Earlier this year, I published a post on the Dogs of the Dow and trading off that theory. Given that we are fast approaching the mid point of 2015, I thought it would be a good time to provide a Dogs of the Dow 2015 performance update.

Here’s a quick reminder about which stocks within the Dow Jones Industrial Average (DJIA) fall into this group:

“The Dogs of the Dow is an investing strategy that consists of buying the 10 DJIA stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks.” – Investopedia

The Dogs Of The Dow 2015 Performance YTD

Below is the list of stocks that make up the Dogs of the Dow for 2015. I’ve listed the beginning of year stock price and the current stock price so that you can see the performance of this year’s group:

You can see from the results above that the strategy has performed fairly well with Pfizer (PFE) and General Electric (GE) the clear leaders. Chevron Corporation (CVX), Caterpillar Inc (CAT) and Exxon Mobil Corporation (XOM) have been under performers as the resources sector has struggled in 2015. When you take into consideration the healthy dividends these 10 “Dow” stocks offer, holding holding them so far this year would have seen healthy gains.

Using Options To Trade The “Dogs Of The Dow”

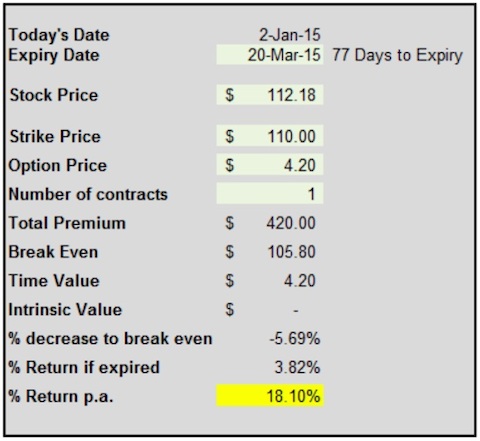

In my previous article I discussed incorporating options into the Dogs of the Dow strategy by selling cash secured puts instead of purchasing the stocks. The example I gave was selling a March 20th $100 put for $4.20.

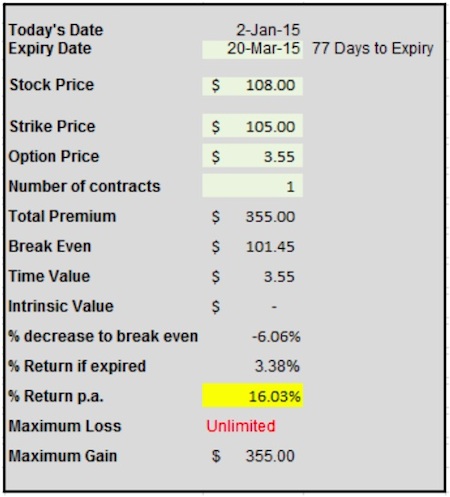

At the time, CVX was trading at $112.18. I ended up taking a similar trade by selling a March 20th $105 put for $3.55. At the time, CVX was trading at around $108. Below shows the particulars of the trade:

CVX bounced around a bit over the next month or so and at one point dipped below $100. By the expiry date on March 20th, CVX had recovered to close at $107.03. As such the $105 put expired worthless for a 3.38% return, or 16% annualized.

Thanks for reading.

Twitter: @OptiontradinIQ

Read more from Gavin on Options Trading IQ.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.