The following is a recap of the April 29 COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at COT report data and futures positions of non-commercial holdings as of April 26. Note that the change in COT report data is week-over-week. This blog post originally appeared on Hedgopia – Paban’s blog.

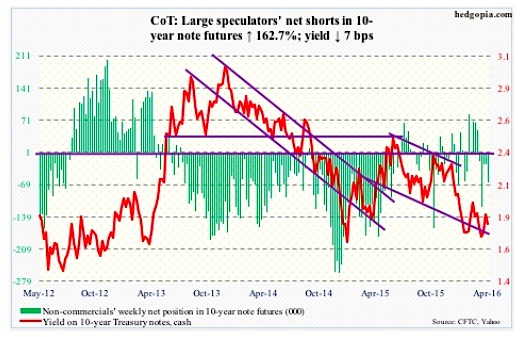

10-year note: Two different central-bank meetings, and two different market reactions this week.

Haruhiko Kuroda, Bank of Japan governor, has a habit of surprising the financial markets, not disappointing them. On Thursday, he did the latter. Market participants were expecting a heavy dose of stimulus. Mr. Kuroda did not pull out his big bazooka this time. The bank maintained its negative 0.1 percent deposit rate and ¥80-trillion base money target. This, despite the fact that it lowered its 2016-2017 fiscal year GDP forecast from 1.5 percent to 1.2 percent. The Japanese Yen reacted by jumping 2.4 percent, while the Japanese stock market (Nikkei) closed 3.6 percent lower.

Across the Pacific, here at home, as expected, the Federal Reserve this Wednesday left interest rates unchanged. Recall that ahead of the meeting it forecast two rate hikes this year, down from forecasts late last year of four.

Be that as it may, the Federal Reserve will have a good excuse not to move in the June 14-15 meeting, which is the June 23rd U.K. European membership referendum on whether to remain in the European Union.

This is a Federal Reserve that, besides its dual mandate of maximum employment and price stability, seems to have added a third one – supporting global markets. And stocks and commodities have been watching.

Wednesday’s FOMC statement expressed less concern about global risks than it did during the March meeting. But it will continue to “closely monitor” global markets. Potential uncertainty over ‘Brexit’ probably takes June off the table.

April 29 COT Report Data: Currently net short 63.8k, up 39.5k.

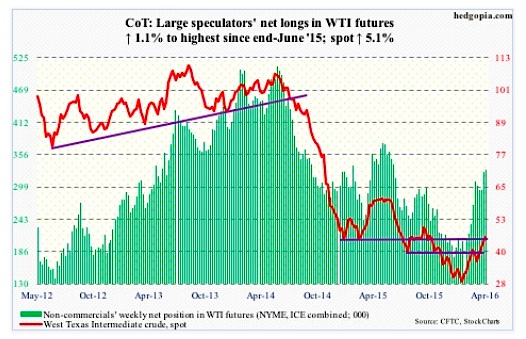

Crude Oil: There goes $43.50 on spot West Texas Intermediate crude oil. This resistance goes back to January last year, and, in fact, can be extended to even July 2004.

Technically, crude oil momentum is intact. That said, Friday, a high-volume session, produced a long-legged doji – first sign of distribution in a while.

This week, help came from the U.S. dollar.

Fundamentally, data were mixed at best.

For the week ended April 22nd, crude oil inventories rose by another two million barrels to 540.6 million barrels. In the past 16 weeks, stocks have gone up by 58.3 million barrels, and are inching ever closer to the all-time high 545 million barrels in 1929.

Also not helping matters were gasoline stocks, which increased 1.6 million barrels to 241.3 million barrels. And refinery utilization fell 1.3 percentage points to 88.1 percent. Utilization has dropped by 3.3 percentage points in the past three weeks.

On the positive column, distillate stocks fell 1.7 million barrels to 158.2 million barrels. Crude oil imports fell 637,000 barrels per day to 7.6 million b/d.

Last but not the least, crude oil production dropped 15,000 b/d to 8.9 mb/d. This was the third straight week of sub-nine mb/d. Production peaked at 9.61 mb/d in the June 5th week last year, so has declined by more than 600,000 b/d.

Spot WTI oil prices (45.99) began its freefall in June 2014, dropping from 107.68 to the February 11th hammer low of 26.05. A 23.6-percent retracement of the decline puts the crude at 45.31.

April 29 COT Report Data: Currently net long 329.8k, up 3.5k.

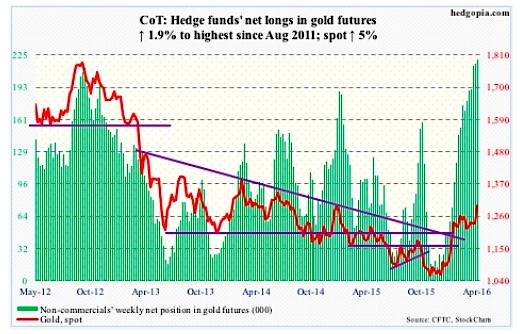

Gold: Since February 11th when the metal spiked 4.1 percent (and stocks bottomed), spot gold prices have hung in there, essentially going sideways.

Since April 1st, buyers have continued to show up at/near the 50-day moving average. This was once again the case this Thursday, when gold prices rallied 1.7 percent, followed by another 2.1-percent move on Friday, breaking out of the range. The dollar helped.

Flows into GLD, the SPDR gold ETF, are not helping matters, though, as $94.3 million were redeemed in the week ended Wednesday, coming on the heels of $206.8 million in outflows in the prior week (courtesy of ETF.com).

Spot gold prices rallied five percent in the week – sort of vindication for non-commercials who of late have been aggressively adding to net longs.

April 29 COT Report Data: Currently net long 220.9k, up 4k.

E-mini S&P 500: This week’s, as well as last week’s, high on the S&P 500 index tagged the slightly declining trend line from the May 2015 all-time high. The April 20th high (2111.05) was a mere 1.1 percent from 2134.72, the May 2015 high.

If stocks come under renewed selling pressure, and the May 2015 high is not breached, technically speaking a bear market could still have begun in that month.

That aside, bulls are probably disappointed that they were not able to build on last week’s golden cross.

This, despite the fact that in the week ended Wednesday SPY, the SPDR S&P 500 ETF, attracted $3.2 billion, after outflows of $2.9 billion in the prior week (courtesy of ETF.com).

As well, following outflows of $9.3 billion in the prior two weeks, U.S.-based equity funds attracted $101 million in the week ended Wednesday. Since the week ended February 10th, however, $16.5 billion has been withdrawn.

Not what one would want to see when momentum is in deceleration. Shorter-term moving averages are rolling over. Prior to Thursday’s 0.9-percent decline, this is how the S&P 500 traded in the prior six sessions – spinning top/doji, spinning top/doji, hanging man, hanging man, filled candle, and doji.

In the meantime, non-commercials no longer hold net shorts, which in previous weeks were a big tailwind for stocks as positions were reversed.

April 29 COT Report Data: Currently net long 1.5k, up 67.4k.

continue reading on the next page…