For much of the past several months, the Euro has been trading in the gutter. It was written off for dead and King Dollar seemed ready to dance on its grave. Well, not so fast. The Euro seems to have woken up from its slumber and a Euro currency breakout may be taking place… and that would have major implications for the financial markets in 2016.

A Quick Recap

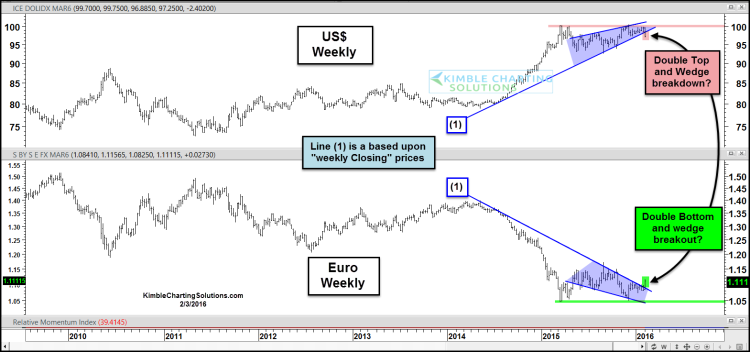

Back in early 2015, the Euro dropped to fresh 11-year lows as capital fled the currency due to concerns over monetary policy and politics. In all, the currency fell from 1.40 to 1.05 in just under a year. That coincided with the rise of the US Dollar and helped to pin select commodities to the mat and provide a headwind for US equities. For most of the past year, the Euro traded sideways before successfully retesting its lows and rallying into 2016.

And now what appears to be a Euro currency breakout and US Dollar breakdown.

Implications

The latest rally looks to have morphed into a Euro Currency breakout that may have legs. If so, it would provide commodities some long awaited relief from King Dollar. Take Gold for example – it’s been on fire in 2016 and looks to be enjoying the tailwind of a stalling/weaker US Dollar. As well, Crude oil, copper, and select grains are off their lows. Perhaps a weaker buck would help them out too.

Lastly, corporate earnings estimates were reduced throughout 2015 and for 2016. If this Euro currency breakout sees upside follow through that leads to a meaningful rally, it would add pressure to the US Dollar and help US corporations with exports and overseas sales. But that part of the equation may take a some time to bear fruit.

US Dollar Breakdown vs Euro Breakout Chart

Thanks for reading.

Read more from Chris: “A Critical Test Is At Hand For Dr. Copper” and “Crude Oil: Is A Bottom Taking Shape?“

Twitter: @KimbleCharting

The author does not have a position in the mentioned security at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.