The consumer staples sector (and underlying consumer foods group) have been one of the best performers in the first half of 2016, and many of the larger names are utilizing M&A and unlocking value by optimizing brand portfolios. At this point in the cycle, revenue growth is difficult to come by so most of the names are undertaking strategic restructuring plans to save on costs to create better value for shareholders. Another reason for outperformance this year is the safety profile of the stocks with attractive dividend yields. In a World where Bonds are barely offering any yield, these stocks are being treated as synthetic bonds in a way.

Major news for consumer foods stocks came last week when Mondelez (MDLZ) offered to acquire Hershey (HSY) in a $23B deal. Furthermore, I expect M&A in this group to remain a theme for the remainder of 2016.

I have seen notable bullish options positioning in many of the large cap consumer foods stocks in this group for the second half of 2016. Those stocks include General Mills (GIS), Post Holdings (POST), WhiteWave Foods (WWAV), Kraft Heinz (KHC), Kellogg’s (K), ConAgra Foods (CAG), Hershey (HSY), Mondelez (MDLZ), Smuckers (SJM), Campbell Soup (CPB) and Mead Johnson (MJN).

For this report I wanted to take a look at some of the lesser known small to mid-cap companies that may make attractive targets. As such, I took a look at comparable valuation and growth metrics. I am leaving out the Pet names (CENT, BUFF, FRPT) and the Meat/Egg names (PPC, CALM, SAFM, TSN, HRL) – I can take a look at those groups later. The focus of this study is on the packaged foods (and goods) stocks.

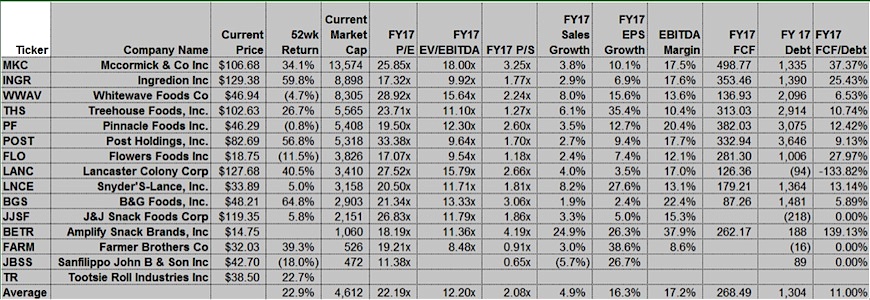

The table below displays the pertinent metrics from the packaged goods names targeting in this report:

Let’s look at each metric individually for the consumer goods group:

P/E: The average P/E for the group is 22.2X FY17 EPS, and the consumer foods stocks with positive price momentum that are trading at a discount to peers are Ingredion (INGR) at 17.3X, Pinnacle (PF) at 19.5X, Snyder-Lance (LNCE) at 20.5X, B&G Foods (BGS) at 21.3X, and Farmer Brothers (FARM) at 19.2X.

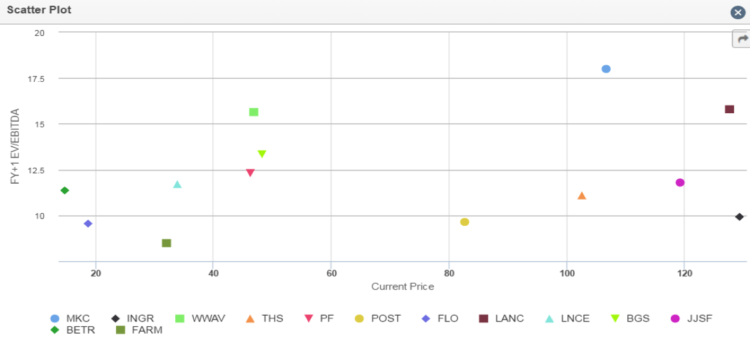

EV/EBITDA: The average EV/EBITDA for the group is 12.2X, and purely looking at valuation, the undervalued names are Ingredion (INGR) at 9.92X, Post (POST) at 9.64X, Flower Foods (FLO) at 9.54X, and Farmer Brothers (FARM) at 8.48X.

P/S: The average P/S for the group is 2.08X, and the names trading at a discount are Ingredion (INGR) at 1.77X, Treehouse (THS) at 1.27X, Post (POST) at 1.7X, Flower Food (FLO) at 1.18X, Snyder Lance (LNCE) at 1.81X, and Farmer Brothers (FARM) at 0.91X.

FY17 Sales Growth: We can now look at which names are growing to see is they are deserved of premium multiples. The average Y/Y sales growth for the group is 4.9%, and the stocks with better growth are WhiteWave (WWAV) at 8%, Snyder Lance (LNCE) at 8.2%, and Treehouse (THS) at 6.1%.

FY17 EPS Growth: The average EPS growth is 16.3%, and names with above average growth include Treehouse (THS) at 35.4%, Snyder Lance (LNCE) at 27.6%, and Farmer Brothers (FARM) at 38.6%.

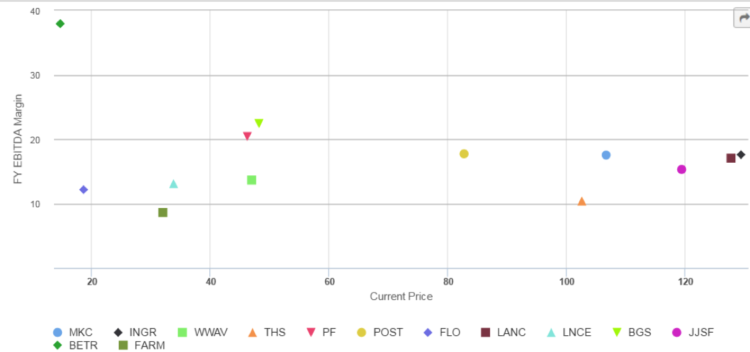

EBITDA Margin: The average EBITDA margin for this subset is 17.2% with the names excelling on the margin front being Pinnacle (PF) at 20.4%, B&G Foods (BGS) at 22.4%, and Ingredion (INGR) at 17.6%.

FCF/Debt: This custom ratio has been a good indicator of success in this sector, and the names that stand out are McCormick (MKC) at 37.37%, Ingredion (INGR) at 25.43%, Flower Foods (FLO) at 27.97%, and Pinnacle (PF) at 12.42%.

Combining all of these factors, I came up with 5 consumer foods stocks that look attractive:

1. Snyder Lance (LNCE) is the most attractive names in this group, trading at a discount to the peer average in P/E, EV/EBITDA, and P/S while having better than peer Sales Growth, EPS Growth, and FCF/Debt. Shares are also lagging, only up 5% over the past 52 weeks. If LNCE can find a way to increase margins, its attractiveness would even growth further.

2. Ingredion (INGR) shares have climbed 59.8% over the past year but still trades very cheap on P/E, P/S, and EV/EBITDA to peers while having a very strong FCF/Debt ratio. Where INGR lacks in attractiveness is its growth profile, trailing peer averages by a wide margin, so although it is one of the better pure value plays in the group, it deserves lower multiples.

3. Treehouse Foods (THS) looks very attractive in this group, trading at a slight premium multiple on P/E, a slight discount on EV/EBITDA, and a major discount on P/S. THS has above average sales and EPS growth, in-line FCF/Debt ratio, but is one of the lowest EBITDA margin names, so needs to show a plan to improve on that front.

4. Farmer Brothers (FARM) is the lesser known name of this group with a small $526M market cap, but at 19.2X Earnings, 8.5X EV/EBITDA and 0.91X Sales, shares are extremely cheap on valuation. Although FARM is set to generate just 3% sales growth, its EPS growth rate of 38.6% is best in class. It’s lower multiples may be deserved, however, as EBITDA margins at 8.6% are half of its peer averages.

5. Amplify Snack Brands (BETR) is one I saved for last as it came public in August of 2015 and is a newer play, but at first glance it appears extremely attractive in this group. BETR shares trade 18.2X Earnings, 11.35X EV/EBITDA and 4.19X Sales while having best in class (by a wide margin) 25% sales growth and 26% EPS growth. BETR also has 37.9% EBITDA margins, way above any of its peers and its FCF/Debt ratio at 139% blows away all other names. Its key brand is SkinnyPop which continues to gain market share with high margins and robust growth. BETR is the top play in this group for growth investors, and just be mindful of the chart trend in this kind of momentum stock.

Hain Celestial (HAIN) and United Natural (UNFI) are two organic food names that were left out, though each has seen some notable unusual call buying recently. Looking at the metrics, HAIN trades in-line on the valuation metrics with above average sales growth and below average margins. Its 23.2% FCF/Debt ratio does make it attractive to most peers. UNFI trades very cheap on all metrics at 16.6X Earnings, 8.4X EV/EBITDA, and sales growth of 10.9% is second to only BETR. The issue with UNFI is its terrible EBITDA margins at 3.5%.

Thanks for reading.

Twitter: @OptionsHawk

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.