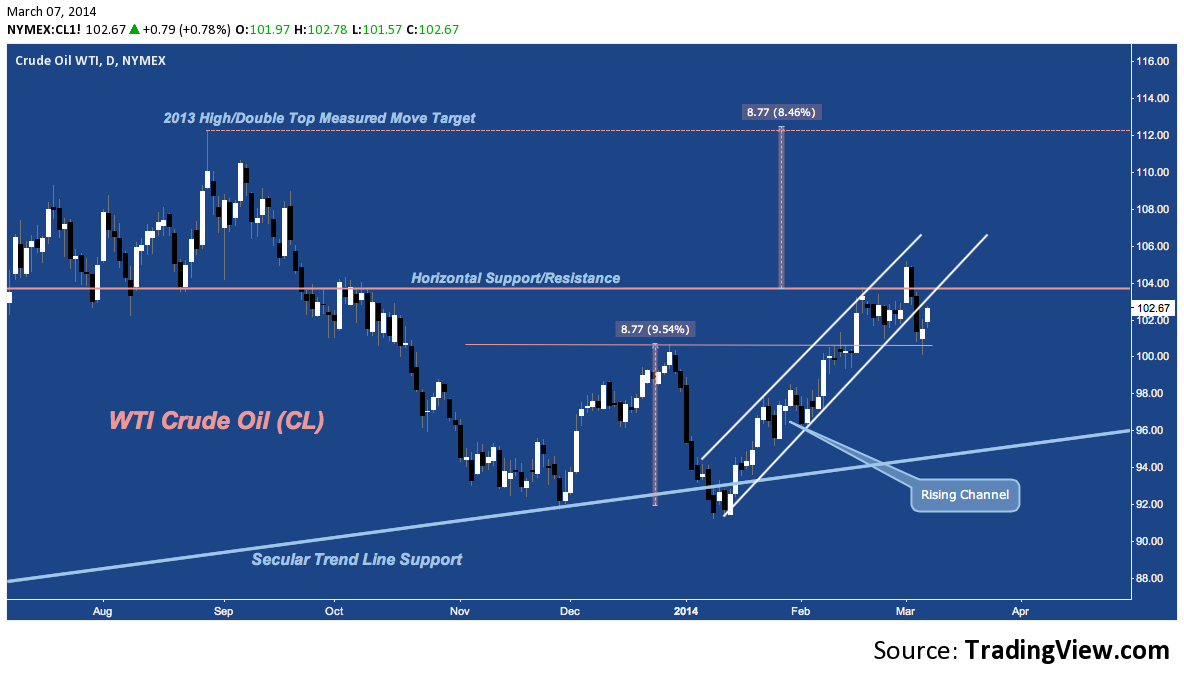

WTI Crude Oil (CL) opened the week trading aggressively higher, reflexively spurred through $104/bbl as traders responded to derivative supply concerns in the wake of the appearance of escalating conflict between Russia and Ukraine. Monday’s sharp thrust higher crossed a key horizontal resistance level, placing CL in the $104-$108 congestion zone that characterized Q3 2013. Bouncing off of 2014 rising channel support and out of February’s consolidation of the Eve-Adam Double Bottom (see November/January lows) breakout over $100, Crude had every appearance as it’s Monday session closed of receiving confirmation that it’s aggressive move off early January’s $91.77 bottom would continue.

WTI Crude Oil (CL) – Daily: Rising Channel Higher Over $100, Activated Double Bottom Pattern Targeting $112

Following Russian President Vladimir Putin’s order to recall 150,000 Russian troops from staged war games near Ukraine’s eastern frontier overnight Tuesday, CL‘s bullish structure began to crumble. Later that morning, Putin offered further conciliatory remarks, inducing a broad risk unwind in their wake as Russia’s less bellicose tone eased anxieties. With Wednesday’s follow through, WTI Crude shed over 4%, bringing it back to the site of its double bottom breakout 10 days earlier. Thursday saw a closing bounce off this level, and with today’s follow through CL is now flat week-over-week.

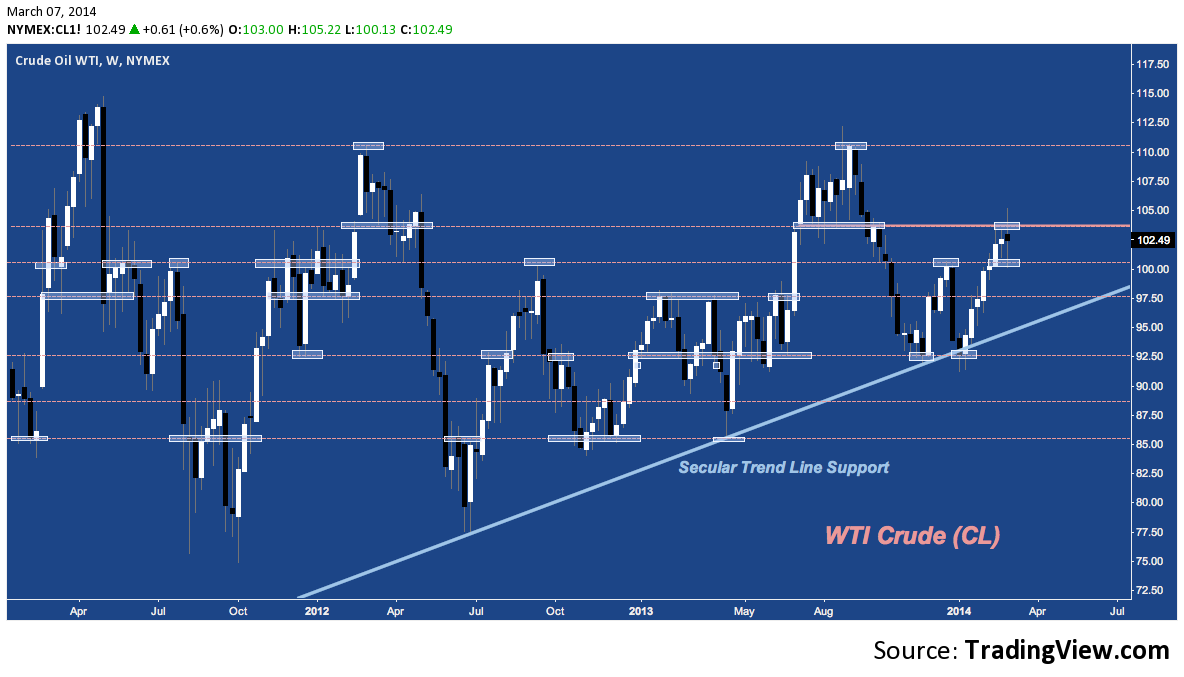

WTI Crude has a vivid memory of it’s previous price action, with major price fulcrum points arrayed at rough $2.50 intervals from $75-$112.50 as depicted below. 2 weeks ago, CL closed at 102.20; last week at $102.59. This week the early run capped out just above $105; and Crude is stabilizing in quiet Friday afternoon trade just above $102.50. The continuous contract’s acknowledgement of these levels is not entirely precise; but weekly closes and intra-week extremes often give deference to them, with this week an excellent case in-point.

WTI Crude (CL) – Weekly – Horizontal Support/Resistance at $2.50 Intervals: $102.50/$105 In Focus This Week

What’s next for WTI Crude, given it’s broad trading range? As the charts above suggests, CL is in a secular up-trend. However, on a shorter (but still long-term) time frame as demonstrated by this weekly chart the contract is in broad consolidation (yet still working off the crash and subsequent measured move up that characterized 2008-2009’s turbulent period).

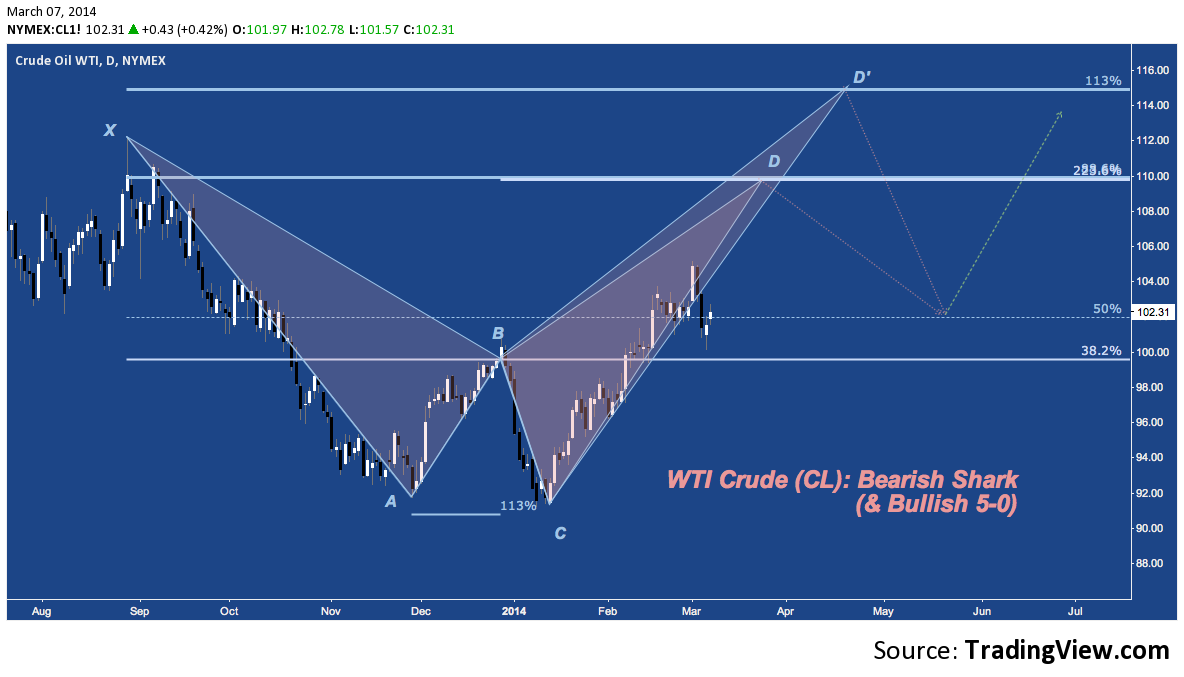

There are many actionable trends within that consolidation for the trader and active investor. The latest plots CL in a 6 Month Bearish Shark harmonic pattern:

WTI Crude (CL) – Daily: Bearish Shark (and Bullish 5-0)

Putting this week’s excitement in broader context, the continuous contract is consolidating around the 50% retracement of the Q3-Q4 2013 drop (line XA) from $112 to $92.

As long as WTI Crude remains above $100 (at point B), its secondary trend remains up. Though the emerging pattern here is “bearish”, to construct it CL must rally to at least $110 (the 88.6% retracement of line XA, at point D), and may continue as high as $115 (the 113% extension of line XA, at point D’) to complete its criteria. If one or both of these targets are tagged, the Bearish Shark then calls for a retracement lower to the 50% retracement of line CD near $103. From there, the pattern morphs into a Bullish 5-0, projecting a measured move up that could carry it to new highs.

Twitter: @andrewunknown and @seeitmarket

Author carries no position in the instrument(s) mentioned at publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Charts courtesy of TradingView.com

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.