europe risks a lost generation if they don’t take policy action soon; millions of unemployed youth are waiting and a lost generation is on the line.

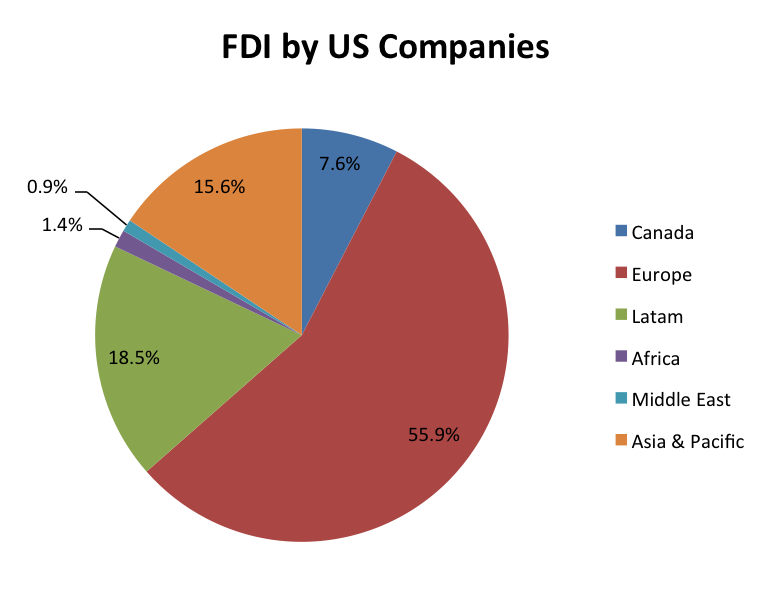

U.S. Perspective These depression level unemployment rates are relevant to U.S. investors for a number of reasons. First, since 1982, the European Union has been the largest recipient of U.S. foreign direct investment (FDI) representing over 55% of the world total. See chart below – click to enlarge image.

Source: Bureau of Economic Analysis

If the international market where U.S. multinationals have historically invested the most is struggling with over 25 million people on the dole, that doesn’t bode well for future growth abroad.

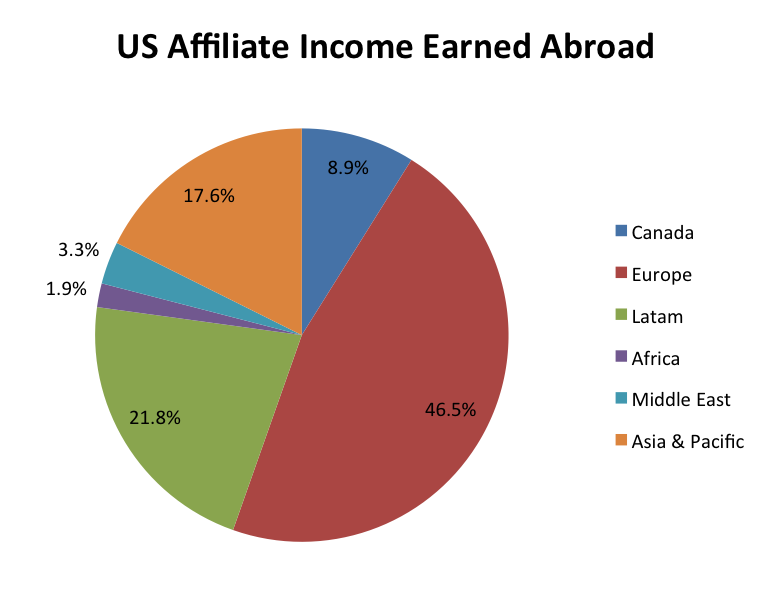

Secondly, and quite logically, the Eurozone is also the most important international profit center for U.S. multinationals with nearly 47% of foreign U.S. affiliate income being generated there (see chart below). I can only imagine what the earnings of many large U.S. multinationals might be if Europe’s youth were working and had the resources to buy American goods and services.

Source: Bureau of Economic Analysis

In summary, the Eurozone is the most important geographic region on the globe for US multinationals when it comes to international growth and profits. Neither China nor Latin America has attracted as much US investment, generated as much profit, or had a bigger role in the international success of corporate America. In my opinion, rather than worrying about Cyprus and every political move, government officials (and investors) should concern themselves with the effects of a disgruntled populace, social friction and the political turmoil that high European youth unemployment rates are beginning to unleash on already fragile European governments and markets. Thanks for reading.

Additional Sources:

- (US Trust Capital Markets Report March 25th)

- Europe’s lost generation of unemployed youth keeps on swelling: Quartz – qz.com

European youth unemployment rates remain very high.

Twitter: @JoshuaSchroede2 and @seeitmarket Facebook: See It Market