Despite the new high in the Dow Jones Transportation Average made on 7/18/2013, the transports seem to be stalling out at current levels. So, is this a Dow Theory hurdle or simply a signal followed by consolidation (before new highs)? Sure, the transports could be pausing before the next leg higher but I’m not certain that’s the case. Or, at least not yet.

Despite the new high in the Dow Jones Transportation Average made on 7/18/2013, the transports seem to be stalling out at current levels. So, is this a Dow Theory hurdle or simply a signal followed by consolidation (before new highs)? Sure, the transports could be pausing before the next leg higher but I’m not certain that’s the case. Or, at least not yet.

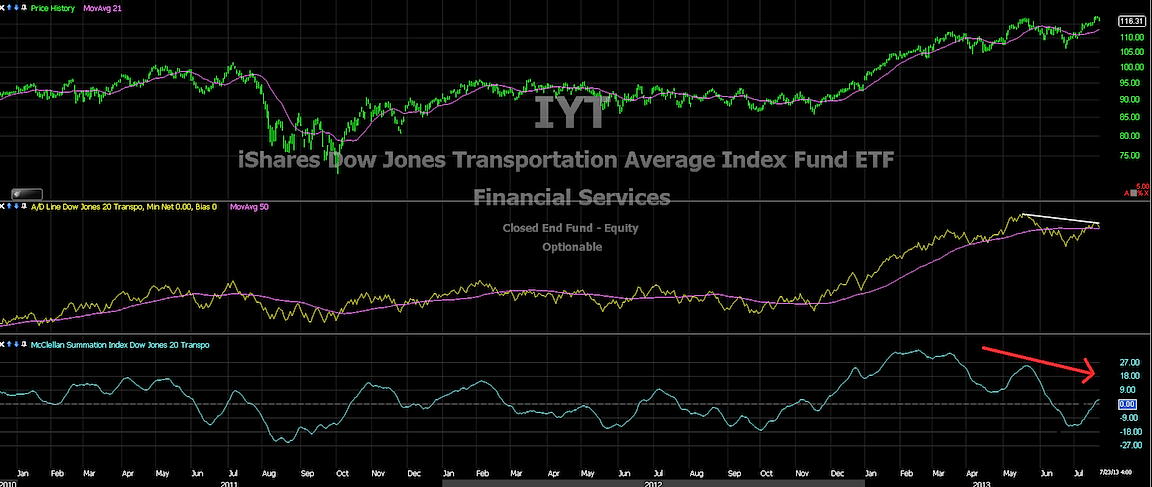

One reason is the cumulative advance/decline line depicted below. The A/D line is not confirming the new highs we are currently trading at. The transports are advancing on fewer companies which usually is a sign of underlying weakness. Second, the McClellan Summation Index of the Transports is also showing relative weakness. Take a look at the major divergence that has formed since February. These two indicators (and the divergence) need to be monitored going forward should we do continue higher. Furthermore, the longer this divergence carries on, the higher the likelihood for a (deeper) correction. Click chart to zoom

Dow Jones Transportation ETF (IYT) Chart with A/D Line and McClellan Summation – Dow Theory Analysis

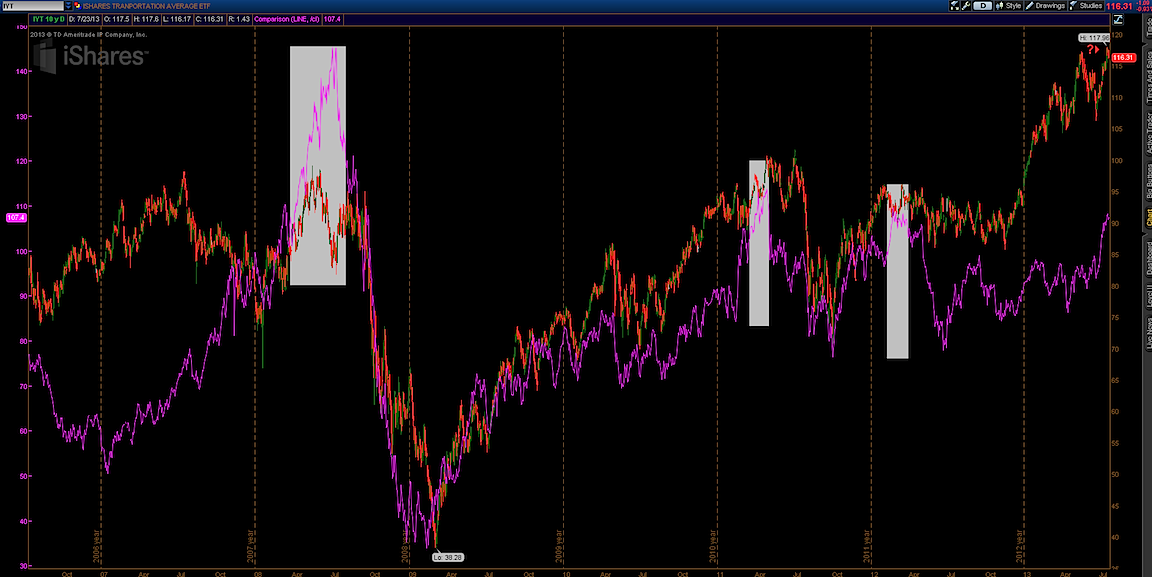

I also wanted to post a chart of Crude oil prices against the IYT. Back in 2008 when crude pushed above $140 a barrel, the dow transports crashed along with all other assets classes. In 2011, crude oil topped out around $113 a barrel and transports later took a dive. There definitely is a correlation between the two, but the question is when do higher oil prices begin to affect earnings?

Crude Oil Prices vs IYT Chart – Dow Theory Analysis

Trade safe. Thanks for reading. ~Korey

Disclaimer: The material provided is for informational and educational purposes only and should not be construed as investment advice. All opinions expressed by the author on this site are subject to change without notice and do not constitute legal, tax or investment advice. At Castle Financial, securities are offered through Cadaret, Grant & Co., Inc. and TD Ameritrade, Inc. Members FINRA/SIPC.

Chart sources: TDAmeritrade and Worden

Twitter: @stockpickexpert and @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.