Even more so than Fed days (especially with Taper pace seemingly on autopilot), there’s no market day anticipated so widely as NFP Friday.

NFP – or “The Employment Situation” as the Bureau of Labor Statistics (BLS) calls it – is watched with obsessive precision: as a key economic indicator; and as a running scorecard of how well Fed policy is fulfilling the “full employment” half of it’s dual mandate. If there’s any market event that follows the classic narrative progression of introduction-tension-crisis-(anti-)climax-resolution that creates the arc of many our most beloved cultural hallmarks – Super Bowl, Christmas Morning, the Wedding Night, the Bright Light following our demise – it’s the (archaically-titled) “Non-Farm Payrolls”.

The period that leads in to all these events is long and full of ceremony – so much so that the “event of preparation” becomes the focal point, effectively exiling the climactic moment being prepared for to that of an excuse or afterthought. And so it goes with the tortured pageantry of granular statistics, meaningless polls (except for the ritual humiliation of the participating economists, who recurrently fail with a mysterious impunity) and sloppy wagering that precede every NFP.

But once the climax unfolds – the last down played, the presents ripped open, the veil lifted on matrimony, the hereafter and 8:30 a.m. (almost) every first Friday – what’s left? A deflated exhaustion; a jilted disappointment that the inanity of life is irreversibly encroaching on the reverie of preparation that held it at bay; a snuffed-out momentum which feels no less abruptly curbed for the weeks of anticipation that preceded it? After NFP prints and the “highlights” are sorted out, all that’s left to do – other than participate in the gasping release of 1000 self-similar template summary articles – is decide to whether and how to trade.

But what does NFP really mean, month-to-month? The statistically tentative nature of the monthly employment report is well-documented, even deservedly called notorious from time-to-time: Birth-Death modeling, seasonally adjusted data, routine multi-month revisions and periodic annualized revisions that can stretch back decades are all typical. You can think of the BLS product served up each month as the non-GAAP reporting of the true “Employment Situation” that lurks several fathoms of obscurity beneath the surface headlines.

In spite of this, NFP sits in a class all its own because of the shared fog of event obsession that hangs over it. (Valid) skepticism over its credibility is a given; but long ago became terminally enshrined in a cynical compromise of politico-economic pragmatism. Not unlike so many other data releases, it is now just another game to play. The age in which the primary media for communicating economic and policy updates were tomorrow’s newspaper and by wire has long since been supplanted. The significance of long-term economic trends will always matter; but streaming data means trading the concatenated releases that comprise them has never been more brief, punctiliar and focused on climax. Nor has the disappointment that comes from realizing the long analytical rites of preparation so popular on Twitter, in the blogosphere, and on cable financial news media – in all their prevalence – have never meant less.

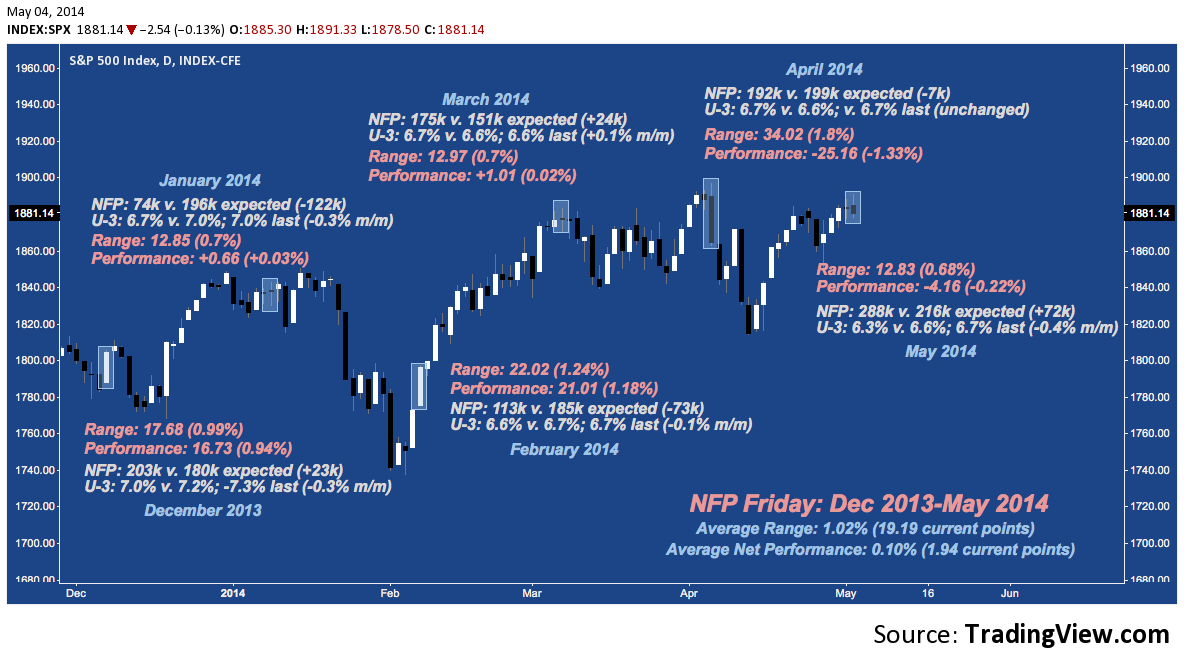

In the chart below, you’ll find the S&P 500 (SPX) with the last six NFPs highlighted. A quick study turns up a couple observations that aren’t new, but are foundational understanding for navigating around (or through) the release.

1) The BLS-reported NFP is usually well off the consensus of analysts who cover it – to say nothing of the outlier guesses. It could be that the initial mean hat economists come up with is closer to subsequent revisions; but that’s the stuff of backward-looking think-tank white papers. By the time some measure of objective truth arrives, traders and investors have long since moved on with in the inexorable parade of macro data to the next intersection where speculation and specious measures of economic vitality meet. The fundamentals of NFP Friday are not only elusive because they aren’t accessible on that day; but because the market doesn’t care enough to revisit them as they gradually unfurl.

2) There’s no consistent correlation between the reported NFP and the S&P 500’s performance that day. Looking closely at the last 6 months, consider this progression:

December 2013’s unemployment rate (U-3) came in -0.3% below forecast (a major positive bump toward “full employment”) at 7% and NFP over +200k; and the S&P rallied.

Predictably, right? Then, January 2014’s U-3 came in -0.3% below forecast: another huge bump; and -0.6% cumulative in just 2 months! But NFP came in way below consensus at 74k v. 196k expected. The result: SPX came in flat. Predictably, again? After all, the data points canceled each other out, don’t they?

Look no further than February 2014 to test that theory. U-3 dropped again, to 6.6% ,or -0.1% below forecast while NFP came in way below consensus – again – at 113k v. 185k expected. Did this recurring monthly disappointment break the market? No: the exact opposite came about, as the subsequent month-long rally attests.

Now fast forward to last Friday: both measures trounced already positively-tilted estimates – yet stocks closed down on the day; a fact made even more egregious following a streak of 15 of 17 positive NFP Fridays.

Do you see the predictive pattern here? There is none.

There may be proprietary statistical edges some traders are employing to “trade the NFP”; but May’s NFP (in the context of a much greater sample space) is just another affirmation that these insight or advantages aren’t even vaguely evident from the headline data.

This composite of the last six NFPs above is as demonstrative as it gets: rational market reactions to the data are effectively random. Even assuming a trader is suitably rational (an inferential leap, in itself), the instrument they’re trading may not respond as the data suggests it should. Why rallies occur on dismal data – the “bad news is good news” prompted by the Greenspan/Bernanke/Yellen Put is the de facto excuse of the last 6 years – or sell off on good data is something pundits always have an answer for afterward as they work their craft of plausible narrative revisionism; but in the moment, why is inaccessible.

Ironically, development of a short-term edge for day or swing-trading the NFP – or any major release (including the FOMC statement and even the Fed Chair Q&A) – begins where caring about the details of the release end. Sure, there’s always a plausible why for what price does; but even if you’re privileged enough to know it, that doesn’t mean rationality provides you with an advantage. Even illicit access to embargoed data can’t save you from the adverse momentum of an irrational market crowd.

The antidote to all this, in it’s purest form, is actually purposeful ignorance of the data: completely avoiding it, as strange as it may sound, is the only way to really take all expectations out of one’s trading. It also completely nullifies any reliance on market rationality as a factor. While that may not seem advisable or preferable (or even possible), for a trader or active investor choosing to “trade the reaction to the print, rather than the print itself” is.

However the data released at 8:30 a.m. compares to the previous month or to expectations, it has a sole predictive element: volatility. Trading the reaction to the print means recognizing sentiment – and price as it’s representation – for what it is: the only true market fundamental available.

Twitter: @andrewunknown and @seeitmarket

Author holds no position in securities mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.