As investors move forward into 2015, many of them will make decisions about where to put their money. Some of them might use technical or fundamental information and many will attempt to use some combination. Others will become casualties of the media and actually act on the news. However, what we know is that most people are “bad” at investing and trading, don’t have a formal plan, and are likely to underperform their benchmark index over time. Fortunately, developing an objective plan is something that’s well within the reach of all investors, traders, and managers.

As investors move forward into 2015, many of them will make decisions about where to put their money. Some of them might use technical or fundamental information and many will attempt to use some combination. Others will become casualties of the media and actually act on the news. However, what we know is that most people are “bad” at investing and trading, don’t have a formal plan, and are likely to underperform their benchmark index over time. Fortunately, developing an objective plan is something that’s well within the reach of all investors, traders, and managers.

Who wanted to be long Bonds in 2014?

At the time of this writing, the 20+ Year Treasury Bond ETF (TLT) has returned around 24% for 2014. That return has probably come as a significant surprise to many people for a number of fundamental reasons. Interest rates have been at historically low levels for a long period of time and many people expect a reversal. The Fed has suggested that interest rates may rise during 2015, which should lead to an increase in fixed income yields and a decline in Bond prices. That being said, it’s unlikely that any of us know what will happen in 2015. Did you think it was a good idea to buy bonds at the end of 2013?

2014 Daily chart of TLT – Is this what you expected Bonds to look like in 2014?

The uncertainty about what will happen in the markets tends to bring about feelings of either frustration or a desire for strategy. In many cases, frustration can be the motivating force behind developing a strategy so it’s not an entirely adverse feeling. Perhaps the bigger problem is finding a strategy that’s suitable for your personality and following that strategy long enough for it to work.

Before we get too far down the road, it’s worth emphasizing that I have no idea what will happen in the market, I have never had any idea, and I highly doubt I will ever know in the future. The media is full of predictions and analysis, but it’s all worthless and there are no prophets. There are only positive expectancy bets that, over time, can lead to a positive outcome. Once we admit that, we can start making progress towards finding a solution.

Now that we know that we don’t know anything, we need to come up with a plan for investing. Our discussion below is going to focus on using prior returns as an indicator of where to invest.

What about 60/40?

Sure, if you’re a 60/40 investor (60% stocks 40% bonds), you had some exposure to Treasury returns in 2014. That being said, 60/40 investors were simply lucky that Bonds happened to make up one of their two assets. The benefits of asset allocation and adding uncorrelated assets to a portfolio are well documented and beyond the scope of this post. For now, let’s just assume that adding uncorrelated markets to a portfolio can improve returns over time.

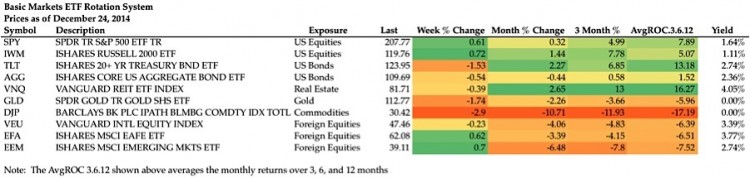

Suppose we decide to simplify our investment options and choose a few different uncorrelated markets that we want to use for investing. Those markets could (and probably should) include US Equities, Foreign Equities, Bonds, Real Estate, and Commodities. Once we’ve decided on the markets, we need to have some sort of system for making investment decisions. In the table below, we’re taking a look at a few different asset classes and using color to illustrate returns over various look back periods. Click to enlarge.

The coloring in the table above makes it clear that in the past few months we’ve seen strength in US Equities (SPY & IWM), US Treasuries (TLT & AGG), and Real Estate (IYR). The SPDR Gold ETF (GLD) has been weak, but not as weak as Commodities in general and those themes are consistent with the recent strength in the US Dollar. Foreign Equities bounced a little bit in the past week, but they’re still weak over a longer look-back period.

So what’s the application going forward?

At this point we’ve objectively discussed what is happening in various markets over a few different periods of time. We know that Real Estate, US Treasuries, and US Equities are strong. My preference as an investor is always to be long assets that are strong and appreciating in price because, ultimately, I want to own things that increase in value. However, as soon as prices and returns shift, it makes sense to reevaluate and change positions.

The full discussion around how, where, and when to invest is potentially answered by an ETF Rotation System. An ETF Rotation System would have taken a position in Bonds during 2014, even if we didn’t think it was the best idea. That same ETF Rotation System will tell us when to sell Bonds and buy something else. The take away is that we need to have an investing plan. Additionally, it’s okay if we don’t know what markets will outperform as long as we have a framework for finding those returns. For the time being, those returns are showing up in US Equities, Bonds, and Real Estate.

For a more in depth discussion about Investing with an ETF Rotation System, check out this post: Investing. Here’s a plan to stop doing it wrong. Thanks for reading.

Follow Dan on Twitter: @ThetaTrend

The author holds positions in SPY, IYR, and TLO at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.