Emerging market stocks came alive during the mid-point of 2014 that led to significant relative strength versus domestic equities. However, since topping in September, the Vanguard Emerging Markets ETF (VWO) has pulled back to its 200-day average as it seeks to define the next path forward.

VWO is currently sitting at a technical crossroads that includes shuffling near its long-term trend line along with a significant point of support near its April high. Currently this broad-based index of emerging markets is down 10% from its high, marking a true correction that has yet to build on the recent rebound in U.S.-based markets.

VWO Emerging Markets Chart

The biggest problem for emerging market investors is the fractured nature of the individual countries that make up a broad-based index. The MarketVectors Russia ETF (RSX) and iShares Brazil Capped ETF (EWZ) continue to show relative weakness amidst political instability and economic turmoil caused by commodity price declines.

However, nations such as the WisdomTree India Earnings Fund (EPI) are focusing on reforming their economic policies and attracting foreign capital. This has led to a wide divergence and comparative strength of individual stocks based on their regional positioning or sector concentration.

Despite these uncertainties, I still believe that emerging markets present opportunities for both long-term investors and short-term traders.

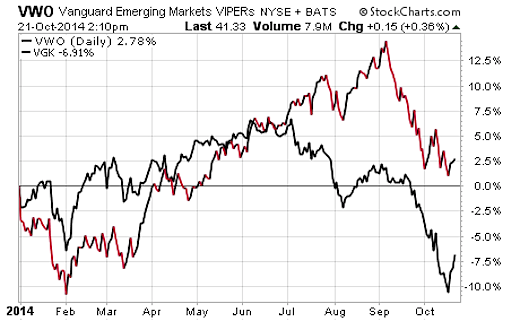

On a year-to-date basis, VWO is continuing to outperform developed nations in the Vanguard Europe ETF (VGK).

VWO Emerging Markets vs VGK Europe – 2014 Chart

This will be meaningful if global stocks resume their uptrend as emerging markets are still a better value than Europe based on multiple years of weak returns. The recent sell off in VWO is likely an attractive opportunity to add to long-term holdings with the expectation of resumption higher.

It’s worth noting that a new asset allocation tool from Research Affiliates lists 10-year expected returns of emerging market equities higher than both EAFE and U.S. stocks. However, that also comes with a concomitant higher expectation for volatility given the associated risks to these developing economies.

On a short-term basis, traders will want to see confirmation of VWO breaking back above the October high to reinitiate a long position. A secondary price target of crossing above the 50-day moving average would be another positive sign that emerging markets are back on track.

Picking an individual country ETF can be used to supplement or overweight your core emerging market exposure. However, based on the hit-or-miss implications of specific regions, it still makes sense to have a broad-based position in a diversified ETF or mutual fund. In addition, unless you are taking a long-term view of this opportunity, you should approach new positions with a stop loss or sell discipline to manage downside risk.

Follow Dave on Twitter: @fabiancapital

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.