The Emerging Markets space has been an interesting one. All hopes of a rally last summer were dashed by a soaring US Dollar. But 2015 has been a different story, seeing what investors believed to be a relief rally, turn into an extended rally when the dollar began to crack during March/April.

But after a strong rally in the Emerging Markets ETF (EEM), and one that took the ETF within a couple dollars of last summer’s highs, investors have taken a break in May. During the latest cool down period, several ETFs have come together in what appears to be mean reversion. The hottest ETFs have cooled off, while the weak performing ETFs have consolidated there gains.

Will this lead to a “we all move as one” rally or decline? Worth watching.

Let’s walk through the Emerging Market ETF’s that I’ve highlighted in the chart below.

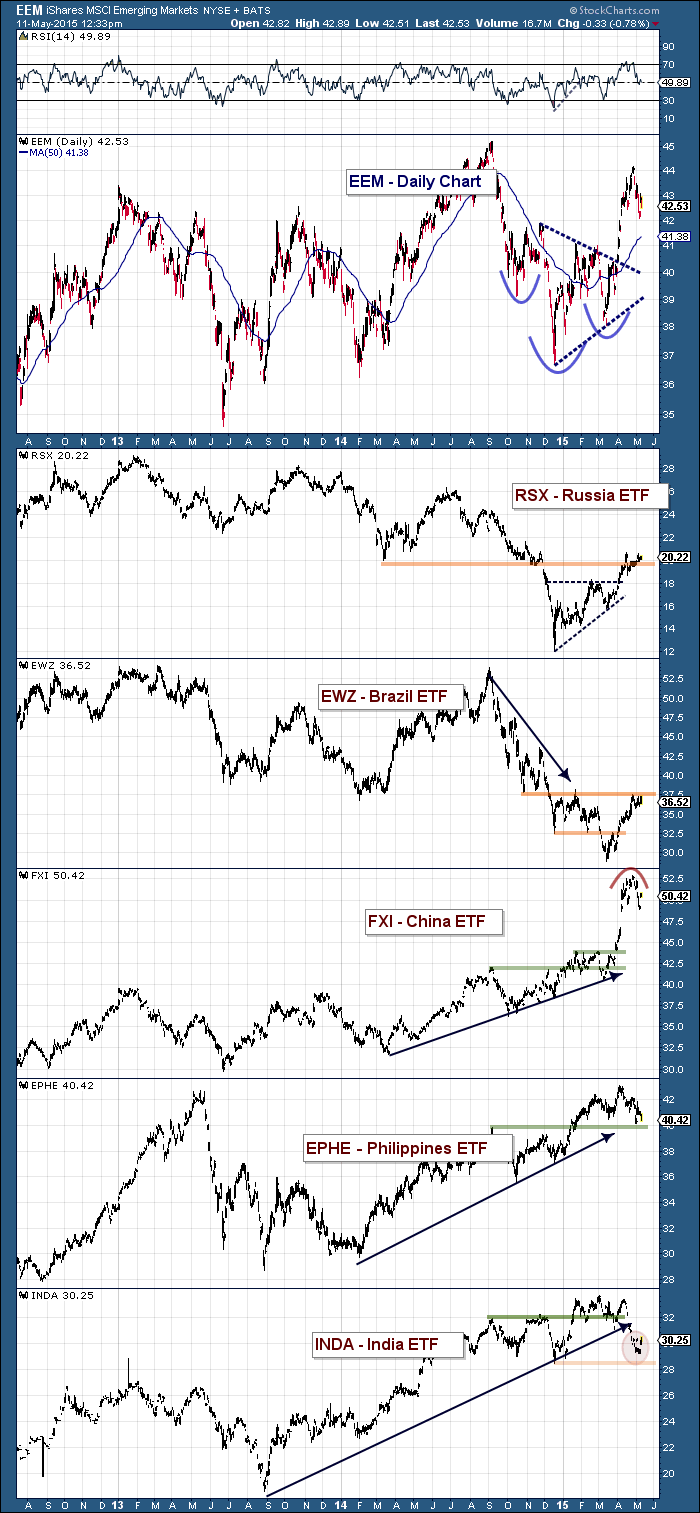

Emerging Markets (EEM)

After breaking out of a downsloping inverse head and shoulder, EEM really took off. As soon as it smelled blood in the water for the US Dollar, it gapped higher leading to a strong move of nearly 10 percent over a matter of days. It’s trying to find support near the November 2014 highs. Just below is the 50 day moving average (currently 41.38). And, as mentioned, there several open gaps. The wild card is the US Dollar. If/When it turns higher could spell trouble for the Emerging Markets space.

Market Vectors Russia ETF (RSX)

Russia has fought back to the scene of its major collapse. And rather than being taken down with the Emerging Markets ETF (EEM), it has consolidated its gains. I don’t know how long it can fight this trend, so it will likely need to see some strength from the sector soon.

iShares Brazil ETF (EWZ)

EWZ has fought its way back to its January highs. This is an important resistance line. It is also consolidating gains (in contrast to the pullback in EEM). A move higher in EEM would likely help the Brazil ETF break out.

iShares China ETF (FXI)

China saw a massive breakout earlier this year. Some huge gaps higher that investors will have to keep in the back of their minds. Another reason for pause is the rounded top on FXI. This could limit performance near-term, and possibly lead to a rollover if the Emerging Markets as a whole roll over. Big time gainer early this year though.

iShares Philippines ETF (EPHE)

This emerging markets ETF has slowly worked its way back to key support. It has put in a bit of a rounded top, but that shouldn’t be of much concern if it can hold support here.

iShares India ETF (INDA)

India has been one of the out-performers in the Emerging Markets over the past year and a half. BUT, recently INDA lost its uptrend line and is now testing important lateral support. Bullish traders would like to see it hold the 28/29 area.

Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.