Another week is upon us and the story for Crude Oil continues to be more of the same: crude oil new lows. The collapse in Oil prices has taken crude down as low as $46 per barrel this morning. Is the drop from $49 to $46 over the past several hours of futures trading enough to elicit a trading bottom? Or just more bottom calls?

Another week is upon us and the story for Crude Oil continues to be more of the same: crude oil new lows. The collapse in Oil prices has taken crude down as low as $46 per barrel this morning. Is the drop from $49 to $46 over the past several hours of futures trading enough to elicit a trading bottom? Or just more bottom calls?

Traders like to see a “panic” session or two to mark a bottom (capitulation). So, if that’s the case, perhaps this week will continue lower to find a tradable bottom. But when considering the drop from over $100 this past summer, some traders think it’s enough selling for a sharp (if corrective) rally to begin at any time.

So the “bottom” debate rages on as traders continue to chatter about when and where crude will bottom.

For now, intermarket clues will reside with the US Dollar Index and a close eye on the EURUSD. Price discovery is also being pushed by fundamental oversupply fears.

Be sure to read David Busick’s excellent post from early December: Could Crude Oil prices fall to $45 Per Barrel?

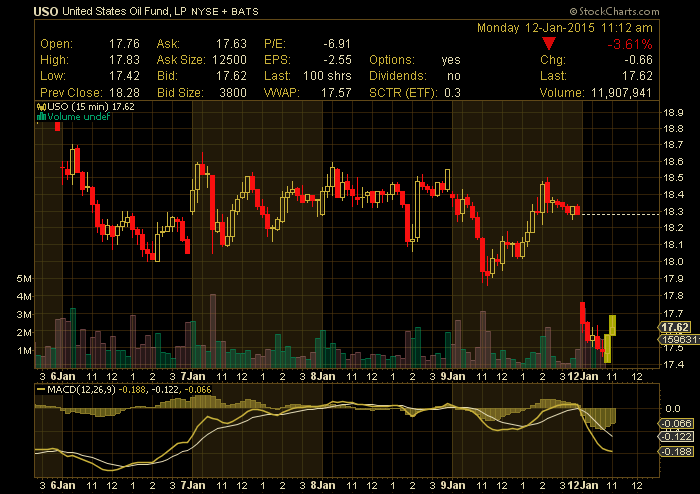

Here’s a look at the popular crude oil trading ETF, United States Oil (USO) in early trading:

Note that another etf that active investors watch is the iPath Crude Oil Total Return ETF (OIL).

Final parting thought: Many traders have been calling for a bottom over the past few weeks… so it’s fair to remind you that picking bottoms has always been an extremely difficult game to play for traders. Especially on the mental side. Always have a plan and know your time frame. Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.